Unlocking the Secrets of the Backdoor Roth IRA: Key Strategies and Mistakes to Avoid

When it comes to retirement planning, the Roth IRA stands out due to its tax-free growth and withdrawal benefits. However, high earners often find themselves barred from directly contributing due to IRS income limits. This is where the backdoor Roth IRA strategy comes into play—an invaluable process, not a separate account type, that enables high-income professionals to navigate around income restrictions and reap the benefits of a Roth IRA.

🎥 Prefer video over the blog? We’ve got you covered!

Watch our YouTube video as we dissect this blog post for you 🎥

Understanding the Backdoor Roth IRA

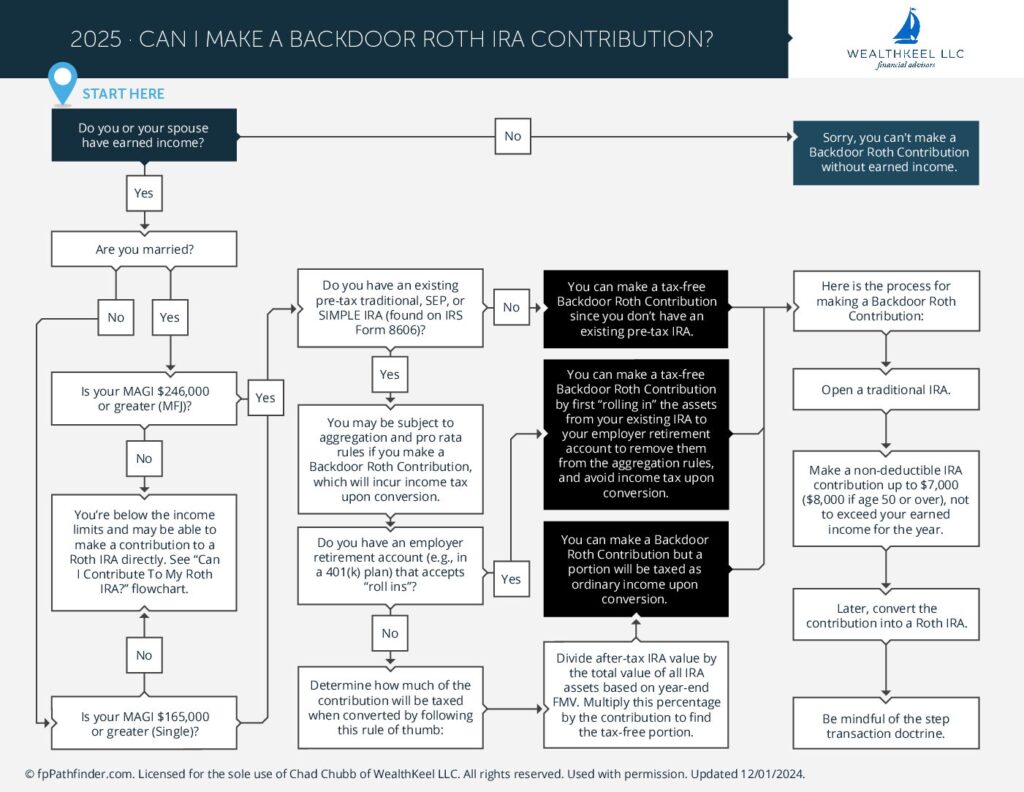

The backdoor Roth IRA isn’t a specific account you can directly apply for; rather, it’s a strategic financial maneuver used primarily by those who exceed the income limits set by the IRS for Roth IRA contributions. Here’s a step-by-step breakdown:

- Open a Traditional IRA and a Roth IRA: You begin by setting up both accounts, which are available through most financial institutions.

- Make a Contribution to Your Traditional IRA: Unlike the Roth IRA, there are no income limits to contribute to a Traditional IRA.

- Convert Your Traditional IRA to a Roth IRA: After contributing to your Traditional IRA, you then initiate a rollover or conversion to your Roth IRA.

For 2025, the IRS has set phase-outs for direct Roth contributions starting at $150,000 for single filers and ending at $165,000, where direct contributions are no longer permissible. For married couples filing jointly, the phase-out begins at $236,000 and caps at $246,000. Extremely low limits apply to the married filing separately category, starting the phase-out at just $10,000.

The “backdoor” method is thus a critical strategy for high earners to bypass these limitations and secure the Roth’s tax advantages—growth and withdrawals are tax-free when done correctly.

Mistake #1: Ignoring the Pro-Rata Rule

A common pitfall in executing the backdoor Roth IRA is neglecting the pro-rata rule. This IRS rule requires that the sum of all IRA balances (Traditional, SIMPLE, and SEP IRAs) be considered when determining the taxable amount of a conversion. Here’s how you can sidestep this complication:

- Consolidate Retirement Accounts: Before performing a backdoor conversion, roll over any funds from SEP or SIMPLE IRAs into employer-sponsored plans like a 401(k) or 403(b) if they accept rollovers. Alternatively, if you’re self-employed with 1099 income, consider rolling over into a Solo 401(k).

The goal here is to reduce your non-Roth IRA balances to zero during the conversion, minimizing the taxes owed during the backdoor process. This keeps the passage to your Roth IRA clear of unexpected tax hurdles.

Mistake #2: Overlooking Form 8606

Form 8606 is crucial as it tracks non-deductible contributions to your Traditional IRA and the subsequent conversions to your Roth IRA. This form helps ensure that you’re not taxed again on conversions of after-tax contributions. Unfortunately, it’s often missed:

- Regular Checks: Actively check if your tax preparer has filled out and filed Form 8606 annually, to ensure all conversions are recorded correctly.

- Self-filing Insight: For those handling their taxes without professional help, resources like tutorials from financial experts or IRS guidelines on completing Form 8606 can provide essential guidance.

This administrative detail is vital for maintaining the tax efficiency of your backdoor Roth IRA strategy.

Mistake #3: Inappropriate Investments in Your Roth IRA

What you hold in your Roth IRA can significantly impact its effectiveness as a retirement tool. Some common missteps include:

- Holding Too Much Cash: Cash in a Roth IRA earns minimal, if any, returns and does not take advantage of the tax-free growth potential. Always ensure that the funds in your Roth IRA are invested according to your time horizon and risk tolerance.

- Investing in Bonds: While bonds are a less volatile investment, they typically offer lower returns compared to stocks. Given the Roth IRA’s long-term growth horizon, equities often provide greater growth potential suited for these accounts.

- Purchasing Annuities: Annuities within a Roth IRA are generally not advisable due to their already tax-deferred nature, high fees, and surrender charges. Keeping a Roth IRA free from annuities ensures better flexibility and lower cost.

Conclusion

The backdoor Roth IRA is a powerful strategy for high earners to access the Roth IRA’s tax advantages, despite IRS income restrictions. By understanding its intricacies, avoiding common pitfalls, and choosing appropriate investments, you can maximize your retirement savings and enjoy a financially secure retirement.

We constantly aim to provide valuable financial insights and would love to hear from you about any topics you’d find helpful for future discussions. Your feedback drives our content, helping us cater to your financial information needs. Please feel free to share your thoughts and questions. Together, let’s demystify more complex financial strategies!

Looking for a more thorough all-in-one spot for your financial life? Check out our free eBook: A Doctor’s Prescription to Comprehensive Financial Wellness [Yes, it will ask for your email 😉]