The physician mortgage loan (sometimes called the doctor mortgage loan) was created by banks because of the distinctive challenges physicians face when borrowing due to their high debt-to-income ratios — thanks to student loans. Many physicians struggle to find a conventional mortgage that meets their needs. This is especially true for new physicians who may have a lower salary during residency/fellowship, minimal savings, and student loans that are through the roof. Depending on the amount of debt you’ve taken on (and whether you’ve been consistent in making payments), you may also struggle with a lower-than-average credit score as you start your career. This could translate to higher mortgage interest rates and higher lifetime payments.

Luckily, there’s an alternative to a traditional, conventional mortgage. The physician mortgage loan is a unique type of home loan specifically for medical professionals. This mortgage can help new physicians lock in low-interest rates, avoid a colossal down payment (can be as low as 0%!), and reduce the total amount they have to pay over the life of their loan.

Key Takeaways:

- You have heard of the physician mortgage loan, but we finally explain it in simple terms and discuss the pros and cons.

- While the doctor mortgage is a great tool to have in your back pocket, it should not be your first option all the time.

- We cover who qualifies for the physician mortgage loan (hint: it is not only for physicians!) and the main requirements.

- Most importantly, is a physician mortgage even right for you?

First, here is a free flowchart we put together for you: What Issues Should I Consider When Buying a Home [PDF]

Prefer video over the blog? We’ve got you covered! Watch our YouTube video as we dissect this blog post for you:

What is a Physician Mortgage Loan?

A physician mortgage is a homeowner’s loan that is only available to qualifying medical professionals. There are fewer restrictions than you might find with conventional mortgages because they’re largely dependent on the calculated future earnings for physicians. For newer physicians, this is an attractive concept.

As a resident or fellow, your salary is notably lower than it will be in the next few years as an attending. In some cases, lenders will even accept an offer letter of employment as proof of income. This can dramatically impact your total debt-to-income ratio in the eyes of a mortgage lender, especially as you start your career.

What are the Benefits of a Physician Mortgage?

Doctor mortgages have a laundry list of benefits. Let’s go over a few of the key benefits you can expect when searching for a mortgage that meets your needs.

Down Payment

When you apply for a conventional mortgage, you need to put a minimum of 20% of the total purchase price down in order to avoid Private Mortgage Insurance (PMI). PMI is a monthly premium tacked onto your total mortgage payment that’s intended to protect your lender in the event that you can’t make payments. If you have a low down payment, you might be viewed as a “risky” borrower. In these cases, the PMI you pay is a sort of assurance to your lender that they’ll be covered if you default.

However, with a physician mortgage loan, you sidestep PMI entirely, even with a minimal down payment. In fact, many physician mortgages don’t require a down payment at all. You can put $0 down and still lock in a low interest rate and skip the PMI — not a bad deal! Of course, if you can, putting some money down will still decrease your total monthly payment and the interest you pay over the life of your loan. A down payment will also add equity immediately, which is also a positive. And don’t forget about FHA loans, as they can offer down payments as low as 3.5% with a good credit score. Here is one of our favorite posts comparing the FHA vs. Conventional Loans.

Debt to Income (DTI) Ratio

When borrowing a conventional home loan, they will often require a DTI ratio of 43% or less. If you’re saddled with hefty medical school loans, staying within that percentage may seem like a distant dream. However, physician mortgages don’t consider your full student loan payment to be part of the debt amount they use to calculate your DTI.

That’s right — a physician mortgage loan only counts the total monthly payment you make through an Income-Driven Repayment Plan (IDR) as part of your total DTI. So, if your monthly payment toward your loans is relatively low due to a lower starting salary when you apply for your mortgage, your total DTI will be significantly lower than if you were to use your full loan value as part of your calculation.

Loan Limits

Through conventional mortgages, the most you can borrow for a conforming loan is between $766,550 in most areas and $1,149,825 in high-cost areas (As of 2024). Physician mortgages don’t have this same borrowing cap, which can provide more flexibility for physicians and their families. Keep in mind, however, that just because you can borrow more than you would be able to through a conventional loan doesn’t mean you should. Physicians should still look to borrow within (or below) their means to maximize their salary.

Interest Rates

A recent study showed that physician mortgage rates are on par with conventional jumbo mortgage rates. However, this isn’t always the case. Your interest rate will still largely depend on your unique financial situation. It can be helpful to look at a physician mortgage calculator to get a ballpark idea of what you can expect.

Ultimately, the different interest rates from a physician mortgage loan vs. a conventional/FHA loan is one of the most vital calculations when comparing your loan options.

What are the Drawbacks of a Physician Mortgage?

A physician mortgage loan may sound like a best-case scenario, especially if you’re a relatively new physician looking to purchase a home for your family. However, there are a few drawbacks that may influence whether or not you decide to pursue a physician mortgage for your home-buying journey.

Interest Rates

With a conventional mortgage, you can often select a fixed mortgage rate that makes it easier to anticipate your mortgage expenses for the life of your loan. A physician mortgage loan may come with a variable interest rate. Variable rates can be financially dangerous, especially if you’re planning to stay in your home for the long term.

Variable rates often increase over time, which might mean you end up paying more over the life of your loan. You always have the option to refinance in the future, but variable rates can be sneaky. Your monthly payment may slowly increase without you noticing, and by the time you think to refinance you’ve already been overpaying.

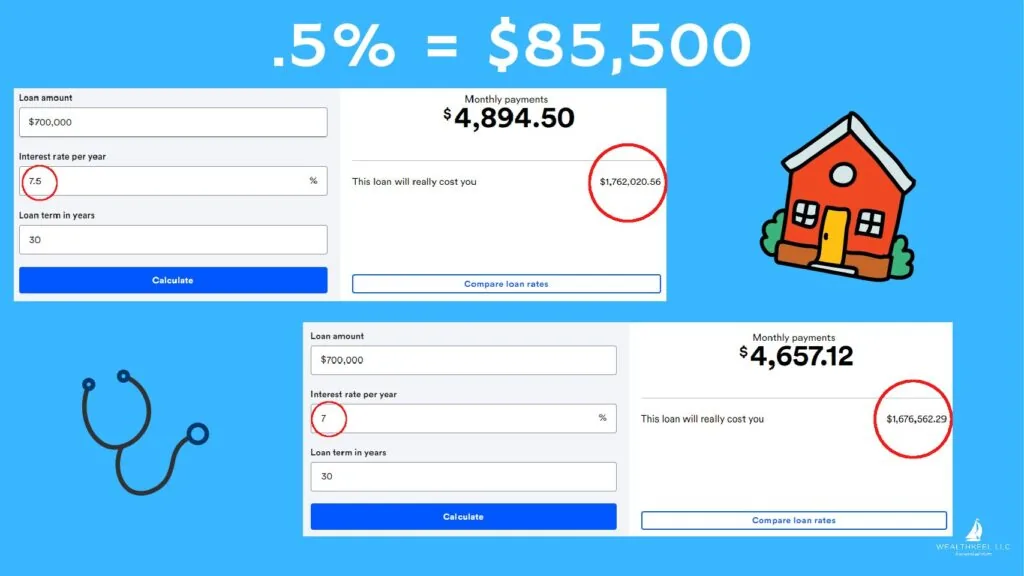

Another drawback to physician mortgage interest rates is that they’re often higher than conventional mortgages. Some conventional mortgages have interest rates of 7% or lower, and many physician mortgages may sit closer to 7.50% or higher (rates as of 1/2024), depending on your unique financial situation. Although the difference may seem minimal, keep in mind that even a small interest rate difference can have a large impact over time.

The tool from Bankrate is fantastic for comparing the total costs of any new debts. Here is an example comparing a $700,000 mortgage for 30-years at 7.50% vs. 7%; you can see that the “small” .50% lower rate ends up saving $85,500 over the life of the loan!

Limits on Primary Residence Types

Some lenders won’t allow you to take out a physician mortgage on a condo as your primary residence. Similarly, they have limits for rental properties and vacation homes. These types of residences often are associated with higher risk, and lenders put limitations in place accordingly.

Who Qualifies for a Physician Mortgage Loan?

To qualify for a physician mortgage, you usually have to be one of the following:

- Medical resident

- Fellow or attending physician (7-10 years out from medical school)

- Dentist or veterinarian

- A degree or proof of education

- Signed contract indicating future salary (not all require this, especially early in your training)

- A good credit score (often 700 or above)

- Deferred student loans (or loans in good standing, aka on an Income-Driven Repayment plan)

- DTI ratio of 45% or less (not including your full student loan amount)

Every lender will have slightly different requirements. Make sure you shop around to see if you meet the requirements for different lenders.

What are the Monthly Costs of a Physician Mortgage?

Your total monthly mortgage payment will be comprised of several factors:

- Principal

- Interest

- Taxes and insurance

- HOA fees (if applicable)

Principal: This is the total amount that you’ve taken out for your mortgage or the purchase price of your home. A percentage of your total mortgage payment goes toward your mortgage principal every month. Paying down your principal should be your primary goal. The sooner you can pay off your principal, the less you pay in total interest.

Interest: Depending on your mortgage rate, you’ll pay a percentage of interest over the life of your loan. The longer you pay on your mortgage, the less interest you owe because the total principal amount of your mortgage slowly decreases.

Taxes and insurance: Your homeowner’s insurance and property taxes can be rolled into your total monthly mortgage payment. This is referred to as escrow; however, you can also pay these items separately, too. Just be sure to be saving for those bills since they will be larger. Be aware that this number can fluctuate from year to year!

HOA fees (Homeowner’s Association Fee): Depending on where you buy, you may pay HOA fees as a monthly payment. These won’t be part of your mortgage payment, but they are something to keep in mind as part of your total housing costs!

Where Can You Find a Physician Mortgage?

There are a variety of lenders in every state who offer physician mortgages. For more information on realtors and lenders, check out the resources page from The White Coat Investor for a state-by-state breakdown and the Physician on FIRE.

Is a Physician Mortgage Loan Right For You?

For many young physicians, a doctor mortgage loan seems appealing. They effectively make it possible to purchase a home in spite of high student loan debt and a low starting salary. However, just because you can take out a physician’s mortgage doesn’t necessarily mean you should. For many new physicians, continuing to rent and live beneath their means can help them to boost their savings and net worth in the long run. Renting has several benefits, including:

- Location flexibility. When you first get started in your career, there’s no telling where you’ll live in 1-5 years. Renting makes it notably easier to relocate for advanced career opportunities.

- Lower responsibility. As a new physician, your primary focus will be growing your career. The last thing you need is unnecessary responsibility, distraction, or expense. Owning a home means the responsibility and expense of maintenance and repairs, and the distraction of ongoing upkeep. Renting means that large repairs are covered by your landlord and, in some cases, landscaping and aesthetic maintenance are also covered.

- Cash flow. An adjustable-rate physician’s mortgage might make it challenging to budget for monthly cash flow as your mortgage payment changes. Renting means a consistent payment that makes budgeting and cash flow strategy much easier.

Unfortunately, the decision to rent or buy isn’t usually as cut and dry as choosing the best financial option. Homeownership is an emotional marker of success, and for many people, the emotional security it provides is worth the financial cost.

If you’re considering buying a home with a physician mortgage loan, especially as a new medical professional, you should speak with your financial planner and mortgage broker to weigh all of your options. Together, you can determine whether homeownership fits within your long-term financial strategy — and which mortgage makes the most sense given your unique financial needs.

Looking for a more thorough all-in-one spot for your financial life? Check out our free eBook: A Doctor’s Prescription to Comprehensive Financial Wellness [Yes, it will ask for your email 😉]

Disclosures