Unpacking the New 529 to Roth Transfer: Guidelines and Strategic Insights for 2025 and Beyond

The introduction of the ability to transfer funds from a 529 plan to a Roth IRA marks a significant shift in personal financial planning. As we usher in 2025, this change is not only topical but promises to be relevant for years, potentially reshaping how we approach savings for education and retirement. This blog post delves into the critical rules of the 529 to Roth transfer, offers strategic advice on optimizing this opportunity, and highlights key considerations to bear in mind.

🎥 Prefer video over the blog? We’ve got you covered!

Watch our YouTube video as we dissect this blog post for you 🎥

Understanding the Key Rules of 529 to Roth IRA Transfers

The transfer from 529 plans to Roth IRAs comes with specific stipulations designed to manage its use and benefits. Here’s what you need to know:

The 15-Year Rule

A 529 plan must be opened for at least 15 years before funds can be transferred to a Roth IRA. This rule prevents the use of 529 plans as a mere backdoor into Roth IRAs, ensuring that the plans serve their primary purpose for a substantial period before being repurposed into retirement savings.

Strategy Tip: Open a 529 plan early—even without immediate funding plans—to start the clock on this requirement. This approach mirrors the strategy often recommended for Roth IRAs, where starting the 5-year clock early can enhance future financial flexibility.

The 5-Year Funding Rule

Beyond the account’s age, the funds themselves must sit in the 529 plan for no less than five years before they qualify for transfer. This rule underscores the intent to prioritize educational savings while still opening a pathway to rechannel excess funds eventually.

The Same Beneficiary Requirement

For a transfer to be valid, the beneficiary of the 529 plan must also be the owner of the Roth IRA. This requirement maintains a direct link between the educational intent of the original 529 plan and the individual benefiting from the transfer.

Note: The implications of changing beneficiaries on the 529 plan are still unclear, particularly whether such a change resets the 15-year clock, an issue yet to be clarified by IRS guidelines.

Contribution and Lifetime Limits

Transfers are bound by both annual Roth IRA contribution limits and a total lifetime transfer cap of $35,000. These limits prevent abuse of the transfer option and ensure it’s used as intended—to reallocate unneeded educational funds, not as a primary retirement funding vehicle. Moreover, the Roth IRA’s contribution limits still apply, based primarily on the IRA owner’s earned income.

Strategic Considerations and Implications

Deciding the Purpose of the Funds

Transfers from a 529 plan to a Roth IRA are irreversible and shift control from the plan’s original owner to the beneficiary. Before initiating a transfer, consider:

- The intended use of funds: Were they earmarked for education, or were they always meant as a nest egg?

- Family dynamics: In families with multiple children, the flexibility to change beneficiaries can help manage varying educational funding needs over time.

Account Ownership Concerns

Once transferred to a Roth IRA, the funds are solely under the beneficiary’s control. This transfer of control can be risky if the funds are misused. Unlike 529 plans, where the account owner (typically a parent or grandparent) retains control over the funds, Roth IRAs provide beneficiaries full autonomy, including the potential withdrawal of funds.

Long-Term Planning

Given the potential complexities and the long timelines involved in both the 15-year and 5-year rules, consulting with a financial advisor or tax professional is advisable. They can offer tailored advice and help parse through evolving IRS regulations and their implications on your specific circumstances.

Utilizing Resources and Professional Advice

To navigate these new regulations effectively:

- Consult with your financial advisor or accountant: Their insights can refine your understanding and strategic use of 529 to Roth transfers.

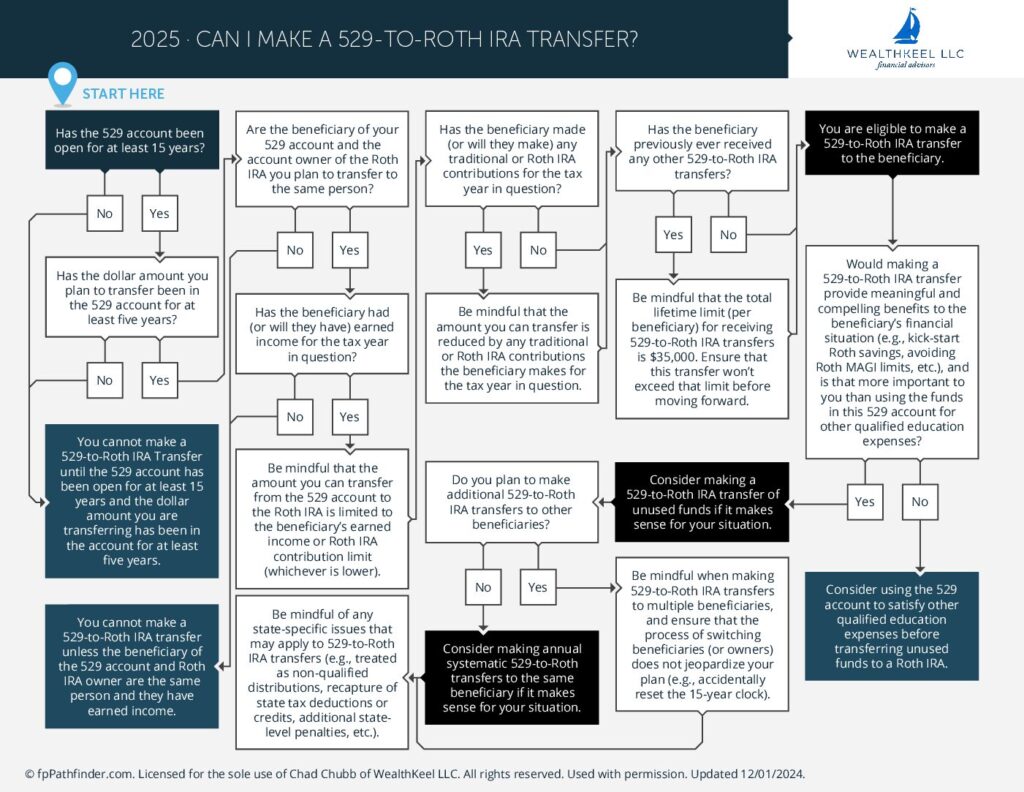

- Use decision-making tools: Flowcharts and other resources can simplify eligibility assessments and decision processes, providing a clear pathway based on specific personal circumstances.

The Future of 529 to Roth Transfers

As this policy is new, we anticipate further clarifications and case studies, which will provide deeper insights into its practical impacts. Such future resources will be vital for anyone looking to leverage this opportunity fully.

Conclusion

The 529 to Roth transfer option represents a significant development in financial planning, offering a flexible solution for managing overfunded 529 plans. While this provides a valuable opportunity to repurpose educational savings into retirement funds, it comes with complex rules and considerations that require careful management and foresight. As we continue to learn more about this new possibility, staying informed and consulting with financial professionals will be key to making the most of this innovative financial strategy. Whether you’re planning for your education or retirement, the implications of these transfers are far-reaching, warranting a strategic approach to personal finance.

Looking for a more thorough all-in-one spot for your financial life? Check out our free eBook: A Doctor’s Prescription to Comprehensive Financial Wellness [Yes, it will ask for your email 😉]