You are headed down the home stretch: your last year as a training physician is coming to an end, and that means it’s time to update your financial planning accordingly. Whether you are finishing up residency or your fellowship, your attending career is about to get started! We have worked with hundreds of physicians making this transition, and today we share some of the main points we seem to address time after time.

In this post, we’re going to walk through seven topics that we see quite often with our clients that are transitioning to attending status: medical contracts, sign-on bonus and how that affects your gap months, lifestyle creep, student loans vs. investing, top-down budgeting, insurance updates to make, and common doctor pitfalls.

KEY TAKEAWAYS:

- It might seem obvious, but we can’t stress it enough: hire an attorney to review your medical contract. After you sign, figure out when your sign-on bonus will arrive to help cover any gap months of limited-no income.

- We know it’s tempting, but try your best to avoid lifestyle creep after you see those bigger paychecks. Don’t be the Doc with a flashy house and cars that’s privately living paycheck to paycheck!

- Don’t stress too much about whether to put more money toward student loans or investing. Our advice is to make sure you’re either on track for PSLF or a 5-10 year repayment while also saving at least 5% (and hopefully more than that).

- Congrats, you’ve now got a much larger paycheck! Small problem: you’ve got expenses. Follow our top-down budget to make sure your financial well-being is prioritized, then reward yourself with discretionary income!

- Be sure to update your disability insurance (updated for your new salary + true own-occ) and life insurance (term life insurance for 99% of you).

Prefer video over the blog? We’ve got you covered! Watch our YouTube video as we dissect this blog post for you.

Review Your Medical Contract

You are likely getting ready to sign a contract that controls the next few years of your life and the biggest income figures of your life thus far. I don’t care what the partners or what human resources tells you about this being a “standard contract,” hire an attorney to review the contract. More importantly, if you can find an attorney who has read that same contract numerous times, he or she can be on the lookout for different income, bonus structures, and other “fine print.”

When we review medical contracts for our clients, we keep an eye on the numbers and rely on the attorneys for all the technical jargon. With that said, your base salary, bonus structure, moving expenses, and sign-on bonus usually all have some wiggle room. If you can find another physician at the hospital/practice who is willing to chat over a coffee or beer/wine that could be very helpful.

There are a few options for Contract Reviews from The White Coat Investor.

Sign-On Bonus & the Gap Month(s)

Speaking of the sign-on bonus, don’t forget to confirm when it will arrive! Most doctors will have a one- to three-month gap between training and attending. What are you going to do for those few months with limited or no income? This seems like a basic question, but I promise it is missed often.

A solid emergency fund going into the gap months will be vital for a few reasons:

- Health Insurance: If you and your family rely on your health insurance coverage, you may have to convert to COBRA for a few months. COBRA can be 102% (2% is a service charge) of your total insurance premium. And total insurance premiums include what your employer was paying, which can be a multiple of what you were paying.

- Moving Expenses: Where is your attending role? If it’s down the street, then you’re fine. If it’s across the country, moving expenses need to be included. We have seen $5,000 to nearly $20,000 in moving expenses, and I am sure someone has spent even more than that. Moral of the story: moving is not free, and you should prepare for a decent bill. Check this handy Moving Cost Calculator for Moving Estimates.

- Living Expenses: While we say “low-income” while in training, the income is good and you usually finish up training around $60,000 – $70,000. If you lower that to $0 right now, what happens? You should be prepared for that if you have a few gap months.

- Home Down Payments: I know what you just said. Yes, you just said, “Oh that won’t matter to me, I am getting a physician mortgage loan with no down payment.” Great, I love those too, but you still need funds to buy a home. Assuming that you don’t like sitting on the floor, furniture and window coverings also cost money.

- Pro-Tips:

- I am a fan of physician mortgages, but if you can get 3-5% down and look for a conventional mortgage, you can likely get a much lower interest rate, which can save you six figures plus on the total paid interest. Yes, PMI (private mortgage insurance) will be there, but if your rate is lower and PMI is ~$100 per month, but the lower rate saved you $300 per month, you are still better off. PMI will also fall off after you hit 20% in equity.

- If you do decide to go with a physician mortgage, once you hit 20%, look to refinance to a conventional mortgage. Yes, there will be closing costs, but if you can lock in a much better rate, you should save a lot of money in the long run.

- We have seen banks tell physicians they have “physician mortgages,” but when we review the mortgage, we find out the bank fabricated some odd mortgage to look like a physician mortgage. Look for a professional who knows what they are doing in this space.

- Pro-Tips:

- Student Loans: If you are not going for Public Service Loan Forgiveness (PSLF) and plan to refinance your loans privately and pay them down aggressively, pump the brakes until you can afford the payment. If you were on an income-based repayment plan, and now plan to pay them off in 5 years or less, your payment is going to go from a couple of hundred dollars to a couple of thousand dollars per month. Be sure to do this once your attending pay has started or if the cash reserves can help with a month or two.

The key takeaway is that you need to prepare for the gap months and do not be afraid to ask your employer to send the funds sooner than later. Most of the time they are happy to do this if it will make your transition easier. You just signed a multi-year contract with six figures on it – they want you to be happy and the best doctor you can be when you walk in those doors.

Avoid Lifestyle Creep

Besides not investing sooner than later, lifestyle creep is the number two destroyer of all financial plans long-term. What is lifestyle creep? It’s when you allow your higher income to be filled in with higher (unnecessary) expenses. Think of the Doc who has the $3,000,000 home, a Tesla, a Range Rover, and only eats at the finest restaurants fresh out of training. On the outside you are thinking, “Wow! That Doc is crushing it!” Au contraire, when we open the hood, we see student loans at 6 figures still on an income-based repayment plan (and not going for PSLF 🤯). We see a very high-income professional living paycheck to paycheck. We see a household savings ratio at 3% because he/she “at least” got the 401k/403b match.

You were likely very happy (all things considered) living off of $70,000, and yes, it just tripled or quadrupled or more, but why can’t you continue to live within that $70,000 for a few years?

If you can live within your means for a few more years, or at least until your loans are paid off, you are setting yourself and your family up for a much stronger financial future.

Scroll down to the “Top-Down Budget” section for more content on how to avoid lifestyle creep. Here are the cliff notes: tell your money where to go first to meet your goals, both short-term and long-term, and if you do this, you don’t have to micro-manage your budget.

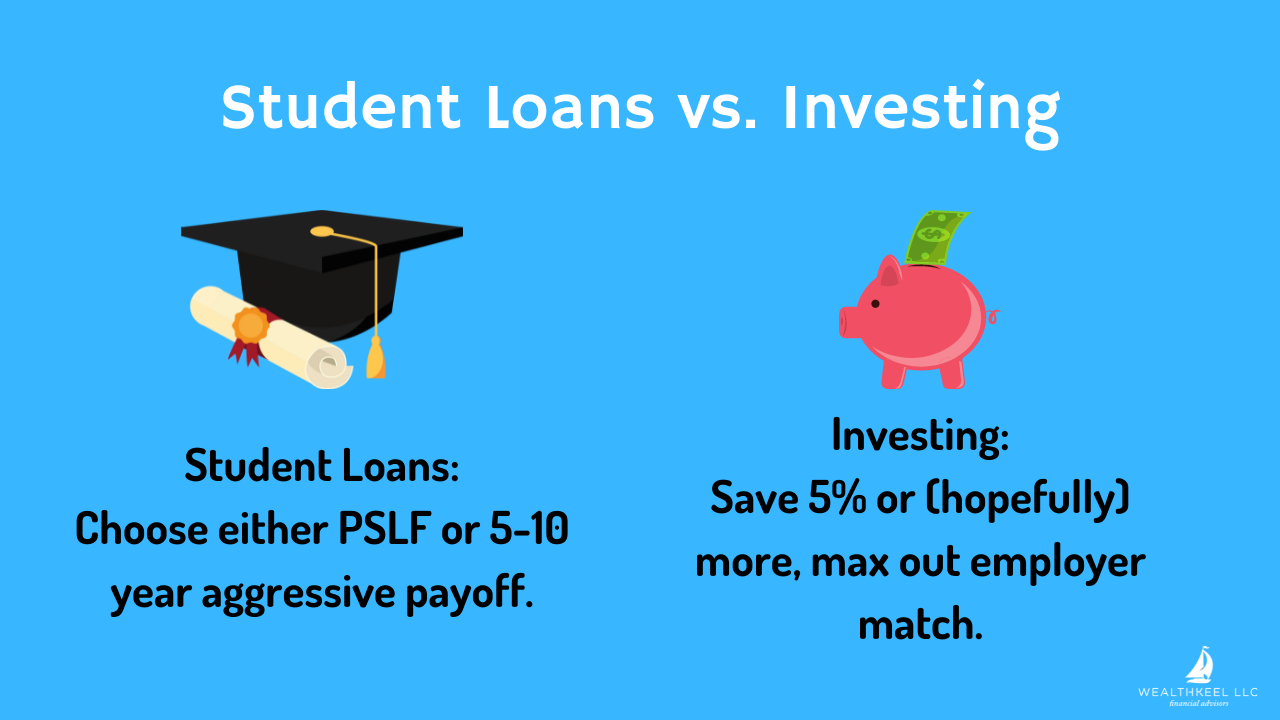

Student Loans vs. Investing

This is the question we get “on the streets” most frequently. For some reason, it seems like many think it is an all-or-nothing situation. Meaning, I put every dollar toward student loans or I put every dollar toward investing. More commonly, the truth lies somewhere in the middle.

You should do your best to get the compounding interest clock started sooner than later. As a reminder, your best tool in investing is time. Time = Compounding Interest.

Goal 1: Either PSLF or aggressive payoff.

By this point in your medical career, you are either well on your way to Public Service Loan Forgiveness (PSLF) or you’re not. If this does not make sense to you, check on some of our other posts on student loans.

If you are going for PSLF, great, keep doing what you’re doing. Make sure you have done and are doing all the items we cover in our Public Service Loan Forgiveness blog post.

If you are going for an aggressive payoff, the aggressive payoff is certainly less than 10 years with a goal of less than 5 years.

Want some “free” money? Use one of the links from the White Coat Investor page to refinance. Some popular options include:

- Credible

- SoFi

- Earnest

- Splash

Real Numbers: $300,000 in student loans at 4.5% for 5 years = $5,593 per month. Prepare yourself; the numbers are not small.

Goal 2: Start the investing clock.

Keep some wiggle room for investing. Start by saving at least 5% of your income — the main goal is to get the full employer match (if offered). If you can save more, great, here are our investing guideposts (as an attending):

3) Joint/Individual taxable account

The main goals are to be sure your loans are either on track for PSLF or a 5-10 year repayment while also starting to save as much as possible with a minimum goal of 5% (that is the very, very low minimum).

Top-Down Budgeting

One of our most popular posts continues to be Building a Budget for Medical Residents. Your days of medical resident budgeting are now over (imagine champagne popping and balloons falling from the sky)! It is time to graduate from the “living paycheck to paycheck budget” and over to the “top-down budget.”

The top-down budget is this: tell your money where to go at the top of your budget, and then you don’t have to micromanage the bottom part of the budget. This one is also known as “have yourself a latte and enjoy the Chick-Fil-A as much as you like” budget.

You just went from $60,000-$70,000 to a multiple of that, so you now have something called “discretionary income” – congrats!

So what goes on at the top of the budget:

First, your net income arrives (the amount that hits your checking account). Net means you already invested in your 401k, you have healthcare for your family, maybe an HSA or FSA, maybe a transit card if you live in a city, and Uncle Sam and the gang have been giving their cut. What’s next?

- Fixed Expenses Toward the Top (no specific order):

- Housing (mortgage + escrow/rent)

- Utilities & Food: I suggest three categories: Utilities, Groceries, Dining Out (we all know this one is not a necessity!)

- Student Loans

- Funding Your Emergency Fund (and other short-term goals)

- Funding Your Backdoor Roth IRA(s)

- Funding Your Joint Account

- Private Insurance (Term Life & Disability)

Whatever is left, have fun! Assuming you are on track for your goals, of course. This is where a financial plan can really help on the budgeting/cash flow side.

What does this look like in real life?

Let’s assume Doc McStuffins (yes, I have two young kids & Disney Plus) brings home $20,000 per month (net).

- Mortgage & Escrow: $3,000/m

- Utilities & Food: $2,000/m — Utilities: $500, Groceries: $1,000, Dining Out: $500

- Student Loans (aggressive payoff in 5 years with $200,000): $3,725/m

- Funding Your Emergency Fund and Travel Fund: $500/m

- Emergency Fund: Replenish when needed, currently at $20,000

- Travel Fund: $500/m

- Funding Backdoor Roth IRAs: Doc McStuffins and her hubby: $1,000/m

- Best to try and max these out once per year with a backdoor Roth IRA as opposed to the monthly saving, but let’s roll with that for now.

- Funding Your Joint Account: $4,000/m

- This along with the 401k and backdoor Roth IRA(s) has them on track for early financial independence in their mid-late-50s, currently.

- Private Insurance (Term Life & Disability): $800/m

- Two term life policies and one own-occ disability policy.

- Left Over: $4,975

By knowing that Doc McStuffins and her hubby are on track for their goals, it now allows for guilt-free spending with the bottom portion of their budget ($4,975). If they change their goals, grow their family, or have any other course change, they would want to reevaluate/update their current budget.

Insurance Updates for Last Year of Training Physicians

There are two main categories to review (plus a few bonus topics!): disability insurance and life insurance.

Disability Insurance: Your income is about to have a rather large increase, and your specialty language is going to get specific. If you don’t already have a private policy, now is the time to get one. If you already have one from residency, call your agent and give them the update. You likely added a rider that allows you to increase your policy amount without any new health questions (known as guaranteed insurability), you just need to provide your medical contract or new paystub to show your higher income. More importantly, make sure your policy is a “true own-occupation” definition.

Your private policy will supplement your group policy (assuming you have one). Most group policies have a weak definition of “own-occ,” low benefit amounts, and benefits are 100% taxable since your employer pays for the policy. This is why you should not solely rely on your group policy for your only disability policy.

Life Insurance: One of the most common calls we get starts like this:

Doc: I was sold this life insurance policy recently, and I am concerned that it is one of those types that The White Coat Investor said to avoid….?

Me: Okay, tell me more about it?

Doc: That’s the thing, I don’t know much about it.

Me: Okay, well what is the monthly premium? That should give me the main detail.

Doc: $4,000 per month.

Me: Ohhhhhhh. Got it, yeah, it might be one of those “types.”

As a side note, I am not anti-whole life insurance. For some, it can be a good fit later in life or if a person has unique circumstances (unique = likely less than 1% of you). We see way too many young physicians with way too much permanent life insurance. For many (say the other 99%), you would be just fine with term life insurance. No fancy bells and whistles, just pure life insurance.

The amount and strategy can vary a good bit for those of you that are single or married with no kids yet compared to those of you with young families. Also, read my note below on promissory notes if you have a loan with not-so-friendly terms or even worse, a co-signor; term life insurance could be important for your risk management strategy.

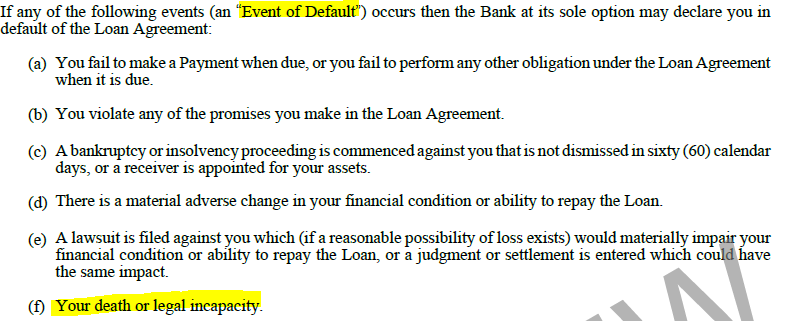

Pro-Tip: If you refinanced your loans with a private lender, be sure to read your promissory note and scroll down to the sections on both death and disability. Each lender has different rules here. For example, SoFi has rules very similar to federal loans for death and disability. However, First Republic Bank says you still owe them even if you die or become disabled (First Republic promissory note listed below).

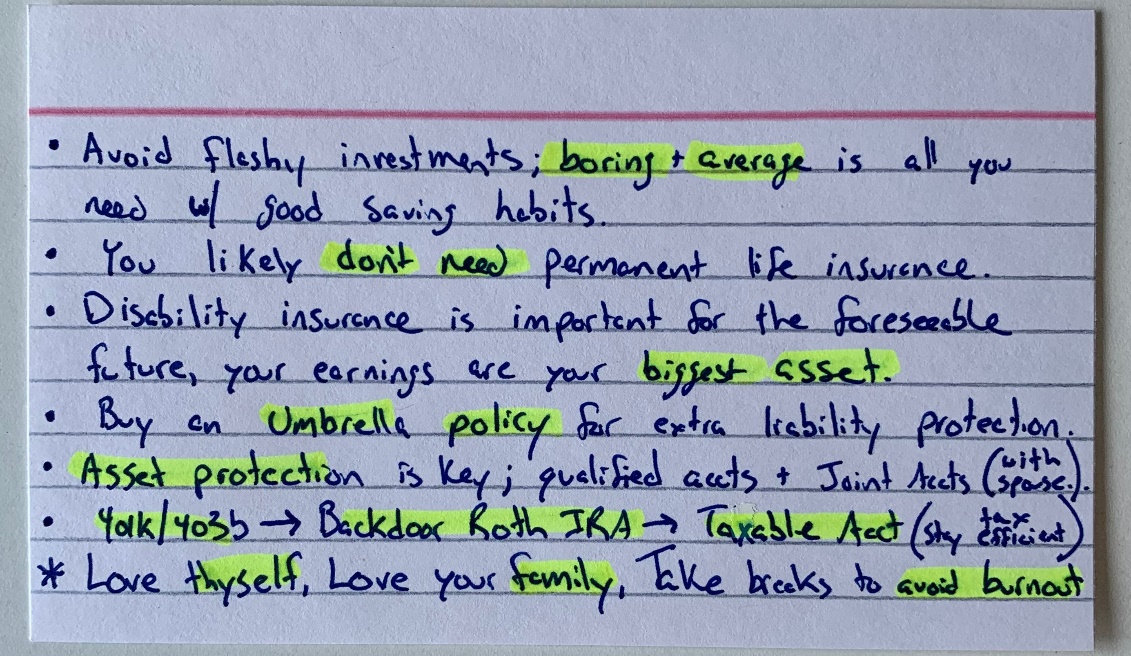

Common Doctor Pitfalls (My Notecard to You):

Good luck out there, Doc! Congratulations on finishing your training. The best is yet to come. Don’t neglect your personal well-being and your personal finances. They are both vital to your overall health and success.

If you have more questions about financial planning, check out our free eBook, A Doctor’s Prescription to Comprehensive Financial Wellness, where we cover 10 vital pieces of your financial life.