Before we get into the importance of financial planning for locums docs, we need to set something straight. As a doctor, you got into this profession to make a difference in people’s lives. However, as a reward for your efforts, your income is also higher than average, which means that financial planning should be one of your priorities.

Unfortunately, all too often, doctors, particularly those in the locum tenens field, fail to adequately plan for things like retirement and other significant financial situations. So with that in mind, we wanted to share seven tips to ensure that you don’t fall into the same trap.

Having a higher salary as a locums doc should mean that you’re better prepared for your financial future, not less prepared.

Prefer video over the blog? We’ve got you covered! Watch our YouTube video as we dissect this blog post for you.

KEY TAKEAWAYS:

- Start off on the right foot by starting your financial planning now, not later. I promise, it’ll make a huge difference down the road! The first step is keeping a good record of your finances, then consider hiring an accountant and financial planner so you don’t have to sweat the details.

- Retirement accounts are a little more complicated for locum tenens physicians. Consider opening a Solo 401(k) or SEP IRA (favor the Solo-K).

- Hopefully, you’re already aware of this, but locums docs don’t qualify for PSLF for their student loans. Technically you can use an IDR plan instead, but the best path forward is likely aggressive pay-off to eliminate your student loans in 5-10 years.

- Disability and life insurance are two things you do not want to ignore during your career. We help lead you through figuring out what makes the most sense for you.

Financial Planning: Start Planning Early

Technically speaking, everyone should follow this advice, not just locums doctors. The sooner you can take control of your finances, the better off you’ll be in the long run. However, in many cases, doctors tend to see dollar signs when their first paychecks start rolling in. A higher income means that they could wind up spending too much, both right away and throughout their careers.

Take it from Dr. Dahle (The White Coat Investor), “Live like a resident!” At least for the first part of your career. While you can grow into a more ample lifestyle later on, you want to avoid giving in to temptation at first.

As a locum tenens doctor, it’s even more imperative to follow this advice. Since your situation is more fluid, you don’t have the stability of a career at a single hospital or clinic. Thus, you want to be sure that you maintain the same frugal mindset from the beginning. Since you’ll be moving more regularly, your expenses will differ from place to place. Be sure that you’re not dipping into your savings every time you do.

Overall, it’s good to maintain a “resident” mentality throughout your career. It’s easy to become complacent when getting an annual salary, but let your early career shape your long-term financial health.

Keep Meticulous Records

As a locum tenens physician, you don’t have the luxury of building a stable financial life right away. Since your position (and location) can change, you need to become your own accountant right off the bat.

Part of the reason you’ll have to be good about record-keeping is if you ever get audited or looked at by the IRS. While it’s not exactly likely, it might happen, and you don’t want to get caught in a bad situation.

Speaking of the IRS, most of your earnings will be paid as a gross sum, not net (aka 1099 income). This means that you will be in charge of paying taxes, annually (your usual year-end tax filing) and quarterly (known as quarterly estimates). You should get in the habit of setting aside a certain amount of income with each paycheck to cover your quarterly taxes. Paying as you go ensures that you don’t get a nasty bill at the end of the year.

Pro-Tip: Set up a tax holding account at an online bank like Ally or Marcus who will pay you a much better rate while you wait!

Talk with a Professional Accountant and a Financial Planner

Chances are that while you may be an excellent physician, you could be a relatively lousy accountant. Even if your record-keeping is decent, you will still want to meet with a professional(s) regularly.

Having an accountant can help you manage your finances more easily, as well as get advice on how to save money more efficiently. For example, you could open a business account for your earnings so that you have more flexibility when paying taxes. Also, if an audit does come your way, a business account can help separate personal and professional income and expenses, which will help bolster your case. This is also vital for asset protection; if you set up an LLC, you better treat it like a business. Don’t commingle personal and business — if you do, you could have a bad day in court if you assumed your LLC added asset protection.

One thing to keep in mind is that there is a significant difference between an accountant and a financial planner. Ideally, you will consult with both to get a better understanding of your finances now and into the future. Your team should have a great CPA and CFP® on it.

Set Up Retirement Accounts

Don’t get us wrong — being a locum tenens physician is an outstanding choice for many doctors. However, it does come with some substantial caveats, one of the most significant being the lack of a retirement plan.

When you work for a single entity like a hospital, you usually have access to a retirement account, such as a 401k/403b/457b. However, when you’re working for different hospitals in varying states, you don’t have that luxury.

So, the burden of saving for retirement falls on your shoulders, along with everything else. As we mentioned at the beginning, starting early is going to be the best option. While most doctors continue to practice in later years, you want to make sure that doing so is a choice, not a necessity.

Fortunately, you have several options when it comes to putting money away for retirement. Let’s break them down.

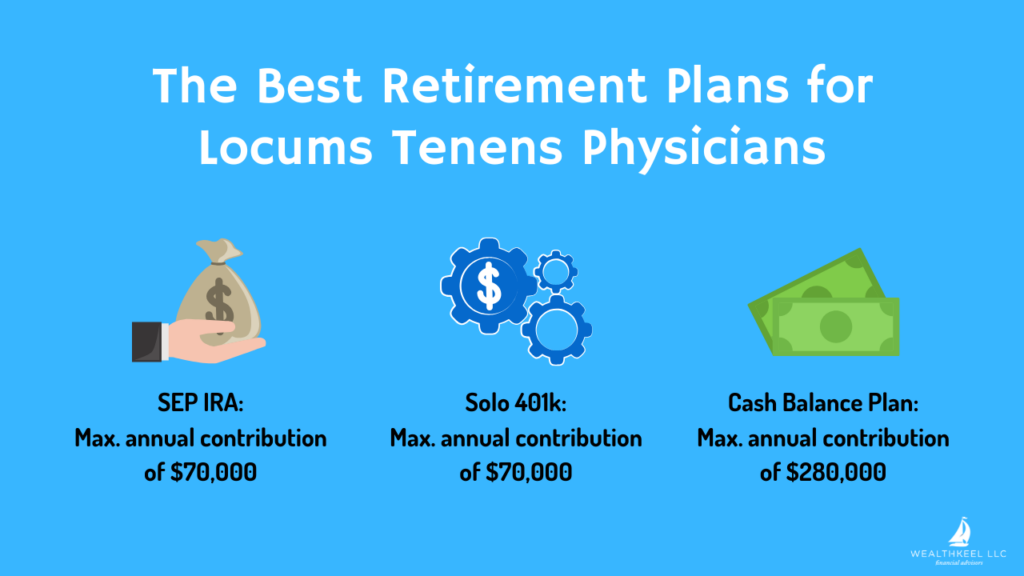

- SEP-IRA: As you may already know, IRAs are an excellent choice for long-term saving. Typically speaking, individuals can either get a Traditional or Roth IRA, as each one has unique benefits. As a locum tenens physician, you’ll likely want to open a Simplified Employee Pension (SEP) IRA as well.

SEP IRAs allow you to make annual, tax-deductible contributions. However, unlike other IRAs, the maximum amount permitted in a given year is currently $70,000 (2025). While that is a substantial chunk of change, you’ll need to be sure to max out your SEP IRA as many times as possible throughout your career.

Pro-Tip: The main disadvantage here is that a SEP-IRA eliminates your option for Backdoor Roth IRAs due to the aggregation rule, so keep that in mind.

- Solo 401k: Typically, 401k plans work like this: you contribute a certain amount to the account and your employer matches it up to a point (i.e., three percent of your total income). However, for solo-401k plans, you are the only one contributing. You are the employer and employee, which has some benefits to it.

This strategy works much like a SEP IRA, with a maximum contribution of $70,000 per year (2025). Once you turn 50, you can add another $7,500 (2025) as well. The money is tax-deferred (as with a standard 401k), so you can deduct it from your earnings.

Pro-Tip: This is our personal favorite (Solo-K) due to the flexibility of the Backdoor Roth IRA.

- Defined Benefit Plan (Cash Balance Plan): Pensions are a desirable retirement plan, most notably because they guarantee a fixed income (or lump sum payment). However, pensions are only available from certain employers, particularly the government. Thankfully, you can fund your own pension plan, which is called a defined benefit plan. This strategy is designed to help self-employed individuals with a higher income, making it ideal for locums doctors. The most likely/common defined benefit plan is called a cash balance plan.

The way a defined benefit plan works is that you contribute up to $280,000 per year (2025), all of which is tax-deductible. Once you retire, the program operates similarly to a pension, paying out monthly annuities as a form of income. You will need to talk to a financial advisor to set this up, though, as it can be relatively complicated.

Pro-Tip: “Relatively complicated” may be an understatement, but you usually will not do this on your own. A good financial advisor will be able to walk you through it step by step. This can be a more costly option depending on your plan specifics, but I can almost promise you that your tax savings alone will help offset those costs each year. Cash Balance plans are the most common option here.

As a Locums Doc, Focus on a Low Cost of Living

When moving from place to place, the cost of living can vary wildly. Typically speaking, metropolitan areas are going to be more expensive than rural ones, so you need to plan accordingly.

Ideally, you will minimize your cost of living no matter where you practice, although that may not be possible in some cities. Realistically, you will want to try to manage a maximum percentage for living expenses. For example, avoid paying more than 28 percent of your total income on housing (rent or mortgage). Depending on the earnings of each position, that rule can help dictate where you live at any given time.

That being said, you should know when to trade budgetary concerns for other, intangible benefits. For example, if you’re raising kids, you may decide that living in the suburbs is preferable to staying in the city. Alternatively, if you love the idea of working in a dream destination, that could justify paying a little more in living expenses.

Pro-Tip: Cost of Living Comparison Calculator

Reassess Your Student Loans

Overall, the running theme of financial planning as a locums doctor is to be prepared for the instability that comes from this line of work. Since your salary is never guaranteed for the long-term, you need to make sure that you’re ready for any gaps in employment.

The first big downside is that you cannot utilize Public Service Loan Forgiveness (PSLF). I hope this does not come as a surprise and someone already broke this bad news, but you are a 1099 independent contractor in a locums role.

Now, technically, you can still use an Income Driven Repayment plan and go for the traditional forgiveness after paying on your loans for 20-25 years. However, the amount forgiven is fully taxable, so plan accordingly. The more common strategy is to refinance and tackle the student loans head-on. You should also run the numbers if you think traditional forgiveness will work for you. I can tell you from experience that with your higher income it is very difficult to get forgiveness that far down the road. Most of the time, you will pay off the full balance. Traditional forgiveness usually looks better for Vets and/or General Dentists.

If you are going for an aggressive payoff, the aggressive payoff is certainly less than 10 years with a goal of fewer than 5 years.

Want some “free” money? Use one of the links from the White Coat Investor page to refinance. Some popular options include:

- Credible

- SoFi

- Earnest

- Splash

Real Numbers: $300,000 in student loans at 4.5% for 5 years = $5,593 per month. Prepare yourself, the numbers are not small.

Get Life and Disability Insurance

Somewhere in the near future (or maybe already), you will likely have a family that depends on your income. However, if you don’t have any life insurance or disability insurance, you could be putting yourself and your loved ones at risk. Talk to an independent insurance agent about getting a term life insurance policy for a set period (i.e., 20-30 years) and a strong own-occ disability policy. You likely do not need permanent life insurance no matter how nice your brother-in-law is or the local *insert large firm name here* agent tells you, “but it helps you start to save with a forced savings…” The only thing “forced” was their sales pitch. 🤦♂️

Any interruption to your income stream could be disastrous to you and your family, so you have to be prepared for anything.

Good luck out there, Doc!

Looking for a more thorough, all-in-one spot for your financial life? Check out our free eBook: A Doctor’s Prescription to Comprehensive Financial Wellness [Yes, it will ask for your email 😉]