🚨 Student loan news is breaking on what seems like a weekly basis, we will do our best to keep this post updated; last updated as of 1/2025. A lot of the information in this post is pending. For example, it feels almost certain that the “SAVE” IDR is going away. We will do a larger update once all the dust settles.🚨

After the excitement wears off of matching for your residency program, you’ll need to start thinking about how to pay off your loans. In this post, we will cover all the details about Public Service Loan Forgiveness (PLSF) and everything else you need to know about student loans in 2025.

While the average medical school debt is approximately $202,000, most PGY physicians earn an annual salary of nearly $64,000. Although physician salaries dramatically increase beyond the residency/fellowship period, that doesn’t necessarily help with the loans you’ll be paying back during your training.

With over $1.76 trillion in total U.S. student loan debt, student loans are among the highest consumer debt categories and a significant financial hurdle for young professionals nationwide. The burden of student loan debt is especially urgent for doctors, who often have to borrow large sums to finance their education and training.

It’s easy to see that student loan repayment should be a significant part of any physician’s financial planning. You don’t want bad dreams about debt once you can finally kick off your much-anticipated physician career! The good news is that you can start planning now to ensure you’re ahead of the curve when it comes time to pay back your student loans.

KEY TAKEAWAYS

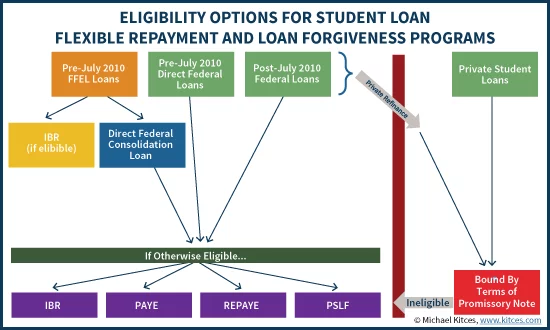

- The two main types of student loans are federal and private. Federal Student Loans usually have more repayment options, are easier to repay, and have lower interest rates.

- Private Loans are usually through a banking institution or private lender that usually cost more than federal student loans. The interest rate and payments can also change without warning.

- Need some help paying off your student loans? We’re sharing an easy-to-follow plan to pay off your debt. We’ve also included a few timelines to get an idea of how long it will take you to pay it off.

Prefer video over the blog? We’ve got you covered! Watch our YouTube video as we dissect this blog post for you:

TYPES OF STUDENT LOANS

The two main types of student loans are federal and private. Some borrowers have only federal, while others have a combination of federal and private loans.

Repayment options and strategies for these two types of loans are very different, so it’s important to know which one is which to develop a successful financial plan.

FEDERAL STUDENT LOANS

The federal government issues federal loans. Since there are more repayment options, they are often easier to repay, and the interest rates are usually lower (but still too high 😉). While many students are eligible for these loans, there are limits on the amount of money that can be borrowed.

Federal loans have a 6-month grace period after leaving school before borrowers must begin repaying the loan. There are additional options for deferment available if the student has a financial hardship. The CARES Act offered relief to student borrowers during the ongoing pandemic by pausing payments and issuing 0% interest rates.

Pro-Tip: Most physicians will benefit from starting their loan repayments right away and skipping the 6-month grace. Why? Well, with income driven repayment plans and likely a $0 income or very low income coming out of medical school, you can get those 6 PSLF payments finished for a likely monthly cost of $0.

Monthly premiums may also be flexible depending on your income. These loans may be eligible for debt forgiveness based on the career or type of service the student pursues (for instance, those that enter into medicine, teaching, military service, and other types of public service — like you!).

Direct Loans

The two types of federal direct loans are subsidized direct student loans and unsubsidized direct student loans.

SUBSIDIZED DIRECT

A subsidized direct loan is for undergraduate students who indicate financial need based on their Federal Aid Form for Student Assistance (FAFSA), which all students must complete.

The school determines the amount a student can borrow, and the Department of Education pays the interest while in school at least half-time, during the first six months after leaving school, and during any period of deferment (postponing payments due to financial hardship).

UNSUBSIDIZED DIRECT

These types of loans are available to both undergraduate and graduate students. The school also determines the amount students can borrow. Students are responsible for the interest accumulated on an Unsubsidized Direct Loan during all periods. The student may elect to defer interest payments, but this interest will be capitalized and added to the principal amount of the loan.

HOW TO TELL IF YOU HAVE DIRECT LOANS

One of the most significant components of loan forgiveness programs like Public Service Loan Forgiveness (PSLF) is making the required number of qualifying monthly payments on your federal direct loans. These forgiveness programs only apply to direct loans, so it’s imperative to determine whether or not you have direct loans before utilizing this repayment strategy.

🚨 PSLF Overhaul: Federal Family Education Loans, also known as FFEL Loans, and Perkins Loans can be consolidated before April 30, 2024* into a new direct loan, and those past payments will still count. Not only that, payments made under any repayment plan can be counted toward PSLF, including non-income-driven repayment plans. Payments made before Direct loan consolidation can be counted towards PSLF.

To determine whether you have direct loans, you should visit NSLDS.ed.gov, click the “Financial Aid Review” button, and log in using your Federal Student Aid ID (FSA ID). The summary page should list every one of your federal loans. Under the type of loan, you will look for the word “Direct” before other indicators. For example, “Direct Consolidated Unsubsidized” or “Direct Stafford Subsidized.”

Perkins Loans

The Perkins Loan is a federal loan available to undergraduate, graduate, and professional students with exceptional financial needs. There is a fixed interest rate of 5%. One of the most distinguishing differences is that some schools do not participate in the Federal Perkins Loan Program. When acquiring the loan, students will make payments to the school, as they are usually the lender. Funds under this program are also contingent on availability.

Important: Under federal law, the authority for schools to make new Perkins Loans ended on Sept. 30, 2017, and final disbursements were permitted through June 30, 2018. As a result, students can no longer receive Perkins Loans. (Source)

Parent or Grad PLUS Loans

These loans are available to graduate students or to parents whose students do not qualify for financial assistance. Parents who obtain a PLUS loan are responsible for paying the loan.

Pro-Tip: Keep in mind that while Parent Plus loans can still get PSLF, it is a much different road to forgiveness based on the parent, not you, the physician. It is also limited to only one income driven repayment plan, which is ICR.

PRIVATE LOANS

Private loans are exactly that – private. They are usually distributed through a banking institution or private lender and generally cost more than a federal loan (sometimes much, much more!). The terms and conditions of these loans also vary, and interest rates and payments could change without warning. These loans typically allow applicants to borrow larger sums of money.

It’s vital to note that the lender charges interest with private loans while the student is still in school. These rates vary based on credit and other factors, and there are usually several fees attached, including an origination fee. In some cases, you’ll need a co-signer.

Pro-Tip: Read. The. Promissory. Note. You need to understand all the fine print with private loans, especially what happens in the event of a premature death or disability. Also, once you go private, you can never come back to federal. So please, please, please, know all the details before you make this change.

STUDENT LOAN REPAYMENT OPTIONS

There are several repayment options to consider for borrowers with extensive student loan debt worrying about repaying the entire balance of their loans.

Many of these plans base your monthly required payments on your income, which can help ensure that you can afford payments even when you’re not yet earning a high income. For some borrowers, student loan forgiveness is also an option.

Public Service Loan Forgiveness (PSLF)

One of the hottest topics in student loans is Public Service Loan Forgiveness and for a good reason. You need to work in the public sector or a qualifying nonprofit to be eligible for PSLF, like public health, military service, law enforcement, and public school teachers and admin.

Requirements for PSLF include:

- Must have federal direct loans (if your loans are not federal direct loans, you can consolidate your federal loans to direct loans)

- Pro-Tip: See our note above “🚨 PSLF Overhaul“

- Make 120 qualifying payments

- The majority of payments must be based on an income-driven plan

- Pro-Tip 1: If not, be sure to look into Temporary Public Service Loan Forgiveness

- Pro- Tip 2: See our note above “🚨 PSLF Overhaul“

- You must work at least 30 hours per week (or whatever your employer considers “full time”)

APPLYING FOR PSLF

If your loans are already federal direct loans, you can complete the Employment Certification for Public Service Loan Forgiveness form to confirm if your employment qualifies. This form verifies you have completed the employment required for the program each year. Both you and your employer need to input information on the form.

While doing so isn’t necessarily a requirement, it’s helpful for your servicer to track your eligibility. We’ve all heard horror stories of PSLF gone wrong by administrative errors and confusion. It’s important to complete this form every year and save it for your records, even if you don’t change employers. Good to be proactive here!

Pro-Tip: This can all be completed online now with the addition of the PSLF Help Tool 🙌

LOWERING YOUR PSLF PAYMENT

You should enroll in a qualifying income-driven repayment plan to take full advantage of PSLF. If you’re planning on utilizing PSLF to forgive some or all of your student loans, it’s in your best interest to keep your monthly payments to a minimum during this time. Since your PSLF payment amount is directly linked to your Adjusted Gross Income (AGI), lowering your AGI will help reduce your student loan payment.

A few strategies for reducing your monthly payment include:

- Contributing to your employer’s traditional retirement plan, such as a 401k, 403b, 457b, etc.

- Contributing to your Health Savings Account (HSA) or Flexible Spending Account (FSA)

- Taking advantage of deductions for moving expenses, educator expenses, and student-loan interest

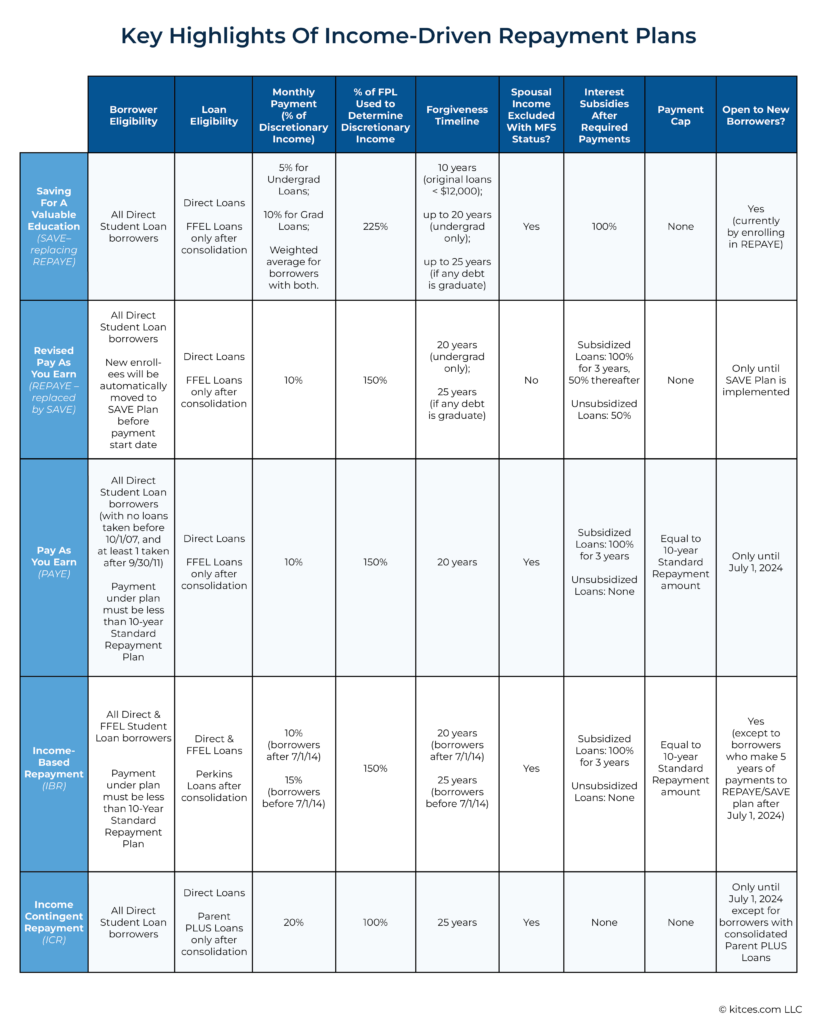

Old & New Income-Based Repayment (IBR)– 🚨 OPEN🚨

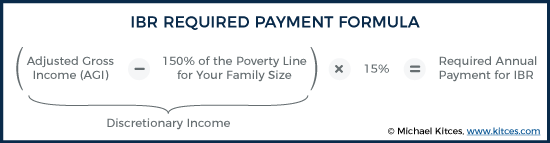

New: IBR is one type of income-driven repayment plan. Under this plan, you’ll pay 10% of your discretionary income if you’re a new borrower on or after July 1, 2014, and loans will be forgiven after 20 years of payments.

Old (Most common today): If you took out loans before that date (7/1/2014), you’d need to pay 15% of your discretionary income, and loans will be forgiven after 25 years. In either case, you’ll never pay more than the 10-year Standard Repayment Plan amount (must prove financial hardship to get into this plan).

Pay As You Earn (PAYE) — 🚨 PAYE is open again🚨

The Pay As You Earn plan, otherwise known as PAYE, requires borrowers to pay 10% of their discretionary income, but never more than the 10-year Standard Repayment Plan amount (must prove financial hardship to get into this plan). Loans are forgiven after 20 years.

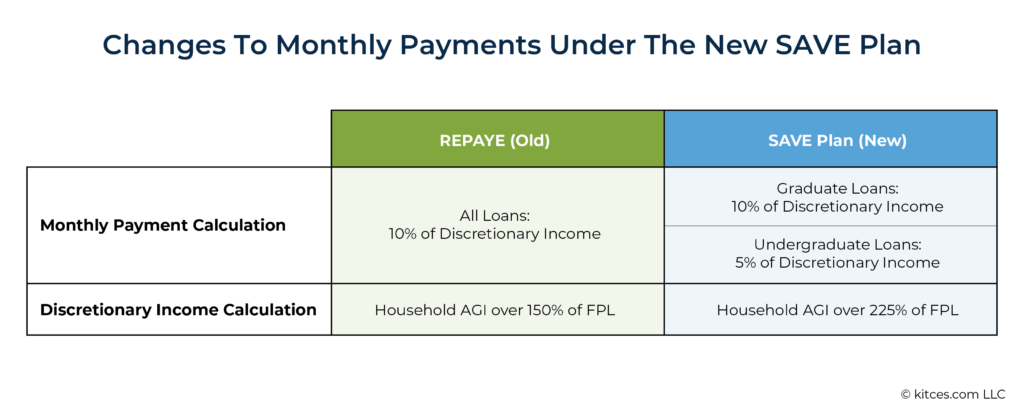

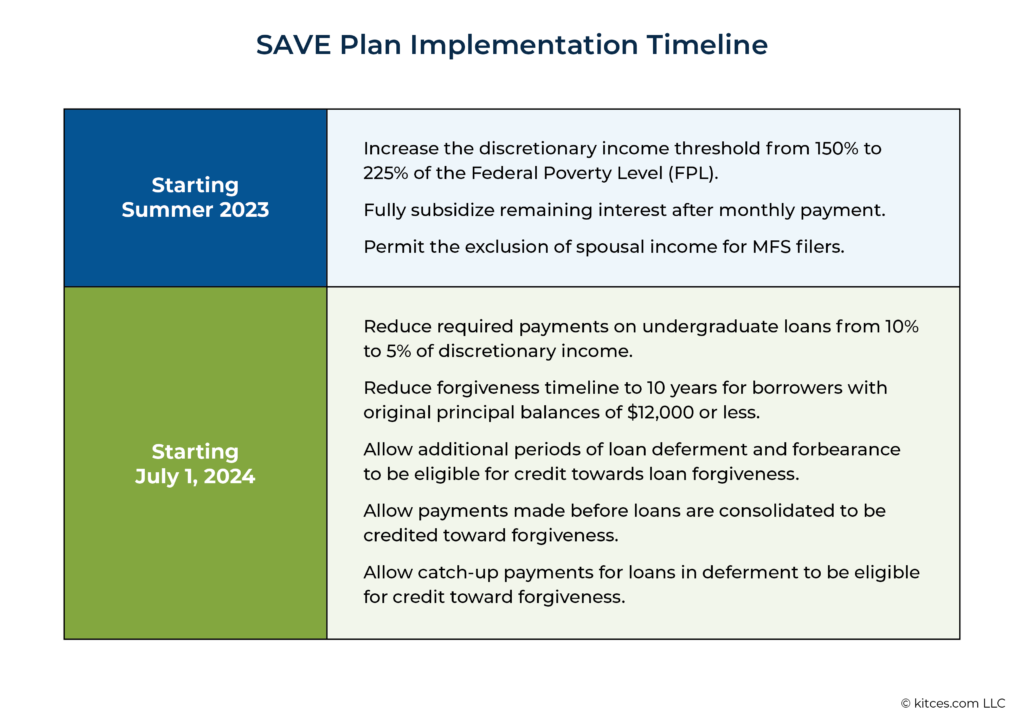

Saving on a Valuable Education (SAVE) – This is the old REPAYE — 🚨 SAVE is likely going away 🚨

- Reduced Monthly Payments

- All borrowers will now have the federal poverty limit increase from 150% to 225% while calculating discretionary income. Undergraduate borrowers will benefit the most, as the payment calculation will be cut in half from 10% of discretionary income to 5% of discretionary income for undergrad loans. Graduate student loan borrowers will not see as great of a reduction in payments, as the payment calculation for borrowers with these loans will still use 10% of discretionary income. However, all will benefit from increasing the federal poverty limit from 150% to 225% while calculating discretionary income. For borrowers with both undergrad and graduate federal loans, their payments will be based on a weighted average between 5%-10% of discretionary income, based on the portion of their initial undergrad and graduate student loan balances.

- All borrowers will now have the federal poverty limit increase from 150% to 225% while calculating discretionary income. Undergraduate borrowers will benefit the most, as the payment calculation will be cut in half from 10% of discretionary income to 5% of discretionary income for undergrad loans. Graduate student loan borrowers will not see as great of a reduction in payments, as the payment calculation for borrowers with these loans will still use 10% of discretionary income. However, all will benefit from increasing the federal poverty limit from 150% to 225% while calculating discretionary income. For borrowers with both undergrad and graduate federal loans, their payments will be based on a weighted average between 5%-10% of discretionary income, based on the portion of their initial undergrad and graduate student loan balances.

- Expanded Forgiveness Options

- The new SAVE plan will also include an updated timeline for receiving loan forgiveness. Under the current plan, borrowers receive forgiveness after making payments in REPAYE for 20 years (increases to 25 years if you have graduate loans). With the new plan, borrowers with only undergrad loans with a starting balance of $12,000 or less will receive forgiveness in 10 years. Borrowers with a starting balance greater than $20,000 can receive forgiveness on any remaining balance after 20 years (every additional $1,000 above $10,000 would add one year of monthly payments required to receive forgiveness). However, borrowers with any graduate loans would still be on the 25-year forgiveness schedule. It is also important to note that the new REPAYE plan will still qualify for PSLF payments.

- Married Filing Separately

- Another big update in the new REPAYE plan is that married borrowers will now be able to exclude their spouse’s income from the payment calculation by filing their taxes MFS. Previously, you could only do this while in the ICR, IBR, or PAYE plans, and REPAYE would include your spouse’s income even if you filed MFS. With this update, the Education Department will also begin to phase out the remaining IDR plans. New enrollments into PAYE and ICR will be phased out, and circumstances in which a borrower can later switch to the IBR plan will also be limited. One item to note is that Parent PLUS borrowers will still not be eligible to enroll in the new REPAYE plan.

- No More Negative Amortization

- The other major win for borrowers is that under the new REPAYE plan, interest will no longer accrue in excess of a borrower’s calculated payment. This is a huge benefit for any borrowers going for long-term forgiveness. Without interest accruing, loan balances will be smaller at the time of forgiveness, resulting in a lower tax bill.

- Phased Out

- The current REPAYE plan will end in 2023 and be replaced by the SAVE plan. Starting July 1, 2024, PAYE and ICR will be closed to new borrowers, except for those with Direct Consolidation loans used to repay Parent PLUS Loans for ICR. Borrowers can enroll in IBR, but will not be able to switch to it after making 60 monthly payments on the REPAYE/SAVE plan starting July 1, 2024.

- Starting next summer (2024), the only options for new enrollees will be the SAVE and IBR plans. For some of you, losing PAYE will be a significant issue since it does NOT have a payment cap. Please be sure to review your situation and plan well before the July 2024 deadline.

Updated Timeline:

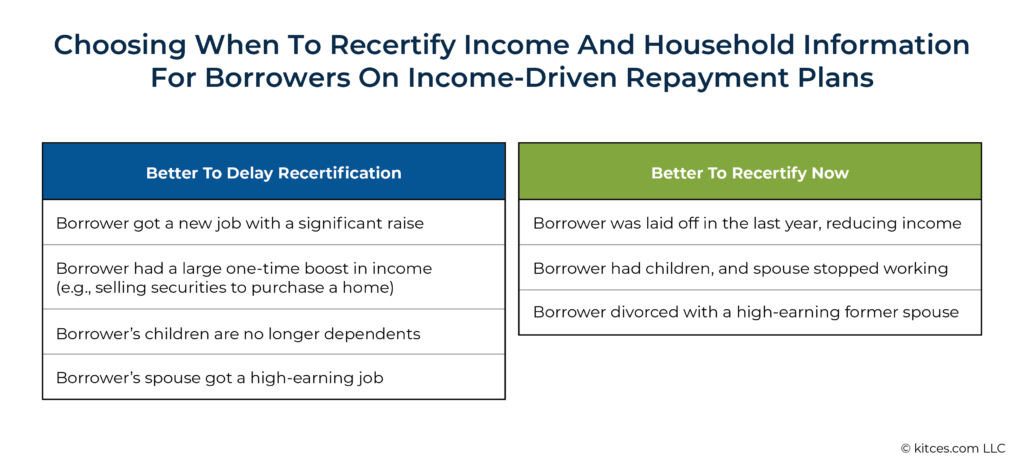

Delay vs. Recertify Now:

In full disclosure, there is one more payment plan called Income Contingent Repayment (ICR). However, it is almost never used, and the few times it is used is from Parent Plus loans going for PSLF. — 🚨 ICR is open again, and while not common in the past, it is a viable option for many now who can prove financial hardship.🚨

HOW TO PAY OFF YOUR STUDENT LOANS: A STEP-BY-STEP GUIDE

Are you worried about paying off your student loan debt? The best way to tackle your debt efficiently is to have a plan. Here’s our simple guide to paying off debt.

1. Get Organized

You can’t hit a target you can’t see. Your first step is to determine exactly how much you owe in student loans.

Take the time to list out each of your loan providers, the interest rates on each of your loans, and the varying balances.

Although these numbers may feel overwhelming, you must be familiar with your student debt as you start your career. You can’t reverse engineer a plan to pay off your loans if you don’t know what you’re working towards!

2. Refinance Your Private Student Loans

If you have private student loans, refinancing may be in your best interest. Remember, this strategy isn’t for Federal loans going for ANY type of forgiveness (they must stay as Federal loans!).

Federal loans lose a wide range of repayment options when refinanced, such as Income-Based Repayment (IBR), Pay As You Earn (PAYE), and Saving for a Valuable Education (SAVE). However, private student loans often have high-interest rates, making them prime candidates for consolidation.

Ideally, consolidating your loans should allow you to lock in a lower interest rate and move all of your private loans under one umbrella. Doing so can help you to pay less over the life of your loan and save you from having to track your progress on paying down multiple private loans – which can be a pain. You should shop around for the best rate based on your credit score and analyze different providers.

Want some “free” money? Use one of the links from the White Coat Investor page to refinance. Some popular options include:

- Credible

- SoFi

- Earnest

- Splash

3. Determine Your Federal Loan Payment Plan

Your Federal loans usually offer lower interest rates and more flexible repayment plans than your private loans. The three most common payment plans are IBR, PAYE, and SAVE. These plans cap monthly student loan payments at 10% to 15% of your discretionary income and help ensure that, regardless of your salary, you can pay a comfortable amount toward your loans as a new physician without going broke.

Some things to consider when choosing between different income-driven plans include:

- The age of your loans – Some repayment plans require higher payments for loans issued before a specific date.

- Your income – It will partially determine how much you need to pay each month under an income-driven plan.

- Your spouse’s income – Under some repayment plans, your spouse’s income will still count when determining your monthly payment, even if you file separately.

- Your debt burden – Consider your debt burden to make sure an income-driven plan is right for you. If you think you could comfortably pay off your loans under the standard repayment plan, you may save on interest and end up paying less overall.

- How fast you plan to pay off your loans – If you plan to be repaying your student loans for the foreseeable future, income-based plans can make the cost more manageable. But if you’re set on paying your loans off early, an income-based plan may not be the best fit.

After 25 years of IBR, 20 years of PAYE, or 10-25 years of SAVE, your remaining federal student debt is forgiven. There is no limit to the number of student loans that can be forgiven, so medical students stand to benefit the most. Remember: this loan forgiveness program only applies to federal loans – private loans don’t qualify.

Pro-Tip: Based on your income as a physician, I can tell you that it is challenging to get this type of forgiveness outside of very unique circumstances based on your high income. I often see this play out better for vets and general dentists. Also, this amount is TAXED as ordinary income. You need to prepare for that tax-bomb now.

When pursuing student loan forgiveness under an income-driven plan, it’s important to keep in mind that student loan forgiveness typically counts as taxable income (excluding PSLF). This means that you could face a sizable burden come tax time, even after your loans have been forgiven. While forgiven student loans are temporarily tax-free through 2025, there’s no guarantee that the government will extend this pause.

4. Know Your Forgiveness Options and Alternative Repayment Strategies

As a physician, you have several unique opportunities to have your student loans forgiven or avoid paying them off while you’re still in residency. These include:

LOAN FORGIVENESS FOR DOCTORS

One way to have your student loans forgiven is through the Public Service Loan Forgiveness (PSLF) program. If you work as a physician in the government or non-profit sector for ten years, you may get your loans forgiven thanks to PSLF. The key is to make sure they are Direct loans and make 120 (10 years) payments. Once you make the required payments, you may qualify for PSLF to forgive the remaining balance on your loans.

Many states also have programs that forgive student loans for doctors who work in underserved areas for a certain period. Other loan repayment programs in exchange for service include:

- National Health Service Corps Loan Repayment Program

- National Health Service Corps Students to Service Loan Repayment Program

- National Health Service Corps Substance Use Disorder Workforce Loan Repayment Program

- National Institutes of Health Loan Repayment Programs

- Indian Health Service Loan Repayment Program

FORBEARANCE

Medical residents who do not wish to begin repaying their loans during residency have the option of going into forbearance.

With forbearance, you don’t have to make any payments. However, interest continues to accrue, and the federal government no longer pays interest on the subsidized portion of a borrower’s loans. Also, interest may be capitalized under forbearance, making this a more expensive option for borrowers.

Let’s look at an example: You have $183,000 in federal loans and use forbearance during a 3-year residency. After residency, you go to a standard repayment plan. Your monthly payment would be $0 per month in residency (forbearance – interest is accruing!) and then go up to $2,700 per month for the next ten years. When all is said and done, you would have paid a total of $329,000, $146,000 of which is interest. Ouch! Forbearance may sound attractive, but it could cost you in the long run. Additionally, forbearance delays the “qualifying payments” you could be making during residency to earn PSLF.

Pro-Tip: Avoid forbearance. Seriously. Leverage income-driven repayment plans to avoid forbearance as much as possible.

5. Consider Ways to Expedite Loan Repayment

Want to pay down your loans faster? Here are some strategies for expediting the process.

USE YOUR SIGNING BONUS

One way to get a head start on your student loan payments is by using a signing bonus to pay down debt. Many hospitals and employers offer signing bonuses to physicians as an incentive to work for them directly out of medical school. These bonuses range from $24,000 to $150,000. Imagine what a $75,000 bonus could do for your loans!

It’s tempting to use a signing bonus toward another important life goal, like purchasing a home. However, putting those funds directly toward one massive loan payment could nearly cut your debt in half (and minimize the total number of years you’ll be paying down your loans.) Just keep in mind that this isn’t a good strategy if you’re pursuing PSLF.

JOIN THE MILITARY

Another option to speed up your loan repayment is to join the military. The military offers a large stipend and a grant during residency to help knock down student debt.

Typically, you’ll have 3 to 5 years of active duty, depending on your agreement and specialty. You would enter as an officer and put your skills to work caring for the brave men and women who serve our country. While this option isn’t for everyone, it can be gratifying as well as financially beneficial.

WORK IN A HEALTH SHORTAGE AREA

Finally, you might consider working in a health shortage area. The AAMC (Association of American Medical Colleges) features a comprehensive list of programs that offer loan forgiveness. Among the list includes the PSLF program and scholarships for those in the medical field.

You can apply if you are a resident or looking for your first job as a physician. Many residents and medical professionals believe it’s difficult to get scholarships while in medical school or find significant repayment options outside of residency. But with some solid research (start at the AAMC website), you can find numerous opportunities!

HOW LONG WILL IT TAKE TO PAY OFF MY STUDENT LOANS?

How long it will take to pay off your student loans depends on how much you originally borrowed, the interest rates of your loans, and the monthly payments you can afford.

While there’s no one-size-fits-all approach to paying off student loans, the sooner you pay them off, the more you’ll save on interest. Here are a few examples of student loan repayment timetables:

Dentist Smith has $300,000 in loans at 7% interest (assumes private pay-off):

- 5 years at $5,940 per month

- 10 years at $3,483 per month

- 15 years at $2,696 per month

- 20 years at $2,326 per month

Doctor Lee has $600,000 in loans at 6% interest (assumes private pay-off):

- 5 years at $11,600 per month

- 10 years at $6,661 per month

- 15 years at $5,063 per month

- 20 years at $4,299 per month

Vet Scott has $150,000 in loans at 5.5% interest (assumes private pay-off):

- 5 years at $2,865 per month

- 10 years at $1,628 per month

- 15 years at $1,226 per month

- 20 years at $1,032 per month

THE “WHY” BEHIND A COMPREHENSIVE STUDENT LOAN PLAN

When taking out student loans, it’s imperative to evaluate your options and only borrow what is needed rather than accepting anything you have access to.

Student loans can quickly accumulate into serious debt, hindering your financial progress as you move into your career. But student loans aren’t all bad! When handled appropriately, student loans are a solid financial solution to pursue your education.

The cost of higher education has risen by over 25% in the past 10 years and shows no signs of slowing down. With this in mind, it’s essential to know the types of student loans available to you, and working out a repayment plan will help your finances. It’s important to do your research and be fully aware of the benefits and burdens of student loans.

Looking for a more thorough, all-in-one spot for your financial life? Check out our free eBook: A Doctor’s Prescription to Comprehensive Financial Wellness [Yes, it will ask for your email 😉]

Disclosures