Congratulations — you’re coming up on a very exciting time in your medical career, and that means it’s time to achieve financial success as a new attending physician! As an attending, you have many doors open to you, and with those new opportunities come great responsibilities. One main responsibility you have is to keep control of your finances.

We’ve said it before and we’ll say it again, saving and investing for the future as early as possible is the easiest way to reach your financial goals. However, there is more to the process than simply creating a budget on a spreadsheet (though we highly recommend that!). You’ll also have to consider investing, insurance, debt, tax planning, asset protection, and your estate plan, among other things.

While your new paycheck may have you memorizing your credit card information to do some online shopping, take a minute to go through our 8-step checklist to help fill in the gaps of your current financial plan.

KEY TAKEAWAYS:

- It’s not a sexy topic, but getting a catered insurance plan that’s specific to your needs is incredibly helpful.

- Hopefully, you established good investment habits while you were in residency, but if not, now is the perfect time to get them started! As a new attending, you should be able to max out both your 401k/403b and your Backdoor Roth IRA, then get started on other retirement options.

- It’s time to get a few financial buckets in order — be sure to make a solid tax plan (and work with a professional), create a debt management system, hone in on a plan to eliminate your student loans, and form an estate plan.

- While that big, new paycheck is tempting, we suggest you budget like you’re still a resident — at least for now. By living below your means for the time being, you’ll maximize your financial success (and financial freedom) later in life.

Prefer video over the blog? We’ve got you covered! Watch our YouTube video as we dissect this blog post for you.

1. Develop an Insurance Plan That’s Built To Protect Your Assets

It may not be a sexy topic, but a good insurance plan is vital to your future success. The right insurance policy can help protect your future, but that doesn’t mean that you need every policy and rider under the sun— no matter what the insurance salesperson tells you.

We recommend having the following policies:

- Disability insurance

- Life insurance

- An umbrella policy

- Medical malpractice insurance

Disability insurance

What is it? How much do you have already and how much more will you need to get as an attending? Odds are you will have to increase it significantly with your new income.

Essentially, disability insurance protects your present and future income should you become disabled. When inquiring about disability insurance, ask if there is a discount for your hospital (Called a GSI, or Guaranteed Standard Issue, and look for this before you are done with your training) and if they offer a unisex rate. A unisex rate will typically yield a lower premium for women. We also recommend doing research on every policy rider before you commit. Riders increase your premium, so if you don’t need it, you shouldn’t be paying for it.

Are you a physician on a visa? If so, understand how the policy would work if you had to go back to your home country for an extended period of time.

Life Insurance

As a general rule of thumb, when it comes to life insurance, opt for term insurance, not permanent. These policies are generally very inexpensive because 98% of them are never used (that’s okay, it means you are alive!).

When researching a company to buy life insurance from, review their Comdex score. Credible companies have a score of 80 or more (the higher, the better).

Umbrella Policy

An umbrella policy, also referred to as personal liability insurance, is put in place to further protect your assets from liability. If someone gets hurt on your property because of a misstep on your part, an umbrella policy will protect you from legal action. We recommend a minimum of a $1 million policy, but $2, $3, even $5 million policies can be wise depending on your net worth.

Medical Malpractice Insurance

This may seem like a no-brainer, but medical malpractice insurance is an absolute necessity for you as an attending. Not only can a medical malpractice lawsuit be financially and emotionally draining, it can also be time-consuming and costly for both your professional and personal life. Medical malpractice insurance is one of the only ways that physicians can protect themselves and their assets against litigation in the event of a medical malpractice suit.

2. Revise Your Investment Strategy

While your investment habits should have been developed in residency, you can further streamline your investments as an attending. Look at your investment goals and ask yourself: What are my current goals? How have they changed?

As a resident, your primary focus was likely on different retirement accounts to get things started, such as:

- 403b or 457b

- 401k

- Traditional & Roth IRA

As an attending, you should be able to max out your 401k/403b with no issues. You should also be able to max out your Backdoor Roth IRA each year. However, after that it can vary; maybe you have access to a 457b, or an after-tax 401k, or maybe your next best option is a joint taxable account. The main goal is to continue to tell your money where to go!

This is also the perfect time to review your asset allocation. When you’re looking to diversify your portfolio, ask yourself what your specific goals are. Of course, your goal is to make as much return as possible, but for what specifically? Write that down, or even better, draft an Investment Policy Statement.

3. Make a Tax Plan

Taxes are an integral part of your financial plan and can make a huge impact on your total income. As you probably know, taxes work a bit differently if you are self-employed (1099) versus employed by a corporation (W2). You will need to work with your accountant on how to properly elect your withholdings if you are a W-2 employee or how to estimate and pay quarterly taxes if you go into business for yourself (1099).

If you decide to own your own business, you will need to develop a business structure that comes with different tax considerations. The right structure for you could be S-Corporation, Professional Corporation, Sole Proprietor, or a Limited Liability Corporation (LLC). We recommend you chat with a business attorney and your accountant on which structure makes the most sense for you.

If you work for yourself, you will also need to look at the benefits packages that are available to you. There are many tax breaks available, and working with an accountant and financial planner could help save you in taxes.

4. Create a Debt Management System

Having gone through years of expensive schooling and “low-paying” residency/fellowship, you’re bound to have some debt (if not, we applaud you). Understand the type of debt you have: student loan, mortgage, credit card, personal loan, auto loan — the list could go on and on.

Student loans are in their own world – see #5 below. Our most common suggestion is to always pay off the highest interest rate debt first. Why? Because there’s a huge difference between 5% interest and 20% interest. Credit cards typically have astronomical interest rates, which is another great reason to never just pay the minimum payment and to only charge what you know you can pay off at the end of the month.

Ask yourself: When do I want to be debt-free?

Be realistic when you answer this question. If you have $25,000 in debt, you may not be debt-free next month, but maybe within the next 1-2 years. Make a plan with a realistic goal and what you can be doing to achieve it.

It can be difficult balancing savings goals and debt-repayment. But just because you have debt doesn’t mean that you can’t be saving.

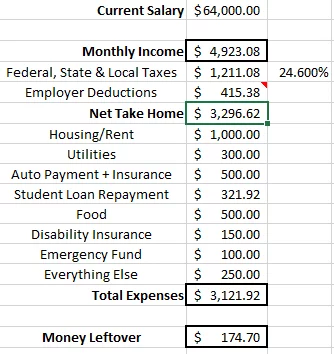

In this type of situation, it can be helpful to create a monthly budget spreadsheet so that you know exactly how your money is being spent.

5. Hone in on Your Student Loans

Student loans — the dreaded two words that no one likes to talk about. Student loans can feel impossible to pay back, but they don’t have to be. Truthfully, this is the tip of the iceberg, and I could talk on this topic for days. However, here are a few notes to keep in mind.

If you have student loans, you will need to know:

- Exactly how much you borrowed

- The type of loans you received (private or federal)

- If you qualify for Public Service Loan Forgiveness (PSLF)

The PSLF program will require 120 payments (10 years of payments) on your Federal Direct Loans to have them forgiven. You will also have to use an income-based repayment plan; two common options for most today are Revised Pay As You Earn (REPAYE) or Pay As You Earn (PAYE).

Understand which repayment strategy makes the most sense for you. At the end of the day, your goal is to get that debt forgiven. Learn more about organizing your student loans here.

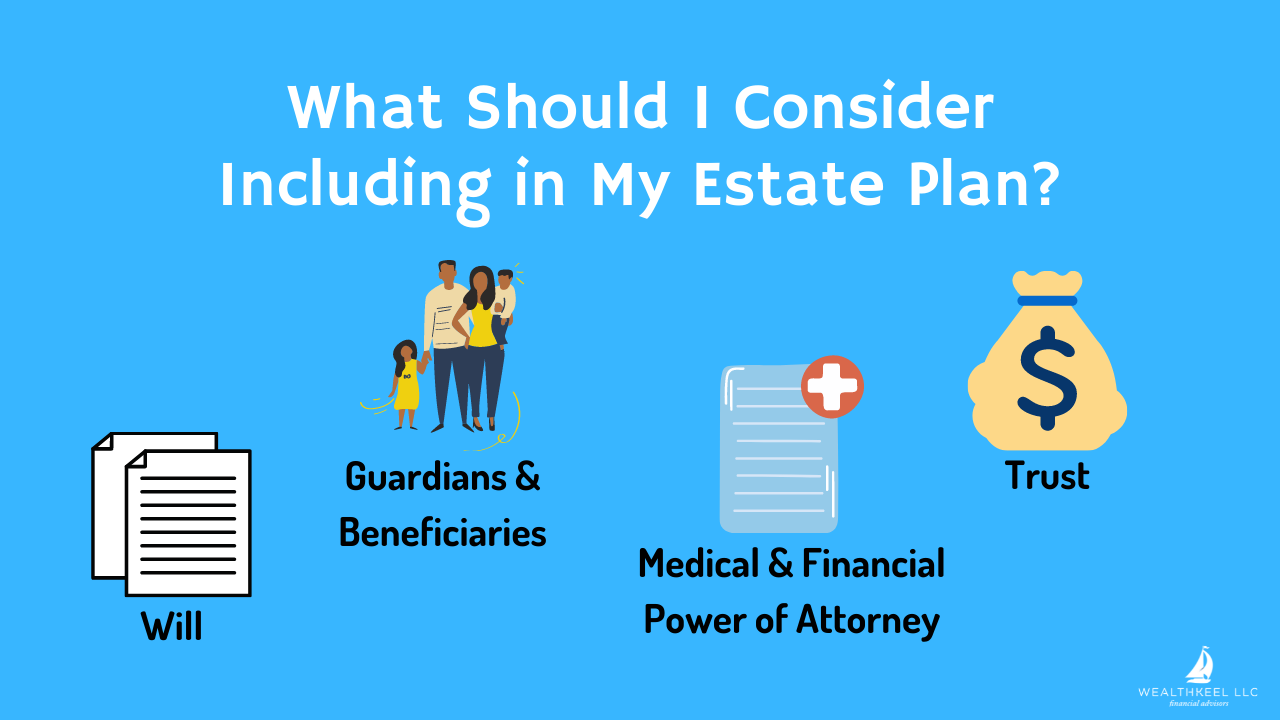

6. Form an Estate Plan

Another not-so-happy topic, but an important one nonetheless. Whether you’re single, married, or have children, it’s important to have your estate plan in order.

Your Will is at the heart of your estate plan. If you have children, your Will should also include guardians. Should something happen to you and you do not have a Will in place, decisions about you and your belongings will be in the hands of the court (not ideal!).

When forming your estate plan, you’ll want to update the beneficiaries on all of your accounts (insurance, investments, retirement, real estate, etc.). You may also want to consider a trust to protect your assets from probate, control funds, and prioritize privacy.

Do you have a medical and financial Power of Attorney (POA)? If not, it’s time to start doing some research. While you are at it, don’t forget to add your Living Will.

A medical POA makes any medical decisions for you if you become incapacitated, and a financial POA would handle any financial matters. Be picky when choosing your POA. After all, they are in charge of two very prominent areas that you don’t want screwed up. Creating a well-rounded estate plan can be a major influence on defining your legacy.

7. Budget Like You’re a Resident

Remember that budget template you created as a resident? Don’t put it away just yet. For at least 6 months to a year, keep your spending to the level as if you were still a resident. We aren’t saying you can’t upgrade from ramen noodles, but don’t start eating caviar every night (both the delivery service and food!).

Remember to always save as much as possible (as early as possible) and adhere to your budget. Here is our free budget worksheet again for you:

If you want a “cooler” budgeting tool, here are two great budgeting tools: Tiller and YNAB.

8. Live The Life You Love

You are a new attending — this is a huge step, and it’s worth celebrating! Be sure that you are working in a place that continues to challenge you and is filled with people with similar goals and values.

Be sure to look at all of your contracts before you sign — in depth (with an attorney!). You don’t want to be put in a bad situation down the road.

Looking for a more thorough, all-in-one spot for your financial life? Check out our free eBook: A Doctor’s Prescription to Comprehensive Financial Wellness [Yes, it will ask for your email 😉]