A medical malpractice lawsuit can be emotionally and financially draining for doctors. Not only is this process time-consuming and costly, but it can also wreak serious havoc on your practice and your personal life. Medical malpractice insurance is one way that physicians can protect themselves against litigation in the event of a medical malpractice suit.

This type of insurance is mandated in most states and can cover expenses including attorney fees, arbitration and settlement costs, punitive and compensatory damages, and medical injuries. Medical malpractice insurance can be purchased as an individual policy or provided by an employer.

While medical malpractice insurance is strongly recommended (and often required) for physicians, nurses, dentists, psychologists, and more, many medical professionals don’t clearly understand how this type of insurance works. This guide will answer some common questions about medical malpractice insurance and how doctors can avoid litigation and protect their assets.

Key Takeaways

- What it is: Medical malpractice insurance is a type of professional insurance recommended for physicians, nurses, dentists, and other medical professionals.

- What it covers: Medical malpractice insurance protects medical professionals and covers costs associated with litigation from malpractice lawsuits.

- Why you need it: Most doctors face at least one medical malpractice suit throughout their career, so it’s essential to be covered appropriately.

Prefer video over the blog? We’ve got you covered! Watch our YouTube video as we dissect this blog post for you:

1. What is Medical Malpractice?

Medical malpractice occurs when a doctor or medical professional causes injury or death to a patient due to negligence or omission. Convicted doctors don’t go to prison; instead, they pay damages to the patient or family. These damages may entirely or partially compensate patients for past and future bills, a loss of income, and the suffering that they experienced due to the doctor’s negligence.

Medical malpractice laws vary from state to state, but the statute of limitations is generally between one and three years. A long time frame means that doctors may be sued even by patients treated months or years ago. A claim must meet several criteria simultaneously to qualify as medical malpractice.

Violates the Standard of Care

The first threshold for medical malpractice is that a doctor must violate the standard of care. Standard of care is a legal term meant to illustrate a reasonable benchmark for the care based on the doctor’s specialty, available field knowledge, geographic area, and more. A successful lawsuit would need to prove that the doctor’s treatment failed to uphold common medical standards. Breaches of this threshold lead to negligence claims.

Results in an Injury

The medical professional’s negligence must have resulted in a legitimate injury to qualify as medical malpractice. This second parameter means that a doctor cannot be charged with medical malpractice only because of negligence; they also need to have caused their patient harm.

Causes Significant Damage

The incident needs to have resulted in significant damage to the patient. Significant damage can take the form of disability, loss of income, medical bills, or unusual pain and hardship. While the definition of “significant damage” can sometimes be subject to debate, it generally means that patients cannot sue medical providers for extremely minor issues.

2. How Does a Medical Malpractice Lawsuit Work?

Medical malpractice lawsuits go through several stages. These include:

- Meet with an attorney. First, the injured patient or family member meets with an attorney to discuss the details of the case.

- Consult a medical expert. If the attorney thinks the case is strong enough, they may request the relevant records and have them reviewed by a medical expert witness, usually another doctor.

- File a case. If the doctor agrees that medical malpractice has occurred, the attorney will then file a claim against the doctor or physician accused of negligence.

- Conduct an investigation. Both parties will investigate the facts and details surrounding the case, which can take up to a year or more.

- Settle out of court. In some cases, doctors and their insurance companies may agree to settle out of court.

- Go to trial. If the two parties cannot agree to a settlement, the case will go to trial. The jury will decide whether or not the physician is guilty of the charges laid against them.

It’s important to remember that only a fraction of medical malpractice claims actually go to court, and the defendant wins even fewer. High loss rates are because a medical malpractice claim must meet the strict criteria we mentioned above (breach the standard of care, cause injury, and result in major damages. In most cases, medical professionals try their best to help patients and are not found guilty of medical malpractice, even in instances where injuries occur.

3. Why Do Patients Sue Doctors?

Patients may sue doctors for a variety of reasons. For example, they may be seeking financial compensation for an injury they suffered, or they may just want to hold a doctor accountable for their actions.

Suppose a patient has been significantly injured or even passed away due to suspected medical malpractice. In that case, patients, family members, and loved ones may be looking for closure and an emotional resolution to their experience.

Ultimately, the reasons why patients sue doctors can be complex and multifaceted. While the end result of a successful medical malpractice lawsuit is usually a check made out to the defendant for damages, these lawsuits may not always be entirely financially motivated. Patients may also feel that a case is a way to get answers to their questions and make sure their voices are heard.

Source: Miller & Wagner

4. How Can Doctors Prevent Medical Malpractice?

While it may sound simple for doctors to prevent medical malpractice, the reality is that even the best medical professionals make mistakes. Unfortunately, no matter how hard you try, there will likely always be instances where you slip up from time to time. That said, there are a few strategies that physicians can employ to help minimize potential malpractice.

Continuously Develop Skills and Knowledge

The medical field is constantly changing, and doctors and other medical professionals need to make sure that their skills are up to date. Therefore, it’s a good idea to keep abreast of developments in your field and make sure your knowledge is as complete as possible.

Confer with Other Doctors and Specialists

If you’re ever in doubt, there’s no shame in seeking help from other doctors and specialists. Not only can your peers provide a second opinion, but they can also help to make sure that your patient’s treatment is as safe and effective as possible.

Pay Attention to the Details

To limit malpractice claims, it’s a good idea to make sure you pay attention to the details of your patients’ cases and make careful, considered decisions when it comes to their treatment. In addition, you should document everything thoroughly and check up on your patients continually throughout the process.

Always Have Adequate Support

It’s easy for mistakes and accidents to occur when you don’t have the proper support. You should have help from nurse practitioners, physician’s assistants, and other medical professionals when dealing with patient care plans.

Avoid Rushing and Overwork

Long hours and rushed treatment are other common causes of medical mistakes. While a doctor’s schedule can sometimes be punishing, it’s important to remember that avoiding overwork benefits both you and your patients. When possible, you should try to be as well-rested as possible and take the time you need to provide treatment to the best of your abilities.

Do No Harm

One of the foundational principles of medical work is the Hippocratic Oath, by which doctors pledge to “do no harm.” While it’s not always possible to make a decision that doesn’t come with inherent risks for a patient, you should keep the Hippocratic Oath in mind and strive for treatment that minimizes harm while maximizing health and quality of life.

5. How Can Doctors Avoid Litigation?

Avoiding medical malpractice litigation isn’t always as simple as not making any mistakes. For one thing, no medical professional can avoid all mistakes at work. Medical malpractice claims also aren’t just about mistakes; they can also occur when patients are upset with their care or feel ignored or unseen.

To reduce the likelihood of a lawsuit, it’s good practice for doctors to listen carefully and thoroughly to their patients’ concerns, even if they feel that these concerns may be misguided. It’s also a good idea to clearly communicate your actions, recommendations, and instructions for patients and document this communication in writing when possible.

If you make a mistake or experience an issue with a patient, you should be sure to seek advice from other professionals and maintain an open line of communication with the patient. If possible, you should explain what went wrong, what you’re doing to fix the problem, and how you plan to keep it from happening again. Many patients looking for an emotional resolution to a medical accident or issue may be satisfied with a clear explanation and a heartfelt apology from their medical provider.

6. How Can You Protect Your Personal Assets?

Because a medical malpractice lawsuit isn’t a criminal charge, you don’t face jail time. Instead, you’re required to pay damages to the defendant if you’re found guilty of medical malpractice. These damages can vary widely from case to case but generally attempt to compensate victims for loss of income, medical bills, and pain and suffering.

Medical malpractice insurance is essential because it protects your assets in case an unhappy patient sues you. In addition, this type of insurance typically covers your defense, expert witness costs, settlement costs, and legal fees.

In the vast majority of cases, insurance protects medical practitioners from losing any assets during a lawsuit. However, physicians looking for extra protection may want to consider purchasing an umbrella insurance policy (Umbrella policies do NOT help cover medical malpractice), investing in protected retirement accounts, setting up an asset protection trust, or establishing an LLC.

Pro-Tip: You are much more likely to lose half your assets to divorce rather than a malpractice suit over your limits. So while malpractice is vital, I would also highly suggest date nights with your spouse!

7. How Much Medical Malpractice Insurance Do Doctors Need?

Many doctors are concerned about how much medical malpractice insurance coverage they need. While there’s no one correct answer regarding the amount of coverage you should purchase, it’s a good rule of thumb to buy a similar amount of coverage from other professionals in your area.

To get a sense of how much insurance coverage you need, you should ask your colleagues how much medical malpractice insurance coverage they have. The amount can range from a few hundred thousand dollars to a million or more.

While it’s always good to purchase as much coverage as you can comfortably afford, it’s not always the best decision to purchase more coverage than you truly need.

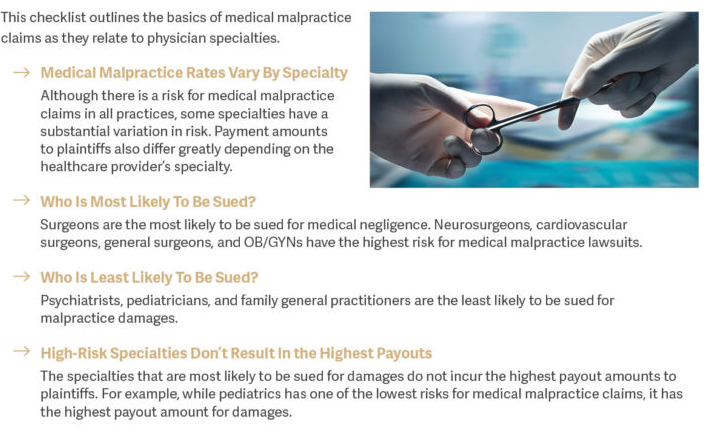

You should aim for a coverage amount in the ballpark of your peers, which is typically enough to cover the costs for your defense, settlement, and judgment in the event of a trial. The common limit is $1M/$3M (The first number is the amount of coverage per occurrence and the second number is the total coverage); however, you need to base this on your specialty, not “general” guidelines. For example, medical malpractice claims from neurosurgery lead with about 20% of all claims, followed by obstetric surgery, cardiovascular surgery, and general surgery.

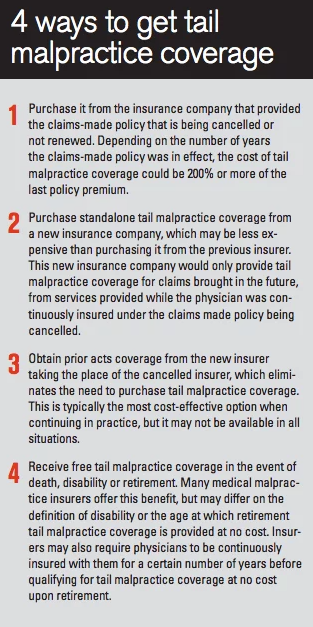

While we did not get into the details of “tail” coverage, it is one of the most critical factors of any malpractice policy. Your policy will either be an occurrence policy or a claims-made policy. If it is a claims-made policy, you need to add “tail” coverage to pay for any claims that may arise after the term of the policy.

Source: Medical Economics

8. Where Should You Get Medical Malpractice Insurance?

Some doctors receive medical malpractice coverage from their employers. In many cases, your employer will already have done the necessary legwork regarding insurance coverage, primarily if you work at a larger organization such as a hospital.

Pro-Tip: If you are working a 1099 role or moonlighting at a different hospital, make sure your E&O covers all your roles!

If you do need to purchase insurance coverage for yourself, you should look for a policy from an established company with a history of medical malpractice coverage. You should ask colleagues and peers in your area who their insurer is. It’s also a good idea to obtain quotes from several different insurers to compare rates and policy details and choose the policy that works best for you.

One of the main items to research when picking your insurer is their financial strength. Ideally, you should be looking to work with firms that are A or better (A+ or ++) from A.M. Best.

Some of the top providers for medical malpractice insurance include:

- The Doctor’s Company

- Medical Protective (Med Pro) – Berkshire Hathaway

- Healthcare Providers Service Organization (HPSO)

- Medical Liability Mutual Insurance Co

- Physicians’ Reciprocal Insurance (PRI)

- State Volunteer Mutual Insurance Company

9. Why Is the Cost of Medical Malpractice Insurance Decreasing?

You may be surprised to learn that the cost of medical malpractice insurance is actually less than it used to be. Medical malpractice insurance prices have declined for various reasons, including additional legal protections for doctors, more advanced medical treatment and technology, and increased competition between insurance companies.

Because there are now more legal protections for medical professionals in place, attorneys and defendants may be less likely to pursue marginal claims that have a low rate of success, which can drive down insurance costs as a result.

Increased technology and established medical processes also mean that doctors are more informed about treatment and less likely to make common mistakes. While prices can vary widely between providers, it’s easier than ever to find an affordable rate for a policy that meets your needs.

Final Thoughts

Medical malpractice insurance is an essential type of insurance coverage for doctors and other medical professionals. It can protect you and your assets if a patient or family member sues you for medical malpractice. While medical malpractice isn’t a criminal charge, it can still have grave consequences, which is why you need to be adequately covered.

In many cases, doctors automatically receive medical malpractice insurance coverage as part of their benefits package from an employer. If you don’t already have a policy, you can purchase one from an established insurance company.

Aside from purchasing insurance, doctors can do a few other things to help prevent the likelihood of a medical malpractice suit. While no doctor is perfect, it’s important to be as careful as possible to avoid mistakes and ensure that you provide the highest quality of care. When the best course of action is unclear, you can always ask for assistance from colleagues and specialists.

If a mistake or accident does happen, you should always be open and honest about it. Many patients file medical malpractice suits because they are upset or angry at a medical provider, not just because they’re looking for a financial settlement. Talking openly with your patients about their experiences and taking their concerns seriously can help to minimize the risk of a lawsuit.

In addition to medical malpractice insurance, there are plenty of other things you should keep in mind regarding your finances and asset protection. Different types of insurance coverage you may need include health insurance, life insurance, disability insurance, and more. Because doctors often have unique financial situations, it’s crucial to have a solid financial plan in place.

Looking for a more thorough, all-in-one spot for your financial life? Check out our free eBook: A Doctor’s Prescription to Comprehensive Financial Wellness [Yes, it will ask for your email 😉]

Disclosures