Many physicians find that, as they continue to grow in their careers, they run into situations where their wealth is compromised. Divorce, lawsuits, and more impact their ability to protect the assets they’ve worked hard for. One of the most common topics we address almost daily is asset protection for physicians.

Putting different protective measures in place now can save you both money and headaches in the future. The best part is that protecting your assets doesn’t have to be complicated. Too often, physicians spend a lot of money and energy purchasing asset-protection solutions that may not be an actual best-fit.

Instead, focusing on the basics can help you create a strong foundation for protecting your assets without overspending or overthinking. By following these eight easy steps, you’re creating an asset protection plan from the ground up.

Key Takeaways:

- The number one asset protection tool = date nights

- Easy ways to build in asset protection as a physician

- When is it time to bring in the legal team

Prefer video over the blog? We got you covered! Watch our YouTube video as we dissect this blog post for you:<

#1: Protect Your Marriage First (Date Nights!)

That’s right. If you want to truly protect your assets, you’ll take your spouse on a regular date night. Open up communication. Go see a couple’s counselor if you’ve hit a rough patch. Take the steps necessary to keep your marriage in tip-top shape to protect yourself against one of the greatest asset-drains of all time: divorce.

This surprises many physicians who are overly concerned with lawsuits or malpractice. The truth is, the likelihood that those things will happen (and drain your assets as a result) is relatively low. However, the divorce rate continues to sit around 3.2 per 1,000 people.

Taking this a step further, most physicians don’t realize that their divorce could end up costing them close to $15,000 just to go through the process. After that, they can expect to pay alimony, child support, and potential additional fees if the divorce goes to court rather than being settled by a mediator. Oh yeah, I almost forgot, and you could have your net worth cut in half. In short: divorce is more likely to happen and is incredibly expensive. Protect yourself against it!

“If you think babysitters are expensive, wait until you see the cost of a divorce. Date nights = live, laugh, and love.”

#2: Invest in Malpractice Insurance

Over the course of your career, it’s incredibly likely that you will be sued, or will have some kind of legal judgment levied against you. Your first step should be to protect yourself with malpractice insurance. Malpractice insurance should cover:

- The resulting fees from any judgments

- Your defense

- Expert witness costs

- Settlement costs

- Legal fees

Not sure how much coverage you need? Ask other professionals in the same field who are local. Understanding what your colleagues pay is usually a good ballpark to start with.

Keep in mind that malpractice suits aren’t about whether or not you’re qualified to be a physician. Even physicians who are proactive about care for their patients inevitably get caught up in malpractice suits. To protect yourself against these lawsuits, your goal should be to both minimize the likelihood that you’ll be involved in a malpractice case by prioritizing your patients and enrolling in malpractice insurance in the event of an emergency.

#3: Find an Umbrella Policy

Umbrella insurance is relatively inexpensive, especially when compared to malpractice insurance, and covers many potential insurance nightmares. An umbrella policy is extra liability coverage that goes beyond the limits of what your current insurance provides. For example, it could extend the “cap” of your homeowners or auto insurance.

It can also go a step further to protect you against vandalism, slander, and invasion of privacy. If you’re a physician who has a notable amount of assets accumulated, an umbrella policy is in your best interest. Your policy will protect you if you’re sued, or if you cause someone injury. This policy should be viewed as a secondary policy — a “back up” to your traditional homeowners, auto, and/or renters insurance. Your policy should cover:

- Legal fees

- Your future salary if you owe your future earnings to the plaintiff in the case against you

- Your current assets

#4: Prenuptial Agreements

Prenuptials often get a bad reputation, but they can actually be incredibly beneficial for both parties. Although your #1 goal should always be to protect your marriage and continue to work with your spouse toward a productive and happy relationship, the reality is that it doesn’t always work out. The divorce rate where one spouse is a physician is higher than the national average, and divorce (as noted above) isn’t cheap.

Instead of worrying about whether or not your assets are at risk in the event of a divorce, a prenuptial agreement can help to protect you against the traditional costs of divorce. A prenuptial agreement requires that both you and your spouse disclose all of your assets, debt, and more. It creates a fully transparent financial situation as you enter your marriage.

Once your financial lives have been explored, your pre-nup will outline financial obligations for each party. These obligations determine what property is shared and separate, and how shared expenses will be paid for. It also covers tax obligations, and future spousal support (if applicable).

#5: Tenants by the Entirety

There’s often a fear among the physician community that, in the event that you’re sued, your creditors can go after your home. Depending on your state, you may be able to list your property ownership as “tenants by the entirety.” This would mean that you and your spouse both own 100% of your home or property. So, if you are engaged in a lawsuit, creditors cannot include your home or property in how they seek payment – because your spouse owns 100% of the asset. The only way you can lose your home is if you both are sued simultaneously.

This is an unusual rule, but it’s relatively common. States that recognize tenants by the entirety for real estate include:

- Alaska

- Illinois

- Indiana

- Kentucky

- Michigan

- North Carolina

- Oregon

States that recognize tenants by the entirety for all property include:

- Arkansas

- Delaware

- Florida

- Hawaii

- Maryland

- Massachusetts

- Mississippi

- Missouri

- New Jersey

- Oklahoma

- Pennsylvania

- Rhode Island

- Tennessee

- Vermont

- Virginia

- Wyoming

- The District of Columbia

Some states even allow you to declare tenants of the entirety for other assets such as bank accounts or brokerage accounts.

#6: Focus on Retirement Accounts

One of the most important ways you can (and should) protect your assets is by protecting your retirement savings. The truth is, you’re going to have financial ups and downs during your career whether they’re a result of lawsuits or not. But during your career, you still have time to “bounce back” and continue earning and growing your wealth.

The one time when that’s not possible is your retirement. You need to focus on protecting your retirement savings because that nest egg needs to sustain you when you stop working.

Depending on where you live, your retirement savings accounts may already be protected against potential lawsuits. However, laws vary depending on location, and there are several things to keep in mind when saving for retirement as a result:

- What’s protected? Usually, the total amount of savings that a judge deems “enough” for you to live comfortably in retirement is covered. However, that number may be different than what you deem enough. Check your state laws to learn more.

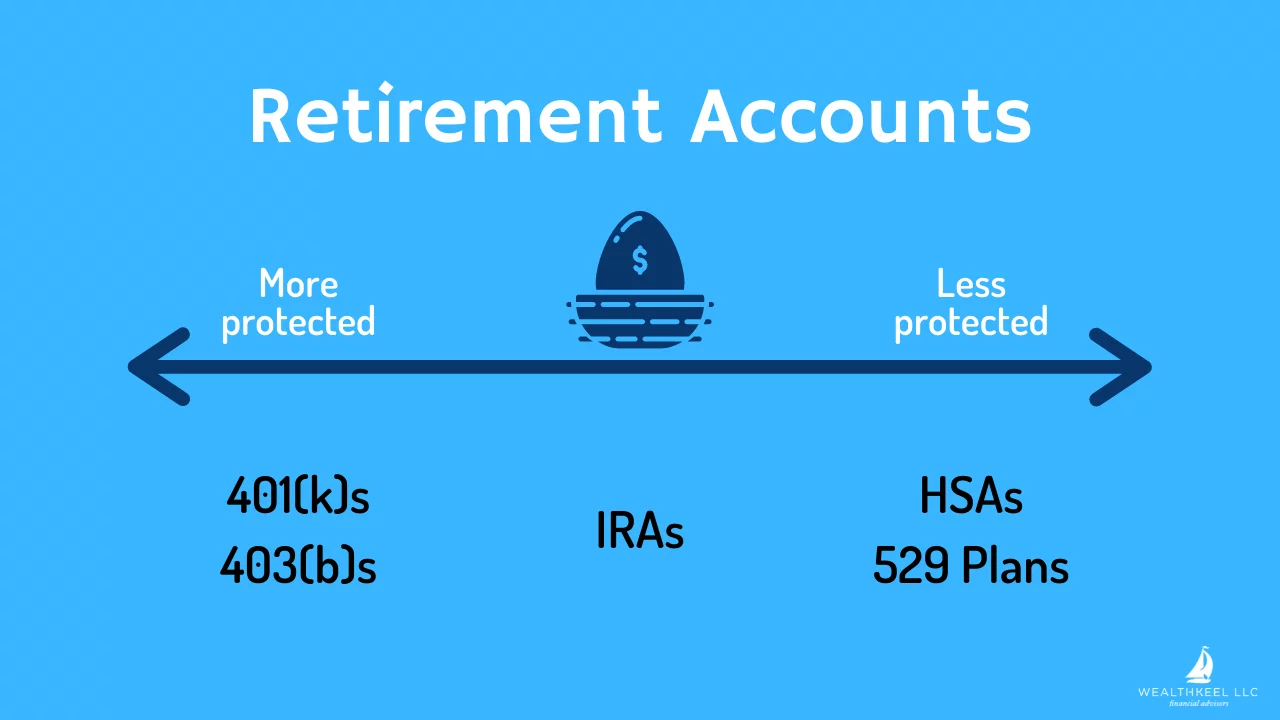

- 401(k)s & 403(b)s often are more protected than IRAs, thanks to ERISA. If this is the case in your state, max out your 401(k)/403(b) contributions before looking toward other savings vehicles.

- Look up your other accounts. HSAs and 529 Plans are protected, but not usually as much as your classic retirement savings accounts. Know your state laws, and fund accounts accordingly.

#7: Leverage Trusts

By setting up an asset protection trust, you’re further protecting yourself against the potential loss of assets. An asset protection trust is an irrevocable trust that protects you from creditors. To set up an asset protection trust, you’d create an APT to hold the majority of your assets.

As the grantor, you are allowed access to the account. However, keep in mind that APTs are a complicated way to protect your assets. They aren’t the right option for everyone but are worth exploring. Before you commit to an ATP, it may be worth having a conversation with a financial planner and your estate attorney to decide whether it’s truly the right fit for your unique financial protection needs.

#8: LLCs and Corporations

Using an LLC for some of your “toxic assets” can also help you to protect your personal assets. “Toxic assets” are often rental properties or other property owned by a physician. These assets pose a risk because they have the potential to drop in value to be less than what you owe on them. By putting them in the name of an LLC, you’re protecting your personal assets in the event that you default on payments.

You can also look to set up an LLC or a corporation as your business entity to separate your practice from your personal assets. Each type of business offers a different level of legal protection. For example, a single-member LLC may offer less protection of your personal assets than a corporation. Consult a small business attorney to determine which business entity makes the most sense for you.

Protecting your assets as a physician can feel overwhelming. Luckily, putting the right systems in place may be easier than you think. Start with the right types of insurance and build from there to leverage more complex strategies like an ATP. When you build your protection strategy from the ground up, you’re setting yourself up for long-term financial success.

Looking for a more thorough all-in-one spot for your financial life? Check out our free eBook: A Doctor’s Prescription to Comprehensive Financial Wellness [Yes, it will ask for your email 😉]