Unlocking Tax Savings with a Donor Advised Fund (DAF)

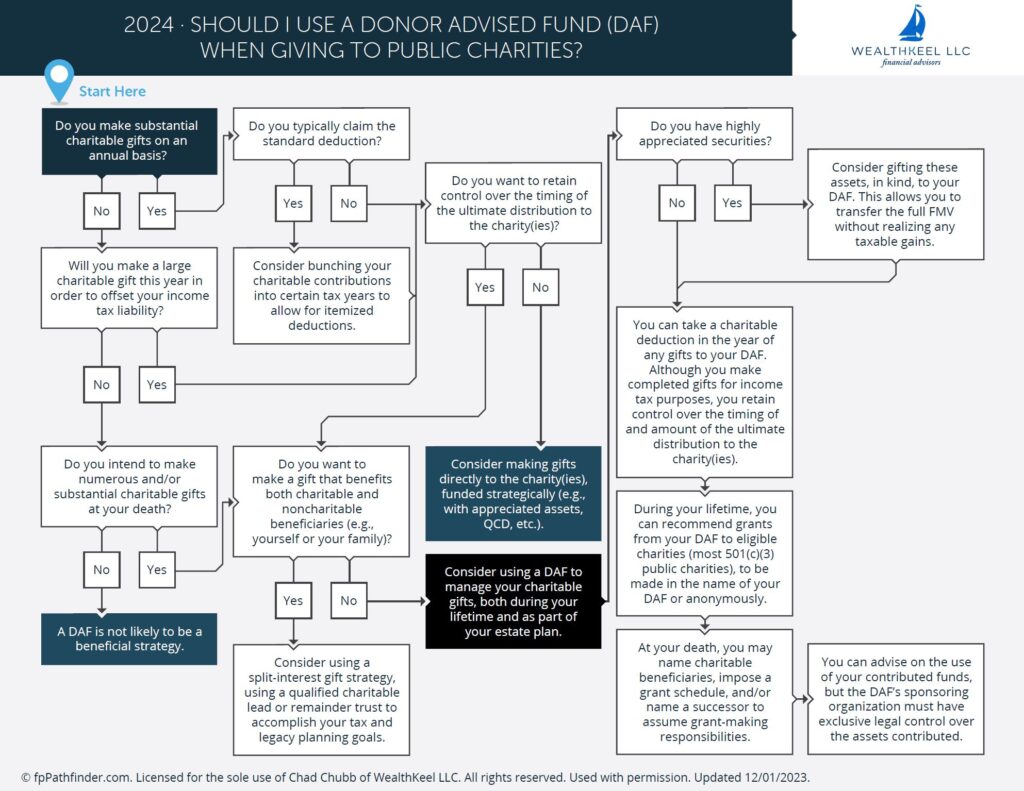

In the realm of philanthropy and tax planning, a Donor Advised Fund (DAF) serves as a strategic financial tool that enables individuals to enhance their charitable giving while optimizing tax benefits. This guide delves into how a DAF functions, its tax advantages, and walks through real-life scenarios using tax planning software to illustrate potential savings.

🎥 Prefer video over the blog? We’ve got you covered!

Watch our YouTube video as we dissect this blog post for you 🎥

What is a Donor Advised Fund (DAF)?

A Donor Advised Fund is essentially an investment account for the sole purpose of supporting charitable organizations you care about. When you contribute cash, securities, or other assets to a DAF, you are generally eligible to take an immediate tax deduction. These funds are then invested and can grow tax-free until you advise the fund to distribute amounts to the charities of your choice.

Major financial institutions like Vanguard and Fidelity offer opportunities to open DAFs, providing a flexible pathway for strategic charitable planning. Not only do these funds facilitate the consolidation of charitable donations, but they also simplify the process of tracking those donations for tax purposes.

Strategic Benefits of Using a DAF

One of the primary advantages of a DAF is the ability to “bunch” multiple years’ worth of contributions into one fiscal year. This method can significantly enhance your ability to surpass the standard deduction threshold, thus maximizing your itemizable deductions.

Example of Contribution Bunching

Consider a scenario where you typically donate $10,000 annually to a charity. In years where this contribution alone does not exceed your standard deduction, you may not receive the full tax benefit from your generosity. By contributing a lump sum of $30,000 to a DAF, you can claim a larger deduction in one year. Over the subsequent years, you can distribute the funds annually to your charity, sustaining your support and smoothing out your cash flows without compromising on your philanthropic goals.

Additional Financial Benefits of DAFs

Another compelling use of DAFs lies in donating appreciated assets, like stocks or real estate, which can further enhance your tax efficiency by avoiding capital gains taxes. This tactic not only maintains the full value of your donation but also resets the cost basis of these assets when you reacquire similar assets in the future.

Navigating Schedule A: Itemized vs. Standard Deduction

Under the U.S. tax code, taxpayers can choose between taking a standard deduction or itemizing deductions on Schedule A. The decision hinges on which method offers the greater deduction, thus lowering your taxable income more significantly.

Sections of Schedule A:

- Medical and Dental Expenses: Expenses exceeding 7.5% of your adjusted gross income (AGI) can be deducted.

- State and Local Taxes (SALT): Deductions are capped at $10,000, known as the SALT cap.

- Home Mortgage Interest: Interest on up to $750,000 of mortgage debt can be deducted.

- Charitable Gifts: This is where DAF contributions are noted.

- Other Deductions: Includes various less common deductions.

Real-Life Tax Planning with a DAF

To explore the impact of a DAF on your taxes, let’s consider a hypothetical case using tax planning software with data based on the 2024 fiscal year.

Scenario Analysis (Live In YouTube Video):

- No DAF Contribution: Standard deduction used.

- $25,000 DAF Contribution: Switch to itemized deduction, resulting in lower taxable income and tax due.

- $50,000 DAF Contribution: Further reduction in taxable income and tax due.

- $100,000 DAF Contribution: Maximizes tax savings, showcasing the considerable impact of a significant DAF contribution.

Each scenario reveals that as the DAF contributions increase, the taxable income decreases—a testament to the potency of strategic charitable planning.

Comparing the Scenarios

When comparing these scenarios side by side, it becomes evident that the ability to itemize deductions, especially through substantial DAF contributions, can dramatically reduce one’s tax liability. The choice between standard and itemized deductions hinges on the ability to surpass the standard deduction threshold, which can be effectively achieved through DAFs.

Conclusion

Donor Advised Funds offer a powerful means to not only support your charitable inclinations but also to optimize your financial strategy and reduce your tax burden. By strategically bunching contributions, donating appreciated assets, and understanding the nuances of itemizing deductions, you can potentially lower your taxes substantially while making a meaningful impact on the causes you support. Annual tax planning, especially as you approach the end of the fiscal year, becomes crucial in maximizing the benefits derived from a DAF.

For those assessing their charitable giving strategies, incorporating a Donor Advised Fund into your financial toolkit might just be the key to achieving both your philanthropic and financial objectives. By consulting with your financial advisor and/or accountant, you can tailor a strategy that aligns with your personal, charitable, and tax-saving goals, ensuring that your generous spirit also yields practical financial benefits.

Looking for a more thorough all-in-one spot for your financial life? Check out our free eBook: A Doctor’s Prescription to Comprehensive Financial Wellness [Yes, it will ask for your email 😉]