This is part two of our financial planning for our early career attending physicians. Earlier on the blog, we got the party started with Financial Planning for Last Year of Training Physicians. The goal of this post is to build on what we covered in that post and make the assumption that you are now a few years into your attending status.

KEY TAKEAWAYS:

- We go over cash flow and top-down budgeting to allow for guilt-free spending and to ensure your financial goals and values are being prioritized.

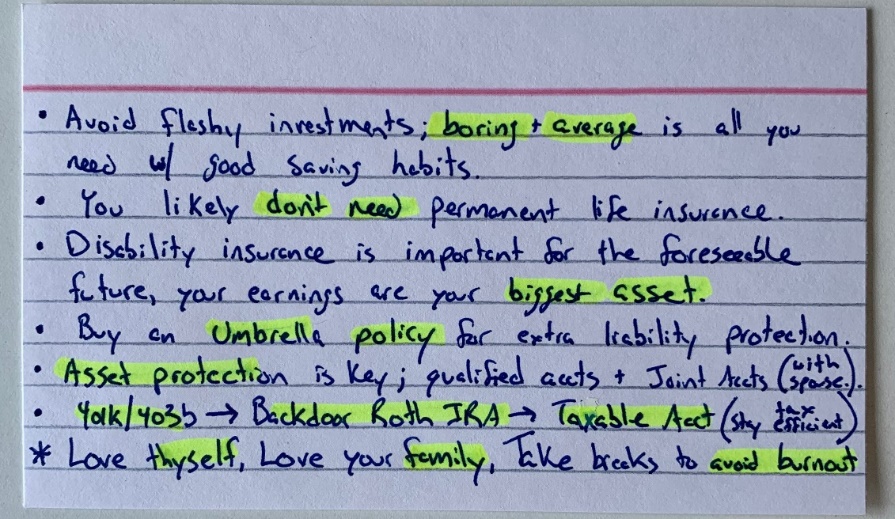

- This becomes a broken record, but the moral of the story is the same: boring and average investing are just fine! Max out your qualified plan(s), max out your backdoor Roth IRA(s), and load up your taxable account to accomplish your goals.

- Not one that you expect to see on a financial planning blog, but family planning and in vitro fertilization is something you may need to consider.

- Disability and life insurance are two things you do not want to ignore during your career. We help lead you through figuring out what makes the most sense for you.

- Unfortunately, in today’s world when people get hurt, they sue for a lot more than just their medical bills. We help to protect your assets — it’s proactive, not reactive.

Prefer video over the blog? We’ve got you covered! Watch our YouTube video as we dissect this blog post for you:

What are the assumptions we are working with?

- Doc. McStuffins is back, and she is better than ever! She was bringing home $20,000 net per month, but she is a more experienced surgeon now, and she is bringing home $27,000 net per month. She is also receiving a bonus of $75,000/year.

- No more student loans! She went for an aggressive 5-year payoff, and they were just finished last month. Yay!

- Doc. McStuffins now has two kids, one boy (3) and one girl (6 months).

- Mr. Doc. McStuffins is now a stay-at-home dad.

Cash Flow & Budgeting for Early Career Attending Physicians

First and foremost, the top-down budget is still the main go-to budget at this point. Let’s use the same budget as we did five years ago, but plug in the $27,000 net. If you need a refresher on the top-down budget and/or how Doc. McStuffins is budgeting with $20,000 per month, here ya go.

Doc. McStuffins brings home $27,000 per month (net).

- Mortgage & Escrow: $5,000/m – Moved into a bigger home with their second child.

- Cars: $1,500/m – They were utilizing public transportation in the city but moved to the ‘burbs and had to add some new whips. Yes, they went against my guidance and bought “fancier” cars. 😉

- Utilities & Food: $4,000/m — Utilities: $1,000, Groceries: $2,000, Dining Out: $1,000

- Private School, Daycare, and Babysitter: $2,000/m

- Funding Your Emergency Fund and Travel Fund: $1,000/m – Emergency Fund: Replenish when needed, currently at $20,000 & Travel Fund: $1,000/m.

- Funding Backdoor Roth IRAs: Doc. McStuffins and her hubby: ~$1,100/m – Best to try and max these out once per year with a backdoor Roth IRA as opposed to the monthly saving, but let’s roll with that for now.

- Funding Your Joint Account: $7,000/m – This along with the 401k and backdoor Roth IRA(s) has them on track for early financial independence in their mid-to-late 50’s.

- Private Insurance (Term Life & Disability): $1,000/m – Two term life policies and one own-occ disability policy. Increased her life insurance and Mr. Doc. McStuffins’ with two kids now

- Left Over: ~$4,000

$4,000 may seem like a lot, but we are missing a lot of things, and if Doc. McStuffins is anything like my wife, the leftover $4,000 likely will be just enough to cover Amazon and Target for the month. No, I am just kidding, but we are missing some big items still. My goal is not to build an exact budget but to show you why the top-down budget makes “budgeting” easier.

Big items still missing: miscellaneous/discretionary spending, insurance payments, coffee, hobbies, activities for the kids, one-time events/gifts, etc. Your specific situation will be able to fill in the blanks here. We work with countless households in this range, and while $4,000 seems like a lot to have “left-over,” I promise it usually finds a way to be spent.

Main takeaway here: By knowing they are on track for their goals, it now allows for guilt-free spending with the bottom portion of their budget ($4,000). If they change their goals, grow their family, or make any other course change, they would want to reevaluate/update their current budget.

Investing

Things that are more important than investing at this juncture: no bad debt (looking at your credit cards) and proper risk management in place (disability insurance & term life insurance). Why does insurance come before investing? If you can’t earn a paycheck, what does it matter if you “maxed” out your Roth the past few years?

The one investment that can happen before the items noted above is the match.

If your employer offers a match, take full advantage of that early on.

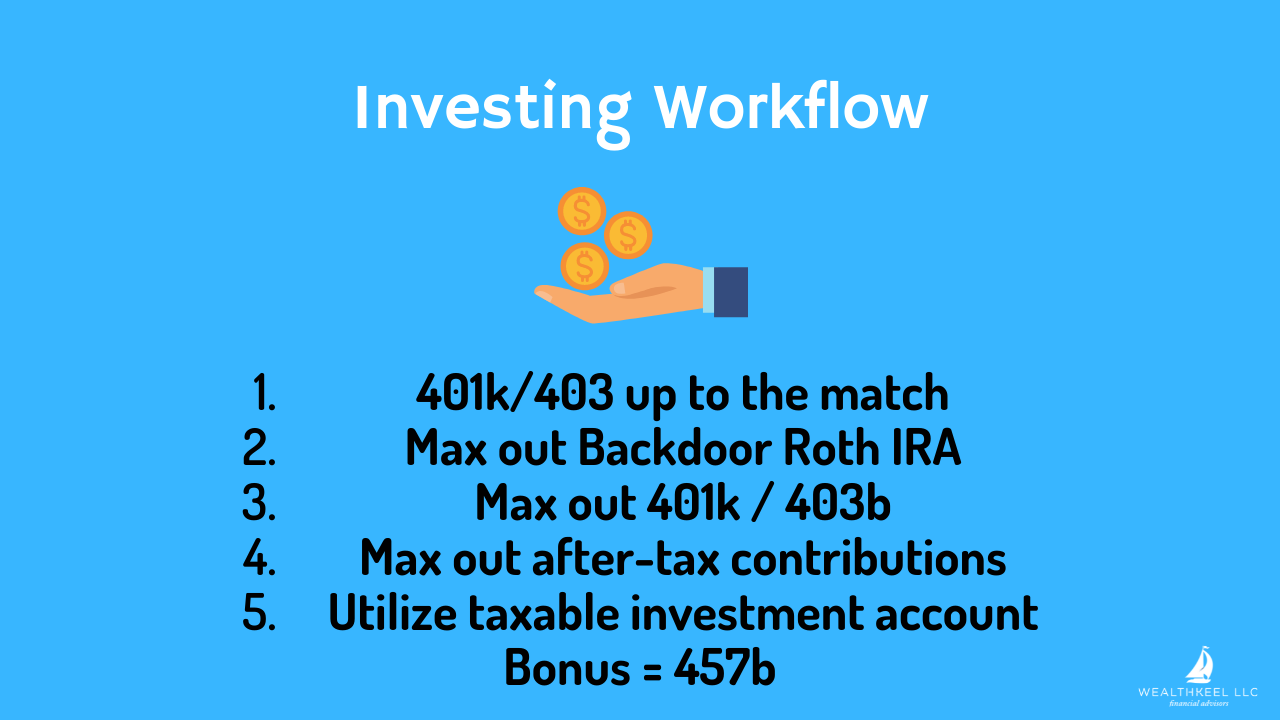

After the items above are taken care of, here is how we would craft an investment plan:

- 401k/403b up to the match

- $7,000 to Backdoor Roth IRA (2024)

- Back to the 401k/403b to fill up your full $23,000 (2024)

- If your employer plan allows “after-tax contributions,” you can save up to a total of $69,000 (2024). The $69,000 includes ALL contributions including your employers. This can also give you a huge Roth IRA opportunity in the future. After-tax and Roth contributions are different, so make sure you ask your HR or plan provider the right questions.

- If you are able to max out your employer plan each year at $23,000, possibly $69,000, and max out your Backdoor Roth IRA each year at $7,000, you should be in pretty good shape from an investing standpoint.

- After all of those are complete, you can start to utilize your taxable investment account (either an individual account or joint account). This is the account that Doc. McStuffins is saving $7,000 per month. Her main goal is early financial independence so that she can slow down in her 50’s.

- BONUS Account: If you have a 457b plan (many physicians in public/non-profit hospitals do). Be sure to take advantage of the 457b plan which allows you to save an ADDITIONAL $23,000 (2024) pre-tax. Again, this is an additional (bonus) savings bucket.

If investing feels too complicated or you feel overwhelmed, your default option can always be a target-date fund. Pick the year that most closely matches your retirement year. For example, if I want to retire in 2055, I would look for a “Target Date 2055” fund. Your specific goals and risk tolerance will ultimately affect your investment allocation, but it’s much better than having cash sitting in your 401k for 30+ years.

Several Investing-Specific Pitfalls:

- SEP IRA – If you have a 1099-paying job (main career or side hustle), a SEP IRA may not be your best investment option. Why? Well, a SEP IRA removes your option for Backdoor Roth IRAs. A better option would be a Solo 401k. Yes, they have a few extra steps to them, but they’re well worth it in my opinion.

- IRA – If you are a high-income household, an IRA won’t make sense for numerous reasons, but let’s keep it short. You shouldn’t have an IRA right now (NOT to be confused with a Roth IRA; a Roth IRA is fine and encouraged). You should be maxing out your 401k/403b/457b each year, then your Backdoor Roth IRA, and then your individual/joint taxable account. If you have an IRA, you will not be able to complete Backdoor Roth IRAs each year (technically you can, but it becomes a pro-rata nightmare). If you do have an IRA, you have two options. The first option is to convert it to a Roth IRA (this is a taxable event, so be aware of that). Second, you can roll over the IRA to a qualified plan (401k, 403b, Solo-K, etc., assuming the plan allows it.).

Main takeaway here: If you don’t have a specific plan in place for your future goals, save as much as you can. The joke that I overuse is that you are never going to yell at me in retirement and say, “Dang it Chad, I saved too much money and now I don’t know what to do with it!” The more important advice would be not to forget to enjoy life today as well.

Family Planning

In Vitro Fertilization

This may be a topic you didn’t expect to see here, but it is important for many young physicians since family life seems to get a later start when compared to your non-physician peers. You go to college, then medical school, then residency, and then fellow, and before you know it you’re 30+ years old. You spend a few years getting financially comfortable, and now you’re in your mid-to-late 30’s and ready to start a family.

It all started after one client paid out of pocket for a successful IVF, and today they have a beautiful little boy (with the world’s cutest chubby cheeks). At our meeting, she asked me if I knew about the states that covered IVF, and I told her I was not aware of any. I am an avid researcher/reader, so when I am hit with a new topic my brain needs to know more. So I hit the books (aka Google).

Did you know that there are 16 states today that mandate IVF coverage? Each of the 16 has their own rules, but many families don’t even know this type of coverage exists. I won’t get into the details. However, I wanted to at least make you aware of this benefit.

Key things to look for: Make sure you read your state’s specific rules. Ask your employer/HR about the program and get all the details.

Insurance for Early Career Attending Physicians

Disability Insurance

First and foremost, update your disability insurance to incorporate and protect your new, increased salary. Hopefully, you had a rider for guaranteed insurability. If so, your insurance carrier will either need to see a medical contract or a tax return showing your new income. If you didn’t have a guaranteed insurability rider, you would need to add a supplemental policy and consider adding the rider for your future income increases.

Now is a good time to check your disability definition. Most young physicians assume all disability is the same because they bought it from the same insurance agent in the hospital cafeteria. All disability is not created equally. You should have a true own-occ policy to protect your specific occupation.

Key things to look for: Find an independent insurance agent. If they only work for one company, you only get one option. That is not ideal. I know the status quo says work until 67-70, but keep in mind that many physicians don’t work that late and/or go part-time or can self-insure. I think age 65 is more than enough, and most likely the policy will be stopped even before that.

The elimination period is how long can you survive without income; we usually go with at least 180 days assuming you have a nice emergency fund. Why do I bring up those points? I am shocked by how many young physicians come to us with a benefit period to age 70 and 90 elimination periods. Longer benefit periods (ex: age 70) and shorter elimination periods (ex: 90 days) lead to a larger commission for the insurance agent. The White Coat Investor does a great job on the specifics in this disability series.

Life Insurance

Life insurance is also important, but it is difficult to make blanket recommendations. If I had to give one piece of advice, it would be to buy a 20-30 year term for $1,000,000 – $3,000,000. Depending on your health this should be cheap, less than $100/m. Don’t let a salesperson “sell” you a whole life policy. In no way, shape or form should your first insurance policy be a permanent insurance product.

Asset Protection

Unfortunately, in today’s world when people get hurt, they sue for a lot more than just their medical bills. Multi-million-dollar lawsuits are commonplace. This is even more common for physicians; you have a target on you. When they know you’re a doctor, they commonly add the soccer flop (YouTube’s Worst Soccer Flops) to any injury. It is tough to give blanket recommendations on asset protection since each state has its own unique rules. However, I want to review a few good practices:

- Umbrella Protection: This is probably the easiest way to add liability coverage for you personally. Remember, this does not cover you in the workplace; that is what malpractice insurance is protecting. This is to protect you in a car accident and/or if someone gets hurt on your property. Also, this is vital if you have children and they have play dates at your house. You know there is always that one parent who would sue you if their kid got hurt at your place because “you’re the richest person ever as a doctor.” I always like to insure your net worth, some say more, some say less, but I think that is an excellent starting point for those without a specific asset protection plan in place.

- Joint Protection: This is a general statement for your home deed, your bank accounts, non-qualified investment accounts, etc. The two most common forms of joint ownership are “Joint with Right of Survivorship” and “Joint Tenancy by the Entirety.” The latter, Tenancy by the Entire, is only available to married couples, and not every state will recognize it. The protection comes from you, the physician, not owning the asset by yourself. By adding the joint owner, you are adding an extra layer of protection in laymen’s terms. If your state allows Tenancy by the Entirety, add it! It’s free asset protection.

- LLC “It”: “It” refers to any risky assets. The most common we come across is rental properties. You should not own any rental properties in your own name. Spend a few bucks to separate the rental property from your name by putting them in a limited liability company (LLC). “It” can also refer to any other risky assets including dirt bikes, four-wheelers, snowmobiles, etc.

- Malpractice: If I asked you these three questions right now, could you answer them? What are your current coverage limits? Is your policy occurrence coverage or claims-made coverage? Are legal costs included in the limits of liability, or will they be paid in addition to policy limits? If you are part of a larger plan, there is not much you can do to change the answers, but it is essential to know what protection you have in force.

- Estate Documents: Estate documents are pretty state-specific, but here are a few of the ones we suggest to clients: Will, Living Will, Health Care Power of Attorney, and Financial Power of Attorney. Also, be sure to name guardians for the kids (also add Temporary Guardianship).

- You could look to establish a few trusts as part of your estate plan: Disclaimer Trusts (protects parents), Dynasty Trusts (protects kids), and IRA Trusts (protects kids).

- Make sure your beneficiaries are updated and reviewed periodically. You can also look to establish “Transfer on Death (TOD)” on your current non-qualified accounts. This would allow those assets to avoid the probate process if something were to happen to both of you.

Key things to look for: Each state has its own exclusive rules, and those should dictate your asset protection plan. Asset protection is proactive, not reactive. If you walk to the mailbox and find a lawsuit, it is too late. Yes, you can make asset protection a lot more “protective” by bringing trusts into the picture, but there is just no way to get that specific in a blog, and for many, you don’t need to get that complicated yet.

Common Doctor Pitfalls (My Note Card to You):

Breaking news, they are still the same!

Good luck out there, Doc! Remember not to neglect your personal well-being and your personal finances. They are both vital to your overall health and success.

Looking for a more thorough, all-in-one spot for your financial life? Check out our free eBook: A Doctor’s Prescription to Comprehensive Financial Wellness [Yes, it will ask for your email 😉]