As a physician, you are in a fortunate spot to have to use taxable investment accounts. However, many of us feel cold sweat bead down our neck when we hear “taxable” as a high-income household. Have no fear! We are here to show you how to build a tax efficient taxable account as a physician. Not only will we discuss taxable accounts, but we will venture into a few other areas as well.

Heck, your taxable account(s) will likely become your largest savings bucket. What do I mean? Well, you are limited to $23,500 to most 401ks/403bs and then limited to another $7,000 for the Backdoor Roth IRA each year. So assuming you skipped the “free” steak dinner from the local insurance guy (good for you!), you know that your most likely next stop is your taxable investment accounts.

Without further ado, let’s build a tax efficient taxable account!

Key Takeaways:

- There are many benefits for physicians to invest in a taxable account, including no limits, no forced withdrawals or penalties, and even “good” taxes! Yes – there is such a thing as good taxes!

- Tax-loss harvesting, donating or dying with appreciated shares, or donating shares to a Donor Advised Fund (DAF) are all strategies to pay fewer taxes. Just be sure to cover these with your accountant.

- I think asset location and tax diversification are two essential parts of a solid portfolio. The main goal of asset location is to place certain asset classes into specific accounts to enhance your overall returns.

Prefer video over the blog? We’ve got you covered! Watch our YouTube video as we dissect this blog post for you:

What Is a Taxable Account and Why Should a Physician Use It?

Short answer: a taxable account is simply a brokerage account. They usually come in two forms, an individual account or a joint account. If it is a joint account, ideally, it is Tenancy by the Entirety if your state allows it – more to come on this later – or Joint with Rights of Survivorship (JTWROS).

The main reason why a physician would use this account is that you are likely (hopefully!) maxing out your tax-qualified plans (401k/403b/457b/Solo-Ks and Backdoor Roth IRA – even 529s & HSAs). While I won’t add details in this post, some of you may be able to really benefit from a defined benefit plan (especially a cash balance plan), but we will save that for another day.

What are the benefits of a taxable account?

- No limits! That’s right, none of those IRS limits on how much you can save each year.

- Flexibility – both in terms of savings, timing, and withdrawals.

- No forced withdrawals from Uncle Sam at Age 72 (RMDs)

- No 10% penalty on funds needed before 59.5

- “Good” taxes! That’s right, some significant tax advantages can come into play when comparing to earned income:

- Passive – everyone loves that word!

- Long-Term Capital Gains Rate

- Qualified dividends rates

- Losses can offset gains (AND up to $3,000/yr in ordinary income)

- Some tax-free income – looking at you, Municipal Bonds

- Deprecation

- 199A Deduction

- No payroll taxes

- Step up in basis at death – more on this in the “Legacy” section.

What does “taxable” mean? Great question; there are two taxes you need to be aware of with a taxable account: long-term capital gains and qualified dividend rates.

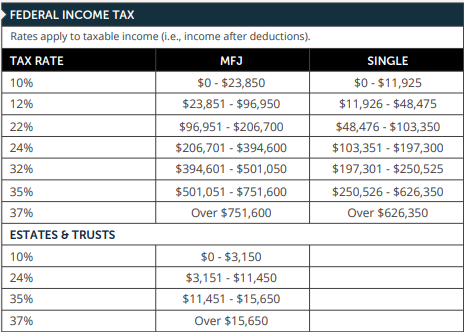

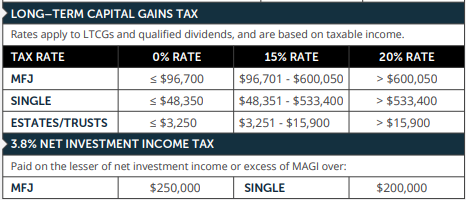

Earned Income = ordinary income, interest, rent (yes, we will get into real estate here), short-term capital gains, and non-qualified dividends. I know, I know, an odd place to start, but it is easiest to start here and work backwards. 2025 Important Numbers Full PDF

“Better” Tax Rates – sounds weird to say, but it’s true. Check out the rates below for long-term capital gains and qualified dividend rates. 2025 Important Numbers Full PDF

Now, as a physician, you likely have two more taxes two worry about (sorry 😔).

- Patient Protection and Affordable Care Act (PPACA)

- Income over $250,000 (MFJ) ($200,000 Single)

- 0.9% Earned Income

- 3.8% Unearned/Investment Income (Included in the chart above)

- Income over $250,000 (MFJ) ($200,000 Single)

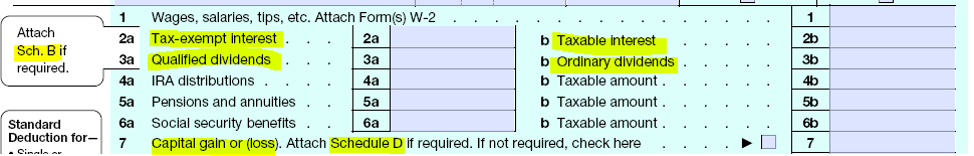

If you are sitting there thinking, do I pay these? If you have a taxable account, I bet you do. The good news is that it is easy to find the spot.

Break out your 2024 taxes, and on page 1 of your 1040, you have all the spots to look. From here, you can dig deeper into your Schedule B and Schedule D.

What Strategies Can I Use to Pay Fewer Taxes?

First disclaimer: tax fraud is no joke, so while I do like to keep a lighter and more fun tone in these posts, I want to make that part clear. The IRS is smart, so don’t try any funny business. All the strategies listed below are by the book, but as always, confirm/discuss them with your accountant.

Tax-Loss Harvesting

This is by far the most popular term you likely have heard of many times over. Now, I always say this, and while I am a fan of tax-loss harvesting – I don’t want the tax-tail to wag the dog. At the end of the day, you are just delaying taxes. Maybe that was a smart move, perhaps that was a horrible move – we won’t know until we know what future tax rates are… (More bad news, they are always changing!)

Main benefits to tax-loss harvesting:

- Losses offset gains

- Unused losses can carry over from year to year

- Up to $3,000/year in capital losses can offset ordinary income.

The last one is really the most exciting one as a physician because of tax arbitrage. If your income tax rate is 37% today, you can offset $3,000/year of your ordinary income. With the main goal of “hoping” long-term capital gains (LTCG) rates are lower when you sell. If we assume 20% LTCG compared to an estimated 20% LTCG, then you saved yourself 17%. Not only did you save 17%, but ideally, the number is much larger now, too. Sure, 17% on $3,000 is only $510, but the power is in the compounding. With that said, tax arbitrage is the most interesting play from the tax-loss harvesting playbook for physicians.

Outside of the tax arbitrage, your main goal is to take advantage of losses without significantly changing your portfolio. This would then allow you to delay payment of taxes (again, maybe a good idea, maybe a bad), and if you hold the assets until you die, you can then pass them to your heirs with a step-up in basis. They would then own no taxes.

How do you tax loss harvest?

It’s pretty easy: sell your losers (stocks, mutual funds, ETFs, bonds). You don’t have a lot of reasons to hold losers in a taxable account.

Pro-Tip: Do not repurchase the same security within 30 days. This would be labeled as a wash-sale and you would pretty much lose all your tax advantages.

After the sale, you either have to wait 31 days, or buy a similar, highly correlated asset with a different CUSIP. A CUSIP is the primary identifier of a security. Or, as the IRS would say, it can NOT be substantially identical. Here is a real-life example: do not try to sell a Vanguard Total Stock Market Mutual Fund to buy the Vanguard Total Stock Market ETF. This is a wash sale, it is the same CUSIP! Now, if you sell Vanguard Total Stock Market Mutual Fund, take a loss and then buy Fidelity Total Stock Market Mutual Fund, you should be safe here.

Moral of the story: you should not have a hard time avoiding the wash sale. Be aware of it, do some research, and you should be well on your way.

Donate or Die with Appreciated Shares

Yes, I know, sorry to be very blunt here, but the strategy does work.

If you bought WealthKeel stock (not a real thing) at $3/share and today it is worth $503/share, you have yourself a “champagne problem.” 🍾

Let’s say you bought 1,000 shares back in 2015 for $3,000, and today that same position is worth $503,000. You would have $500,000 in gains.

At this point, you have two tax-smart plays: 1) Donate the shares to your Donor Advised Fund (DAF), or 2) Hold on to the stock until you die so that your heirs get the step-up in basis.

Donate the Shares to Your Donor Advised Fund (DAF)

This is one of the really cool and flexible accounts that can be a huge help for these situations. Most charities are not in a place to be able to receive stock donations. So the easier route is to donate to your DAF, and then the DAF will sell and send funds directly to the charity. Make sure your charity is a 501(c)3!

Fidelity’s DAF has no minimums now.

Vanguard’s DAF still has a $25,000 minimum contribution to get started.

Pro-Tip: You must have owned the shares for AT LEAST one year. If not, you can still donate it, but you won’t get a tax deduction.

Biggest Benefits to a DAF:

- Convenient & easy

- Flexible; make the gift now or later but get full tax break upfront

- Itemized deduction for the FULL value of the donated asset

- No capital gains for you and none for the charity (a true win/win!)

- Keep the cash in your pocket that you were going to donate/gift

- No wash rules; you can buy the same stock the next day if you want to

- You can also keep it anonymous (as Dr. Dahle says, it helps avoid the “charity porn”)

How to Build a Tax Efficient “Taxable” Account?

Let’s review three asset classes that are typically part of a taxable account. After we cover the main items here, we can dig into the popular topic of asset location.

The main goal with all of these asset classes is to avoid short-term capital gains (taxed at your ordinary income tax rates) and even try to limit long-term capital gains.

Stocks

When reviewing stocks, particularly stock ETFs and mutual funds, you need to keep an eye on turnover, distributions, and dividends (especially ordinary dividends).

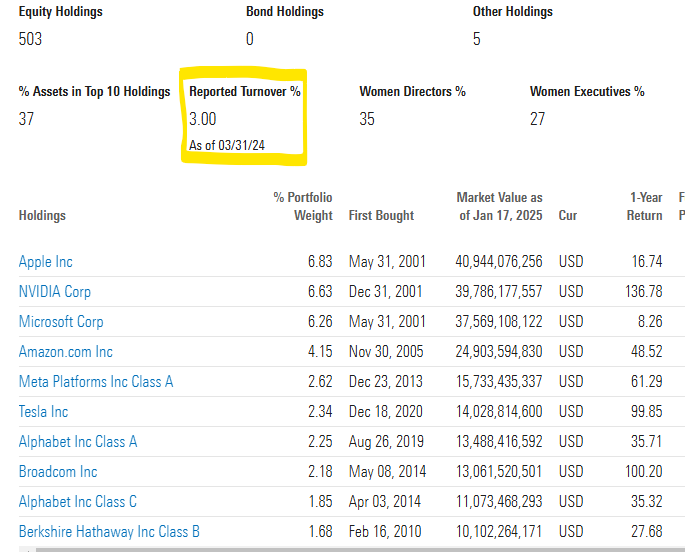

Case study! Okay, let’s review the iShares Core S&P 500 Fund.

- Turnover = 3% (Morningstar) – The lower, the better when in a taxable account. 3% would mean that this fund turns over ONCE every thirty-three years. Not bad!

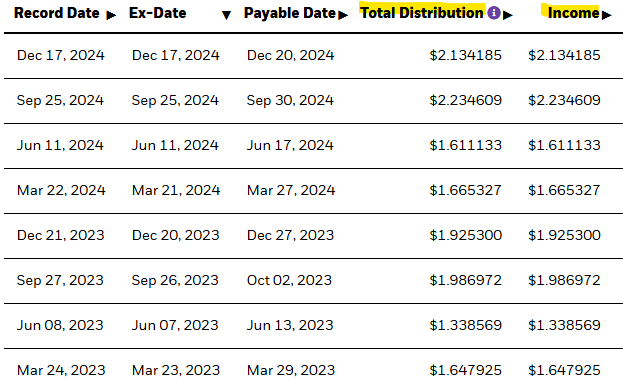

- Distributions: the one downside (from a tax efficiency perspective) is that it does commonly make quarterly distributions from dividends. However, that is not uncommon for dividends, and Vanguard Total Stock Market Index has a similar distribution process in place for dividends. Here is the chart from BlackRock, and as you can see, it is always income. They have not distributed capital gains in a very long time — like, since the year 2000 (good for tax efficiency and ETFs).

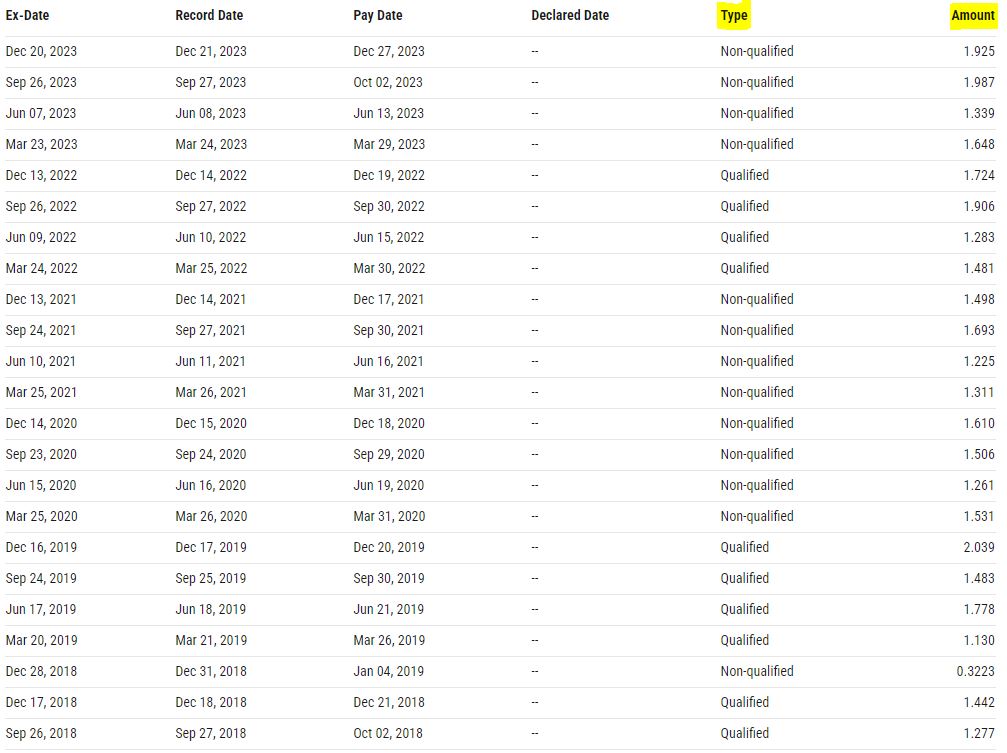

- Dividends: the other downside to this fund is that it bounces between non-qualified (ordinary) dividends and qualified dividends. Once again, Vanguard Total Stock Market has a similar tendency to bounce around between the two; however, they do an excellent job of keeping the larger distributions as qualified and the smaller ones as non-qualified. We prefer qualified for tax-efficiency. The chart below is from Y Charts. Please note the chart is now behind a paywall. The screenshot is from late 2023 but the details still stand.

The main goal is to avoid high-turnover funds. Some funds will have over 100% turnover in a given year, which is going to lead to more taxable events outside of your control. The other goal is to limit distribution, especially from non-qualified dividends (ordinary dividends). I am big fan of ETFs and mutual funds, so those are usually the main areas to watch.

However, if you own individual stocks, you should keep an eye on the dividends. There are 80 stocks in the S&P that don’t pay any dividends. While this may give you more chances to tax loss harvest and donate to a DAF, it also adds uncompensated risk, a growth/risk tilt, and it will add to the overall complexity of your asset allocation.

If you do have a more active fund or a fund that spits out more distributions, try to hold that in a 401k or Roth IRA (really, any tax-qualified plan will do).

If you want to add complexity (I believe in simplicity), you could really nerd out and hold the growth index in a taxable account and the value index in a tax-protected account. Why? Well, the growth index will have a lower yield, while the value index will have a higher yield. For example, this can be done with the Vanguard Total Stock Market fund and break it into a value and growth portion.

Bonds

The most tax-efficient bond holding you will find is a municipal bond. Municipal bonds are wonderful because there are no federal taxes due. If you can buy municipal bonds from your state, you can also avoid state taxes. As of today, Vanguard offers PA, CA, MA, NJ, NY, and OH.

Most of the time, you will access municipal bonds via a mutual fund or ETF, which will give you greater diversification. Every now and then, you will see some individual municipal bonds. If you go this route, please be aware that there can be liquidity issues, so plan to hold to maturity. A good strategy here could be building a municipal bond ladder.

Now while this sounds great, you should still add bond diversification. For example, we usually stick to about ~60% municipal bonds, and the rest may be taxable bonds or US Treasuries.

Treasury bonds can also be a great little tax tool for your taxable accounts. They are easy to buy at Treasury Direct and have no state income tax due.

Savings bonds (EE & I Bonds) are another excellent tool, but the main caveat is that you are limited to $10,000/year per social security number – bummer. The biggest benefit is tax-deferred growth until redemption.

- Series EE Rates = 2.60%/year

- Series I Rates = 3.11%/year – I know, looks good, right? Keep in mind this rate will adjust 2x/year.

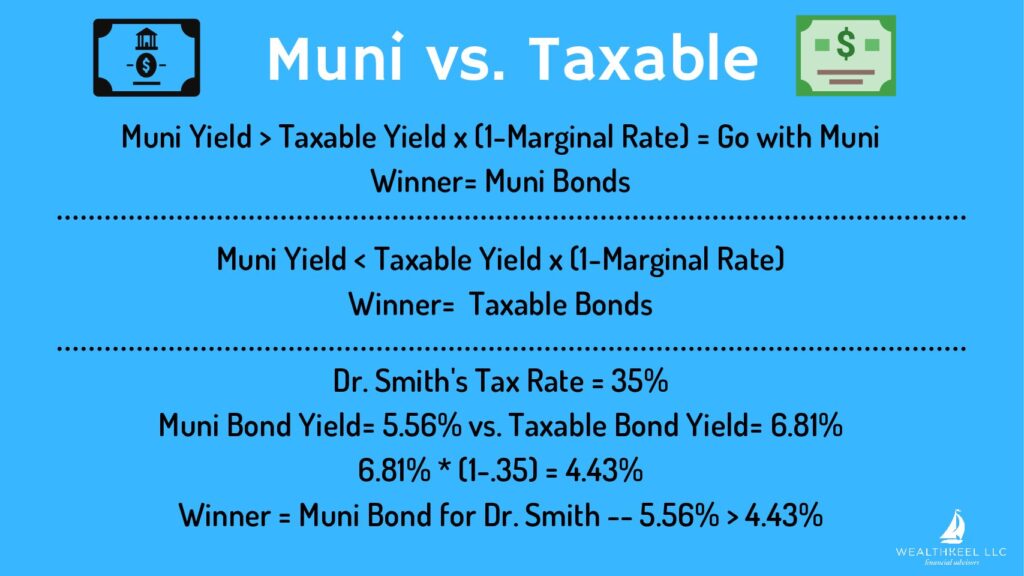

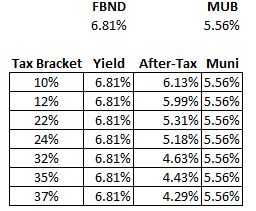

So when do you use municipal bonds vs. taxable bonds? The good news is the math is simple; the bad news is it changes often. The cliff notes would say that as a physician, you are likely in the higher tax brackets, which would mean you should lean towards municipal bonds.

I compared FBND to MUB for this post, and oddly enough, based on the current yield, you would actually be better using FBND in all tax brackets. If FBND’s yield came down, you would see the more usual scenario play out that says around ~24%+ would likely benefit from municipal bonds.

Real Estate

In the most simple terms, equity real estate can be in your taxable account, while debt-equity should be in a tax-protected account. For the debt-equity, you are going to be limited here to likely a self-directed IRA (proceed with caution) and maybe a Solo-401k.

Rent is taxed as ordinary income, but for the most part, you should be guarded by depreciation. As of late (hopefully, it stays around), you could also take advantage of bonus depreciation!

Depreciation that is not used can be carried forward to offset future income. In the end, it can be recaptured at the sale, but that is at a 25% rate (max rate). So if your tax rate is higher than 25%, you have a chance for some tax arbitrage there too. Keep in mind, you don’t have to sell! If you use a 1031 exchange or you die as the owner (step-up in basis), you can avoid the recapture.

Pro-Tip: Depreciate, exchange, depreciate, exchange, depreciate, exchange, and then die = you likely built yourself an excellent real estate empire and your kids got it tax-free.

“Winning.” – Charlie Sheen

As of now, you can also take advantage of the 199A deduction until 2025.

If you are ready for the big leagues, get Real Estate Professional Status (REPS). As a physician, your income is likely too high (>$150,000 MAGI) to use real estate losses against your income. But, enter REPS! If you or your spouse can obtain the REPS, you can then use those losses to offset your ordinary income.

Real Estate Professional Status Requirements:

- > 750 hours per year in real estate (15 hours per week) AND

- No other activity that is > 750 hours (aka like being a doctor)

If you own one or two properties, it is probably hard to say you spend more than 15 hours per week (unless those tenants are a nightmare…). So this usually comes into play once you have a few homes or a few multi-unit properties.

Taxable Accounts for Kiddos; UTMA & UGMA

Depending on your state, it is either a Uniform Transfer to Minor Act (UTMA) or a Uniform Gift to Minor Account (UGMA).

While these are taxable accounts, you have some unique tax thresholds:

- First $1,350 (2025) in unearned income is tax-free

- Next $1,350 (2025) in unearned income is taxed at the child’s tax rate (likely 10%)

- Anything above $2,700 is going to be taxed at the parent’s rate.

Two reasons why I don’t love these accounts: 1) It hurts on the FAFSA form. Now as a physician, your kid(s) are likely not getting financial aid, but what can I say, I am an optimist. 2) The child gains FULL control of the assets age 21 (21 for most states, some states are 18, the range is 18-21; here is the full list).

Life-Tip: I love my boys very much, and I know they will grow up to be great young men, but at 18 (heck, 21), I was still doing some dumb sh*t. If my parents had given me $100k at 18, me and the buddies would have had a hell of a trip somewhere crazy.

The smaller the account (less than $100k), the likelier you don’t need to fine-tune the allocation for tax purposes. You might even want to tax-gain (GAIN) harvest each year to keep moving up that basis if you have room in those lower brackets (under $2,700).

For larger accounts (greater than $100k), you should follow the rules above to keep the account as tax-efficient as possible.

Asset Location and Its Goals

Personally, I think asset location and tax diversification are two essential parts of a solid portfolio. While I love asset location, I think it’s challenging to have all your growth stocks in your taxable account and all your bonds in your tax-qualified accounts. Why? Well, because it is not that simple.

Early on, most of your assets are likely in tax-qualified accounts. It may take years, if not many years, to build up the taxable part of your portfolio. More importantly, you might not be able to stomach an all-growth stock portfolio in the one account that is accessible in your early career (pre-59.5). Asset location is important, but it is more complicated than that.

The main goal of asset location is to place certain asset classes into specific accounts to enhance your overall returns (aka net of taxes).

4 Lessons for Asset Location:

- If possible, keep everything in tax-qualified accounts. For many physicians, this is likely impossible. And if it is possible, you probably are not saving enough.

- Tax-qualified should be your higher ratio – less tax drag and better asset protection.

- Avoid taxable income in your taxable account(s). #2 and #3 will always be the siblings that fight. #2 tells us to have better growth potential in tax-qualified accounts (aka stocks), while #3 says to have income-producing investments in your tax-qualified account (aka bonds & REIT). #2 & #3 are why I think asset location is more of a moving target and not an exact science.

- #1 Ideal for Taxable Account (All IR Environments): Muni Bonds, Muni Money Markets, Precious Metals.

- I would add cryptocurrency here too, but stay tuned for any changes to the tax code. But as of now, pretty tax-efficient holding.

- #2 Next group (Low IR Environment – if high IR, switch with #3): Taxable Money Markets, Corporate Bonds, TIPS (beware of taxable income), Treasury Bonds.

- #3 Next group (Low IR Environment – if low IR switch with #2 ): US Stocks (Passive Index Funds), International Stocks (Passive Index Funds), Emerging Markets (Passive Index Funds), Equity real estate.

- #4 Last Resort for Taxable Account (All IR Environments): Actively managed funds, REITs, Junk Bonds, Debt Real Estate.

- #1 Ideal for Taxable Account (All IR Environments): Muni Bonds, Muni Money Markets, Precious Metals.

- Simply put, try to avoid placing sells in a taxable account. No selling = no capital gains.

- Donate the asset to charity: That’s right, donate the asset to your DAF (Donor Advised Fund) and get the tax deduction for the current value and the charity gets the asset tax-free. A true win-win!

- Leave for your heirs. Why? Well, they get a step-up in basis at your death. So if you bought WealthKeel stock for $3/share, and it now increased to $3,000/share, when you die (sorry!), your heirs get a step-up in basis to $3,000/share.

- Real-estate only: Don’t sell, complete a 1031 exchange. Personally, I think this is one of the neatest ways to build a real estate empire. It gives you a chance to keep increasing your property size while continuing to defer taxes each time.

- Pro-Tip: Depreciate, exchange, depreciate, exchange, depreciate, exchange, die. This is how you create a real estate empire for your heirs.

Rebalancing, Tax-Efficiently

We can start with #4 from above: avoid selling anything with a gain. And if you must sell when there is a gain, please, pretty please, make sure it is a long-term gain (1 year AND 1 day) and not a short-term gain. Besides that, “don’t let the tax tail wag the investment dog,” which is an overused phrase in our industry, but still very important. Taxes are important, but taxes are a good thing. You made money. Don’t make “bad” decisions to avoid paying taxes.

A few other tips and tricks from over the years:

- If you have losses, use those losses to offset any gains incurred during the rebalance. I call this the “clean slate” strategy.

- Rebalancing “usually” does not to be that frequent. I am amazed by how many rebalance numerous times in a year. Set a “drift” parameter for 3-5%, and when you get out of those limits, then update. But read my notes below, because you will have numerous times to course-correct with new money without selling. I would say once every one to three years is most common; sometimes more, sometimes less.

- Use your new contributions to rebalance. This is one of my favorite and easiest ways to rebalance periodically.

- If you are donating to a DAF or a charity, use that opportunity to rebalance.

- If you are using the account to fund your living expenses, use that opportunity to rebalance as you need the funds.

- I like dividends being reinvested automatically to remove emotion, but you could also have them go to cash and then rebalance the cash. My only emphasis would be to have a plan/system in place. Don’t allow your emotions to come into play!

- If you are trapped and must sell, sell your highest basis and long-term holdings first. Don’t forget to review each tax lot, not only the summary listed on the main page!

- Last but not least: don’t forget to check if you have any carry-forward losses from previous years, as this would give you more wiggle room to make updates to your current portfolio.

Planning & Asset Protection for Taxable Accounts

- Your heirs will get a step-up in basis at your death! Essentially, they will get the asset tax-free.

- If you are able to die with any asset (you don’t need it), don’t sell!

- If you are in a bind, you can look to borrow against your portfolio (or house) with a loan. While this can get complicated, it could also save you and your heirs some serious dollars.

- Don’t forget that you can also push your “date of death” back six months if your estate is large enough for estate taxes. It won’t do you much good (we’re assuming you are dead here – sorry), but it could really save some tax dollars if your assets continued to increase after your death. Talk to your estate attorney.

- Tenants by the Entirety

- If you work with us, you know how much I love this one! It’s so easy but missed by so many. It is pretty much free asset protection if you are married.

- The kicker… you need to live in one of these 18 states: AK, AR, DE, DC, FL, HI, MD, MA, MS, MO, NJ, OK, PA, RI, TN, VT, VA, and WY.

- Side note, these 7 states allow it for real property, but not personal property (aka your home, but not your investment): IL, IN, KY, MI, NY, NC, and OR.

- Domestic Asset Protection Trust (DAPT)

- This is outside of my expertise (aka we would bring in an asset protection attorney), but you can place homes, vehicles, bank accounts, and taxable investment accounts in it. It would avoid probate (keeps it private), and statutory law can protect it from creditors.

- The downside is that it is irrevocable, so for most, you can’t really put this into play until later (heck, maybe once you are done practicing medicine).

- Caution: This is one place where some asset protection attorneys “sell” asset protection when it’s not needed. As soon as they say we will use “insert any state that is not your home state,” you should get a second opinion.

- Good states for a DAPT: AK, DE, HI, MI, MS, MO, NV, NH, OH, OK, RI, SD, TN, UT, VA, WV, and WY. If you are not in one of these states, you should not go out of state.

- Another downside is that it is taxed at your rate, not the trust rates. It might not be such a bad thing, but be aware of it. If you are charitably inclined, the other big downside is that your charitable contributions are limited to the income of the trust, not your personal income.

- What to leave to my heirs:

- Roth IRA (you gotta love the Roth IRA!) – Tax-free

- Life Insurance – Tax-free

- Taxable account – Tax-free with step-up

- Tax-deferred accounts (401k, 403b, IRAs, etc…) – Taxable but can be stretched (10 years or less for most)

- Health Savings Accounts (HSA) – Taxable and no stretch

- I know, I know, one of my favorite accounts does not do well here. Use the funds or give this to charity.

- Fun trick: reverse the order of this list, and that is the order to which ones to leave to charity.

In closing (to our longest blog post thus far!), I hope you were able to take away some tips and tricks to help you with your taxable investment account(s). Whether you are opening your first taxable account or you have had one many for years, you should have received at least one or two new ideas/strategies from this post.

Don’t be afraid of the taxable accounts. With a few good practices, your taxable account can be extremely tax efficient.

Free Resources:

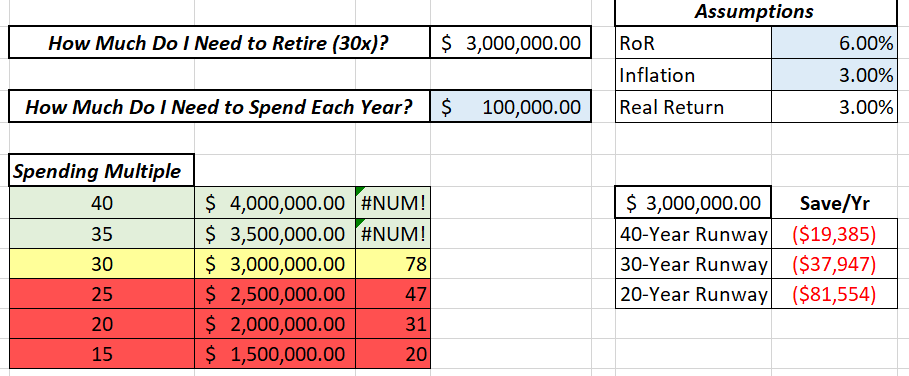

Excel Spreadsheet: Calculate Your Nest Egg

Looking for a more thorough, all-in-one spot for your financial life? Check out our free eBook: A Doctor’s Prescription to Comprehensive Financial Wellness [Yes, it will ask for your email 😉]

Disclosures