In the past, few doctors gave locum tenens much consideration as a possible career path. Stability and growing within one company were the main goals for many. However, newer generations of physicians have a different perspective on their careers and how they fit into their lives.

The newest physicians have shown far greater interest in making a career out of locum tenens. However, knowledge of the term Locum Tenens and the implications of working locum tenens is still not widespread. The goal of this post is to lay out the key financial aspects of working as a Locum Tenens before you decide to make a career or part of your career out of it.

KEY TAKEAWAYS:

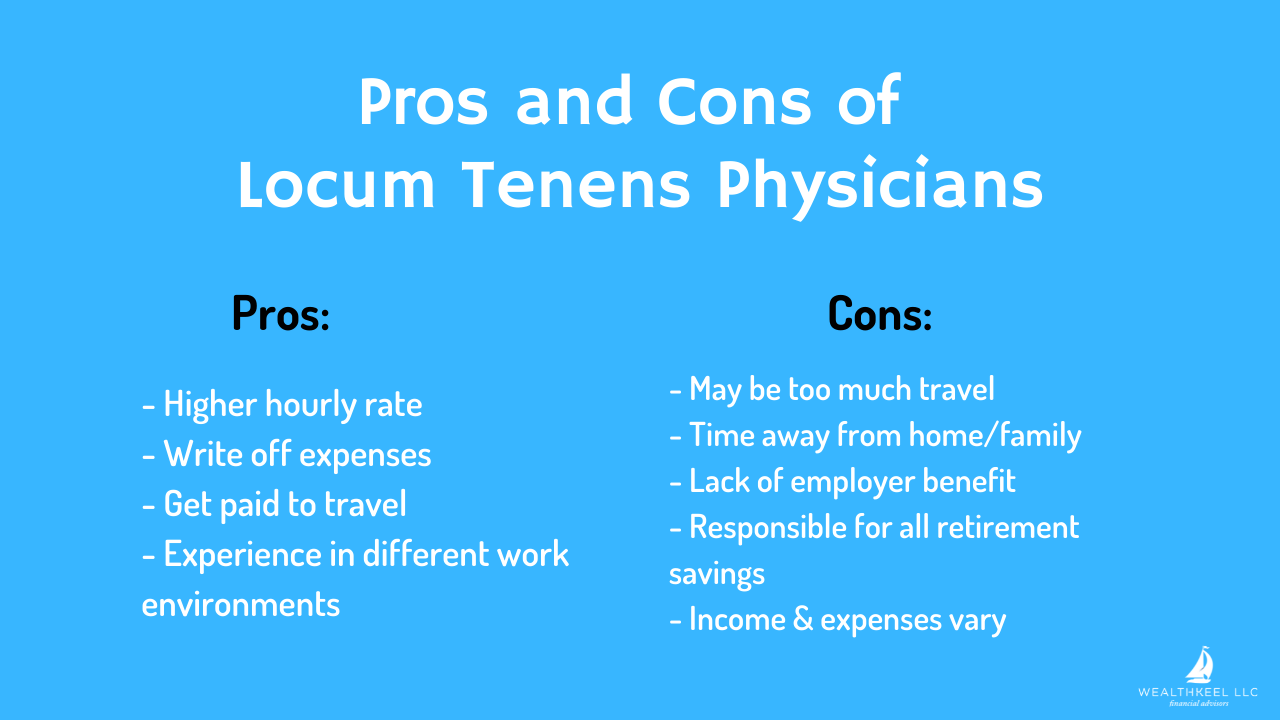

- There are pros and cons to being a locum tenens physician; let’s walk through a few together.

- Retirement savings can be a bit more complicated as a locum tenens, from solo-401ks to defined benefit plans, we got you covered.

- As a locum tenens physician, you won’t have access to group benefits, let’s review what you should have in place for your risk management.

Prefer video over the blog? We’ve got you covered! Watch our YouTube video as we dissect this blog post for you:

What is a Locum Tenens Physician?

Locum tenens is actually a Latin phrase that translates to “to hold a place.” In the physician world, a locum tenens physician is a doctor who fills a position in a hospital for a temporary period of time. This period could range from a few days to a few months, and possibly even longer.

Locum tenens play a huge role in filling the void for hospitals and clinics that are in communities that struggle to attract doctors to remain with them for the long-term. Locum tenens physicians can help fill the gap and provide relief to the doctors already working in these communities to help them avoid burnout.

Obviously, locum tenens physicians can provide a great benefit to the communities they work in and the long-term doctors they help out in the process. But the position also comes with benefits of its own for the physicians filling these roles.

Benefits of Working as a Locum Tenens Physician

Key Benefits:

- Higher hourly rate compared to permanent employee counterparts

- Ability to write off expenses as an independent contractor

- Getting paid to travel

- Experience in many different work environments

Working as a locum tenens physician can have major financial benefits. In many instances, hospitals are willing to pay more when they are desperate to bring in locum tenens to temporarily fill a position. This results in a higher hourly rate than if you were a permanent full-time hospital employee. It also helps that as a locum tenens, you will be taxed as an independent contractor and will be able to write off many of the expenses associated with the job and travel.

In addition to having higher compensation, you can have the added benefit of reducing your expenses. Many of these positions will also cover the travel and housing costs during the time you are relocated for the position. It is even common to receive a stipend for food as well. You can use this higher compensation and reduced expenses to your advantage and aggressively pay down your student loans. Although you will not be eligible for Public Student Loan Forgiveness as a locum tenens doctor, you will still be in a great position for an aggressive debt payoff to remove that balance as quickly as possible.

In addition to the financial benefits, there are several other advantages of working as a locum tenens. One of these is the ability to travel. If you love traveling, working as a locum tenens physician allows you to travel and experience different parts of the country (or even around the world) while still earning a strong income. Working in these positions also gives you added flexibility. You are able to decide when, where, and how much you would like to work, which helps promote a better work-life balance!

Locum tenens also have the opportunity to test run many different work environments. If you ever decide to settle down at some point in your career, you will have a better idea of what environment best suits your skills and personality and will allow you to better select the best opportunity for yourself. On top of all this, you will have fewer administrative duties to worry about and can focus more on providing great service to your patients.

Drawbacks of Working as a Locum Tenens Physician

Key Drawbacks:

- Potentially too much travel

- Time away from home & family

- Lack of employer benefit

- Responsible for all of your retirement saving

- Income and expenses will likely vary from job to job

While working as a locum tenens physician can come with great benefits, there are several drawbacks to consider before investing all or part of your career into locum tenens. The first drawback is that serving in this role can result in an overwhelming amount of travel. If you do not plan to move to the location of your assignment, traveling back and forth can be exhausting. While some jobs are available close to home, others may require you to travel to the other side of the country, resulting in long hours at the airport or long road trips. All the travel can lead to more burnout on top of working the shifts of your assignment. Plus, constantly having to meet new co-workers and learn new policies at each facility can be straining in its own right.

Not only can the travel itself be draining, but it is important to remember that this position could also result in more time away from your family. While some families may move to different assignments together, this is more difficult for families with young kids. Although this time away can be limited by taking shorter assignments that do not require you to be gone as long, this is still an important challenge to consider.

Although working as a locum tenens doctor can have financial benefits, there can also be some financial disadvantages as well. The most significant of these is that as an independent contractor, you will not have the typical employer benefits that a physician employed by a hospital would have. These can include things like a 401k/403b/457b; health, dental, and vision insurance; group life insurance; and group disability insurance. Therefore, it will be your responsibility to create your own retirement account and make sure you are appropriately insured. However, the higher compensation you receive will help make up for this lack of benefits and allow you to obtain coverage on your own.

Another drawback is that your income and expenses will vary as you change assignments. Not having a stable income can make things more difficult from a budget standpoint. However, this just increases the importance of having a strong emergency fund. Not knowing what your income will look like month to month (or year to year depending on the duration of your assignment) makes it even more crucial to make sure you are living well within your means since your next assignment could result in a pay cut.

It is important to weigh these pros and cons before deciding to pursue a career as a locum tenens physician. Assuming you decide to pursue locum tenens, the rest of this post will lay out the key financial areas you will need to take control of in this role. You can also check out our post on Financial Planning for Locums Docs for more tips on how to handle your finances as locum tenens.

Saving for Retirement as a Locum Tenens

Options When Saving for Retirement:

- Solo 401k

- SEP-IRA

- Defined Benefit Plan

- Backdoor Roth IRA

- HSA

- Taxable Accounts

Although you will not have an employer-provided retirement account such as a 401k/403b/457b, you still have several options when it comes to retirement accounts as an independent contractor. These include Solo 401ks, SEP-IRAs (formal name is Simplified Employee Pension Plan), and defined benefit plans, among others.

The Solo 401k (or individual 401k) is a terrific retirement planning tool for independent contractors. They operate similarly to 401ks provided by employers, except they are designed for businesses that have no employees (besides the owner’s spouse). In 2025, these accounts allow you to save up to $23,500 ($31,000 if age 50 or older) in “employee” contributions, just as a standard 401k would. However, since you are technically both the employee and employer, you are able to make an additional “employer” contribution. As of 2025, this contribution can be equal to 20% of your net income, up to a maximum contribution of $70,000 (the maximum amount includes both the employee and employer contribution).

You can also set up your solo 401k to allow for Roth contributions for your employee contributions — the employer portion of the contribution will always be pre-tax. However, given your significant income as a locum tenens physician, it is typically best to max out your pre-tax contribution to help reduce your taxable income.

Another option you have available is a SEP-IRA. These accounts are somewhat simpler to open than a solo 401k and have the same maximum contribution limit of $70,000 in 2025. However, you are only able to contribute up to 25% of your net income in any given year. Therefore, you would need to earn $280,000 of net income to be able to contribute the maximum $70,000. An advantage of these accounts is that you are eligible to make contributions until Tax Day (typically April 15) of the following year, giving you a few additional months to max out your contribution. However, one notable downside to these accounts is that you will run into the pro-rata rule that will prevent you from making Backdoor Roth IRA contributions.

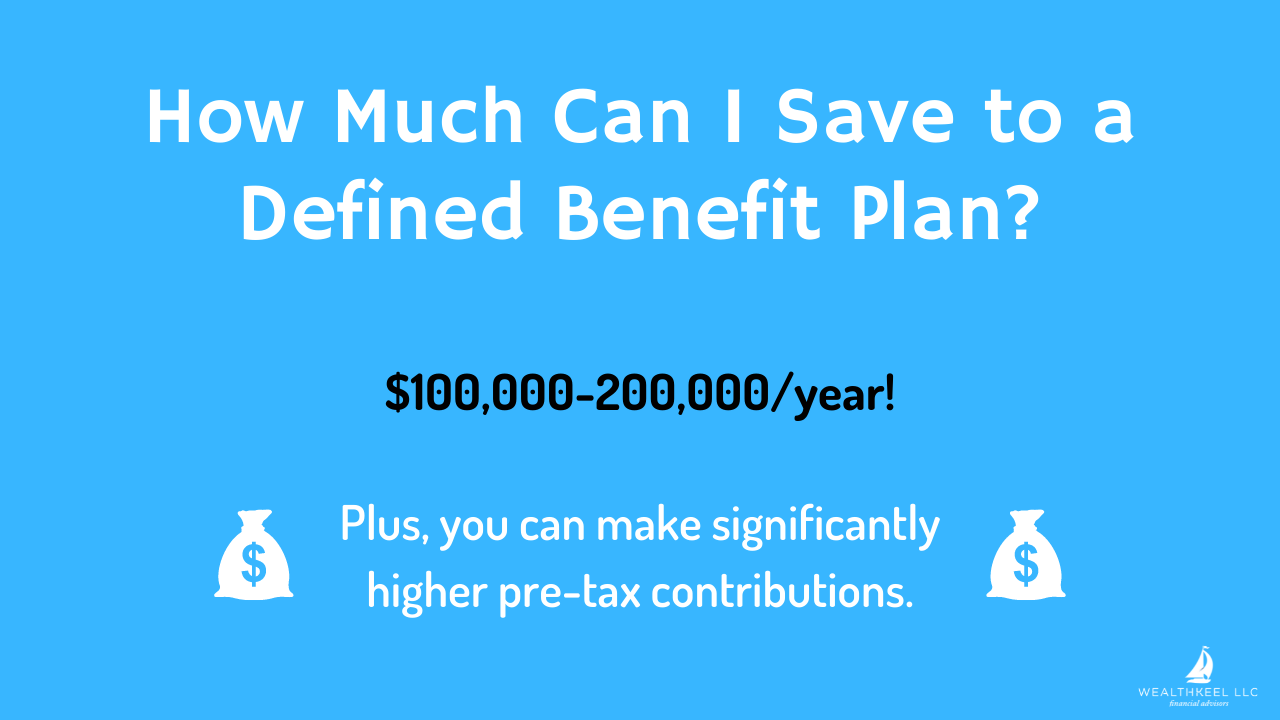

Additionally, you could opt to establish a defined benefit/cash balance plan. This is a less common option for independent contractors looking to save for retirement as it has higher expenses to administer than the Solo 401k and SEP IRA. However, if you have significant 1099 income, this type of account can be a gem! This gem has the advantage of being able to make significantly higher pre-tax contributions. These contributions can be in the range of $100,000-$200,000 per year. Here is one of our favorite calculators from July Business Services.

Other accounts you can look to utilize when saving for retirement include: Backdoor Roth IRAs, HSAs, and even taxable accounts.

Here is a helpful post on which retirement accounts to use and how you can use these accounts to save for retirement efficiently.

Risk Management for Locum Tenens Physicians

Another area you will be solely responsible for as an independent contractor is managing both financial and health risks. There are 5 major categories of risk that most physicians will need to insure against at some point during their lives:

- Liability

- Illness/Injury

- Disability

- Death

- Loss of expensive property

It is essential to cover both your professional and personal liability. Professionally, you need to have malpractice insurance, which will typically be provided by the locum tenens agency. To cover your personal liability protection, you will utilize several types of insurance. These include auto insurance and renter’s/homeowner’s insurance. It is also vital to have an umbrella policy that sits on top of the coverage provided by your auto and renter’s/homeowner’s policies to provide additional personal liability coverage. Umbrella coverage usually comes in increments of $1,000,000, and you want to cover your net worth in umbrella coverage roughly. Therefore, you will need to increase your coverage as your net worth grows.

Obviously, as medical professionals, you realize the importance of having a quality health insurance plan. It is also crucial to have disability insurance in place to protect your income in the event a disability left you unable to perform the duties of your occupation. The key is to purchase a policy with an own-occupation, specialty-specific definition of disability. You also need to protect your loved ones in the event you were to have a premature death. This is typically best accomplished through term life insurance. Here is a post that takes a deeper look at what type of insurance you need.

Choosing a Business Structure as a Locum Tenens

As an independent contractor, you are a separate “business” from the locum tenens agency and the facility you are working at. As a separate business, you should get a federal Employer Identification Number (EIN). It is also important to open a separate bank account to keep your personal expenses and income separate from the business. You should also be aware that because no employer is withholding taxes for you, you will need to make quarterly estimated personal tax payments to the IRS. We suggest seeking the help of a CPA to calculate these quarterly estimates for you.

Since this is likely the first time you will be working as a non-employee, you may be wondering what type of business structures are available to you and which one would work best for your situation. The basic options you have available include sole proprietorship, partnership, C corporation, S corporation, and limited liability corporation (LLC). Before making a decision on which to use, you should discuss these options with an accountant and business attorney in your state.

While working as a locum tenens physician certainly comes with its own set of advantages and disadvantages, it can be an incredibly rewarding career due to the unique challenges you will face. Good luck to all of you looking to take on this challenge!

Looking for more information? Check out another great post; 7 Financial Planning Tips for Locums Docs

Looking for a more thorough, all-in-one spot for your financial life? Check out our free eBook: A Doctor’s Prescription to Comprehensive Financial Wellness [Yes, it will ask for your email 😉]

Disclosures