Services

Comprehensive Financial Planning

We’re here to help you build a comprehensive strategy that provides the flexibility to enjoy life today... while still preparing for the future.

Tax Planning

Physicians pay more than their fair share in taxes. Our goal is to optimize your tax planning so that when you pay Uncle Sam, you don’t leave him an unnecessary tip on top of it. We help our physicians take advantage of all the tax deductions, tax credits and tax exemptions that Congress and the Internal Revenue Service (IRS) will allow. These tax breaks and tax strategies offer ways for physicians to reduce their taxable income — both today and in the future.

We provide:

- Tax strategies for W2 & self-employed physicians

- Specific tax benefits for physicians with families

- Unique tax benefits of rental real estate, defined benefit plans, Backdoor Roth IRAs, Donor Advised Funds (DAF), and more

Investment Management

We offer our clients direct investment management via Fidelity, or if you prefer to self-manage, we can provide investment guidance. Either way, we’ll help you figure out the best way to invest your money in order to meet your long-term financial goals and grow real wealth for the life you want.

For your assets that can’t be directly managed (such as 401ks, 403bs, 457bs), we can link those accounts to our financial planning portal so we can gather necessary updates each night. Need clarification or your info tweaked? No problem — we can jump on a screen share to help you with any questions or concerns.

Here’s what we offer:

- Low-cost, diversified ETF portfolios

- Delegation to investment professionals (or use us for guidance!)

- Insight to build your investment portfolio the right way — from Backdoor Roths IRAs to 529 plans to defined benefit plans

Retirement Planning

We’ll make sure you’re on track for your future financial independence and retirement while helping you achieve today’s goals, too.

As we near your retirement age, we will shift our focus from accumulation to decumulation planning. We utilize a bucket strategy to craft a tax-efficient investment plan for your later years. Roth conversions and Qualified Charitable Distributions (QCDs) will also come into focus at this phase.

We provide:

- We analyze all the moving parts and streamline it all into two, simple categories: “on track” or “not on track”

- Whether you are looking for traditional retirement plan or early financial independence, we’ll be there to chart and navigate all of life’s course corrections

- We also model numerous “what-if” scenarios, including time-off for important family events, sabbaticals, mission work, slowing down to avoid burnout, possible career shifts, or any other journey you’d like to plan for.

Student Loan Planning

Our founder was one of the first Certified Student Loan Professionals (CSLP) in the country, so it is safe to say we are proud to be considered “student loan nerds” — and as such, we can provide immense value and clarity around the complexities of student loan planning.

Whether you are going for PSLF and need help navigating your payment plans and tax filing status, or if you need a game plan to help pay off your private practice loans, we build a strategy that fits your goals. Rest assured, we are your people.

Here’s what we offer:

- A team of super nerds in PSLF and income-driven repayments

- Scenario analysis for student loans, including cost comparison for academic medicine vs. private practice

- Clarity around how student loans tie to your overall financial plan and tax strategies

Insurance Planning

We want to make sure you, your assets, your most valued possessions and your family are all protected. You work too hard to leave these areas of life vulnerable, and we’ll work with you to determine the proper amount of coverage for your needs.

While we don’t sell any insurance products, we team up with the nation's leading experts in physician risk management to make sure you are properly protected, every step of the way!

We provide:

- True Own Occupation Disability, Term-Life, and Umbrella Insurance are our focus areas

- Review all your current policies and continually monitor any adjustments in your coverage needs

- Annual reviews of your employer’s open enrollment packets so you can take full advantage of your benefits and protections

Financial Wellness

Financial wellness includes several major factors, including: cash flow, budgeting, how you manage debt (and how to get out of it), your net worth, what’s available for emergencies, as well as life planning for your goals.

We offer financial wellness advice and planning around:

- Cash flow and budgeting

- Debt repayment strategies

- Short-term goal planning (such as buying a new home, home repairs, starting a family, and more)

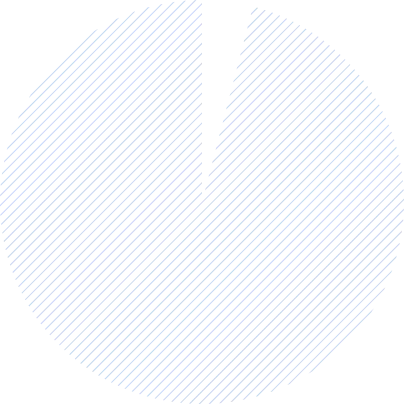

Pricing

empty box

Plan Creation with Ongoing

Planning & Investment

Management

One-Time Plan

Creation Only

Plan Name

Inpatient Planning

Outpatient Planning

One-time Plan Creation Fee

$3,000

$7,000

*For Medical Residents & Fellows, we offer a reduced flat-fee of $500 for your monthly subscription while in training.