I am beyond excited for you to jump into this wonderful guest blog post from Larry Keller, where he shares his ultimate guide to disability insurance for physicians. And we are fortunate to have yet another rockstar contribute a guest blog post for our second-ever guest blog post.

I don’t have any fun stories on how I met Larry; heck, truthfully, we have never met in person yet. I just kept reading his stuff on the White Coat Investor and saying to myself, “this guy knows his stuff!” Fast forward a few years, I cold emailed Larry with a tough question. And in true Larry fashion, he gave me a thorough answer in a few minutes. For any of you that have worked with Larry in the past, it was one of those “does this guy ever sleep?” moments.

Over the past few years, we shifted away from selling insurance products and more toward true fee-only advice, Larry (and Adam!) has been one of our main and most trusted resources to help with tough questions and to make sure our clients are properly covered for all their risk management needs.

Without further ado, let me introduce you to one of the best (if not, THE BEST) physician disability experts in the country, my friend, Larry Keller.

As a physician, you are in a unique position. You have spent a lot of time preparing to earn income and, as a result, you have less time to accumulate wealth. While a lot of websites I frequent tend to focus on budgeting, paying down student loans, maximizing your retirement plan contributions and creating an asset protection plan, they seldom mention protecting your most valuable asset: your ability to earn an income.

Disability insurance is something that anyone who is working and has not yet achieved financial independence needs. You might love what you do, but you are working because you need to generate an income. You need to protect that income, and the only effective way to do that is to purchase disability insurance.

Employer-Provided/Sponsored Group Long-Term Disability Insurance

If you work for a large practice, multi-specialty clinic or hospital the odds are very good that you are provided with or offered some type of Long-Term Disability (LTD) insurance coverage. While I would not recommend it serve as the foundation of your disability income protection due to the generally less favorable contractual provisions associated with it, there may be some significant benefits to it – especially when supplemented with an individual disability insurance policy.

Employer-provided or sponsored group LTD plans will cover a percentage of your income up to a maximum monthly benefit or “cap.” For example, a typical LTD plan might provide coverage of 60% of salary to a maximum of $15,000 or $20,000 per month. However, the percentage of income being replaced can vary along with the maximum monthly benefit under the plan. Therefore, it is important to understand the coverage provided to you by your employer, if any, when purchasing or increasing your individual disability insurance coverage.

Many physicians mistakenly believe that their group LTD plan will support their lifestyles in the event of a disability. Unfortunately, this may not be the case for several reasons:

- Group LTD plans may not include certain components of your earned income (such as overtime pay, shift pay, bonuses and/or productivity or “incentive” pay) when calculating the monthly benefits payable.

- Long-Term Disability policies have a “cap” or maximum monthly benefit associated with them. For example, if a physician earns $300,000 annually and is insured under a group LTD plan that covers 60% of income to a maximum of $10,000/month, they would be insured for the maximum benefit of $10,000/month. However, this policy would only insure them as if they were only earning $200,000 (60% of $200,000 provides for $120,000 annually or $10,000/month, the plan’s maximum monthly benefit). In this example, the physician is earning $100,000 in excess of what the group policy covers, leaving a significant amount of income uninsured!

Individual disability insurance policies will take all components of income into consideration when determining the amount of coverage available and, therefore, a larger amount of your income can potentially be replaced.

Most physicians may also not be cognizant of the fact that if their employer is paying the premium for their group LTD plan and not adding it back to their taxable income, any benefits received from the group LTD plan would be taxable, further reducing the amount of their income actually being replaced.

The monthly benefit from an individual disability insurance policy is typically received on an income tax-free basis when paid with personal post-tax dollars.

Group LTD policies typically do not have a true “Own-Occupation” definition of disability. In fact, a well-known group LTD carrier’s policy states that, “You are disabled when due to your sickness or injury: You are unable to perform the material and substantial duties of your regular occupation and are not working in your regular occupation or any other occupation or, you are unable to perform one or more of the material and substantial duties of your regular occupation, and you have a 20% or more loss in your indexed monthly earnings while working in your regular occupation or in any occupation.”

While this policy protects a physician’s income, their monthly benefit may be reduced or potentially eliminated if they can no longer perform the duties of their medical specialty and choose to work in another occupation or specialty. As a result, supplementing a group LTD plan with an individual disability insurance policy can also be very important.

Group LTD plans also typically subtract (from your disability benefits) any payments received for Social Security Disability, Worker’s Compensation, and other “deductible” sources of income. With the exception of the Social Insurance Substitute (SIS) Rider, which coordinates with payments received under Social Security and some other government programs, individual policies do not take these benefits into consideration.

Disability Insurance Limits

Insurance companies don’t want you to earn a higher income when you are disabled compared to when you were working. For this reason, most insurance companies will limit the amount of disability insurance available.

Ideally, you would like to have 60-80% of your earned income replaced in the event of your disability. However, when you have group insurance in place, this will limit the amount of individual coverage available – even if you are willing to pay for a larger amount of coverage.

For this reason, when you are shopping for an individual disability insurance policy, it is best to provide your insurance agent or financial advisor with a copy or summary of your employer-provided LTD insurance plan, if any, for review along with your annual income, a description of your job duties, and if you have any health issues and/or are taking any prescription medication(s). Then he or she can present you with illustrations of coverage from several insurance companies and help you compare the pros and cons of each in terms of cost vs. benefits.

Residents, Fellows, and “New In Practice” Physicians

Residents, Fellows, and “New In Practice” Physicians can purchase coverage without regard to their actual earned incomes or employer-provided/sponsored group Long-Term Disability policies. These amounts can range from $5,000-$7,500 per month.

The Cost of Disability Insurance

Premium rates are based on several factors including your age, gender, state of residence, monthly benefit, and optional riders selected. The younger you are when the purchase is made, the lower the cost of the insurance. Therefore, you should purchase a policy as early in your career as possible to lock in lower premium rates.

It is not unreasonable to think that most physicians would rather be on the beach than in clinic or the operating room. As a result, claims experience has been less favorable in certain states such as California and Florida. Therefore, policies are typically more expensive with less liberal contract provisions.

Unisex Rates

Due to a higher morbidity rate, premium rates for females are substantially higher compared to their male counterparts. This is due to pregnancy and complications of pregnancy, a higher rate of claims resulting from mental/nervous and/or substance abuse disorders, and a higher rate of autoimmune disorders.

The solution is for female physicians to purchase a policy that includes a unisex (gender-neutral) rate structure and a discount. This is a blended rate that greatly favors females and can generally provide them with a savings of 40-50% off the normal female premium rates.

To qualify, one would normally purchase their policy as part of a Multi-Life Discount program through one’s employer or as part of a Guaranteed Standard Issue (GSI) program, except in Montana (where all policies have unisex rates) or in the Commonwealth of Massachusetts (where due to Bill H.482, some insurance companies offer unisex rates). Ameritas also provides unisex rates for all policies issued with a discount in the State of Ohio.

Unfortunately, this rate structure is now more difficult to find than it was in the past. Principal is the most recent example, as they stopped offering unisex rates to Attending Physicians as of January 1, 2021.

Even if unisex rates are unavailable, in most cases, Residents/Fellows should be able to obtain a 10-20% discount or more off of their policies. Additionally, Attending Physicians may qualify for association discounts of 10-15% off their policies. Every physician will qualify for a discount with at least one of the carriers.

What to Look for in an Individual Disability Insurance Policy

Non-Cancellable and Guaranteed Renewable

A policy that is Non-Cancelable and Guaranteed Renewable provides you with the greatest degree of protection as a consumer. As long as required premiums are paid, the policy cannot be canceled, the premium rates cannot be changed, and the policy provisions will remain the same until the policy’s expiration date (typically age 65).

Certain insurance companies may also offer a Guaranteed Renewable (not Non-Cancellable AND Guaranteed Renewable) policy. However, this allows the insurance company to change the premium rates by class of policyholder with state insurance department approval.

While this can provide you with premium savings, in my opinion, it is not worth the risk in most cases. After all, we don’t know where financial markets are headed, where medicine is headed, and what claims experience might represent over your career.

Insurance is about transferring risk away from you to a third party (the insurance company) until you have either gained the ability to self-insure or have reached financial independence.

Definition of Total Disability

Look for a policy that contains a true “Own-Occupation” definition of total disability. The term “Own-Occupation” and the definition of total disability associated with it mean different things to different people, all depending upon who you ask. If nothing else, most physicians have been told to purchase a policy with an “Own-Occupation” definition of total disability.

Typically, “total disability” or “totally disabled” means that due to an accident or illness, you are not able to perform the “material and substantial” duties of your occupation. This definition of total disability makes it possible for you to work in another occupation or medical specialty and still receive your full disability benefits – even if you are earning the same or more income than you were prior to your disability.

In fact, in their most recent offering, Berkshire adds a qualifier or a threshold that can be met in order to receive full disability insurance benefits and reads as follows:

“If Your Occupation is limited to a Medical Doctor or Doctor of Osteopathy and more than 50% of Income is earned from performing Surgical Procedures, We will consider You to be Totally Disabled even if You are Gainfully Employed in Your practice or another occupation so long as, solely due to Injury or Sickness, You are not able to perform Surgical Procedures.”

OR

“If Your Occupation is limited to a Medical Doctor or Doctor of Osteopathy and more than 50% of Income is earned from Hands-On Patient Care, We will consider You to be Totally Disabled even if You are Gainfully Employed in Your practice or another occupation so long as, solely due to Injury or Sickness, You are not able to provide Hands-on Patient Care.”

This language changes the focus from solely your duties to your source of earnings and provides more ways to qualify for total disability benefits.

If you have a mixed practice or your income comes from several sources, this can be an advantage as it stipulates the percentage of income that must be met in order to qualify for total disability benefits.

Otherwise, as long as a policy contains an “Own-Occupation” definition of total disability, the carriers will all evaluate a claim in a similar fashion. Keep in mind: an individual’s eligibility for benefits is determined on a case-by-case basis, taking into consideration the factual circumstances presented as well as the terms and conditions of his/her policy(ies).

Several years ago, one well-known carrier introduced a “Medical Occupation” Definition (MOD) of Total Disability. That same carrier has since introduced a Medical “Own-Occupation” Definition of Total Disability (MOOD).

The bottom line is that despite how they might read on the surface, if you work in another occupation, any earnings will be taken into consideration. A calculation is then made by the insurance company in order to determine the benefit that may be payable, if any. Unfortunately, this could result in a reduction or elimination of your policy’s monthly benefit.

As of this writing, there are only six companies that offer this definition of Total Disability to physicians, including Berkshire Life (a Guardian Company), Standard Insurance Company, Principal, Ameritas, MassMutual, and Ohio National (No new policies after 5/1/2023!). However, the availability of this definition may also vary based upon the state of residence and/or medical specialty.

Residual Disability Rider

While “Own-Occupation” is the most liberal definition of disability, it is not the end all. What happens if your disability is not total? What if you can still work in your occupation, but must work fewer hours — you can do some but not all of your job duties or you have physically recovered but not financially?

This rider protects your income by providing benefits proportionate to your loss of income in the event you are not totally disabled. To qualify for residual disability benefits, you generally must experience an income loss of 15-20% or more compared to your pre-disability earnings. Additionally, if your loss of earnings were greater than 75-80 percent, then 100 percent of your monthly disability benefit would be paid.

A Recovery Benefit is typically built into the Residual/Partial Disability Rider and is designed to do more to assist with your financial recovery following a total disability. This provision can be invaluable – especially if your practice has been built on referrals from existing patients and/or other healthcare professionals or you are compensated in whole or in part on an “incentive” or “eat what you kill” basis.

Should you continue to suffer a loss of income of 15-20 percent or more compared to your pre-disability income, and there’s a demonstrable relationship between your current loss of income and your prior disability, benefits would continue to be payable.

This provides significant benefits if you are no longer sick but your current income loss was caused or contributed to by your prior disability.

Finally, it is imperative that you do not purchase a policy that requires that you be totally disabled first in order to collect benefits under the residual disability rider. While this is not the case with individual policies, this is very common in group policies offered by professional associations.

Cost Of Living Adjustment (COLA) Rider

A COLA rider is designed to help your benefits keep pace with inflation after your disability has lasted for 12 months. This adjustment can be a fixed percentage or tied to the Consumer Price Index. Ideally, you want a COLA that is adjusted annually on a compound interest basis with no “cap” on the monthly benefit.

Although expensive, this rider can be vital to maintaining your standard of living during an extended disability. However, if cutting the cost of coverage is an issue, this might be the first optional rider to consider excluding from your policy or using the additional premium associated with this rider to purchase a larger monthly benefit, if you are not already contemplating the purchase of the maximum monthly benefit for which you qualify.

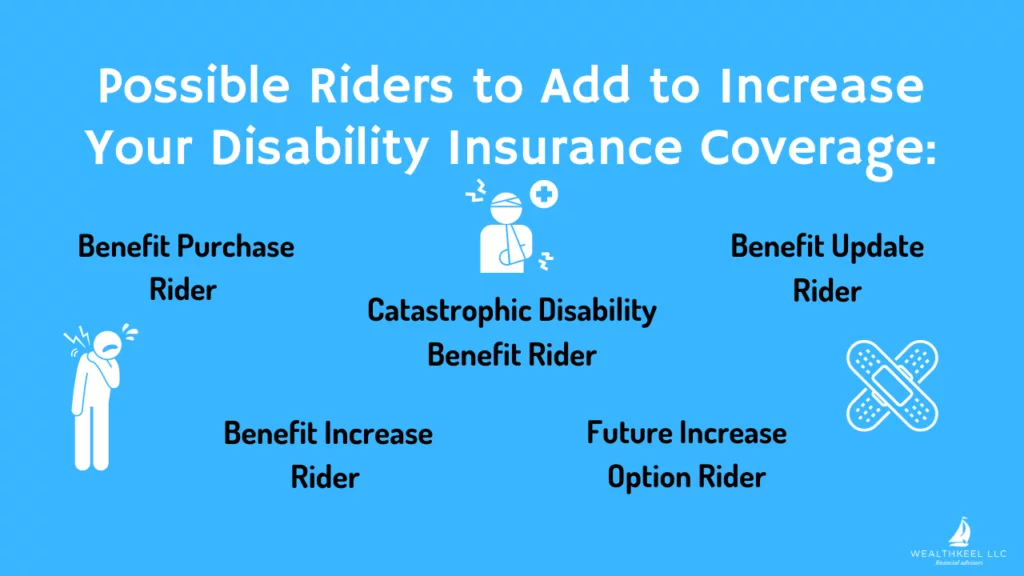

Future Increase Option Rider (FIO) / Benefit Increase Rider (BIR), Benefit Purchase Rider (BPR), Benefit Update (BU) Rider

These riders provide you with the ability to increase your disability coverage, without providing evidence of good health, as your income rises. This guarantees that any medical conditions that develop after your original policy’s purchase would be fully covered and not subject to new medical underwriting.

The Future Increase Option or Future Insurability Option (FIO) Riders are “traditional” increase options, and you pay a premium to have them included in your policy. They typically allow you to purchase 2-3x your policy’s initial monthly benefit and the maximum monthly benefit that can be reached is a combination of the base policy plus the FIO Rider.

The FIO Rider option is available annually and can also be used “off anniversary” if certain conditions are met. There is nothing administrative that needs to be done, and you can decide if you want to increase your coverage and to what extent based upon your individual needs, goals, and budget. When the FIO Rider is exercised, the overall cost of your coverage increases but the cost of the FIO Rider itself is decreased proportionally.

In some cases, a new policy is issued when the FIO Rider is exercised. As such, the contractual provisions may differ from the original policy. In other cases, the insurance company amends the original policy and provides the insured with updated policy schedule pages reflecting the increased monthly benefit and premium.

The Benefit Increase Rider (BIR), Benefit Purchase Rider (BPR), and Benefit Update (BU) Rider are no-cost riders and may be included in your policy if certain criteria are met. Unlike the FIO Riders, there is no pre-determined maximum and you can purchase up to the maximum that the insurance company makes available based upon your income and other disability insurance enforce (either individual, group or association coverage) at the time of the exercise. Additionally, if the insurance company’s limits increase, you can potentially take advantage of them.

Since this is a no-cost option, the insurance companies stipulate that you must “check-in” with them every three years and complete an application to increase your coverage. If you do not qualify for additional coverage after the application is reviewed, you do not need to do anything else, and your increase option will be preserved for future use. However, if you do qualify for additional coverage, you must purchase at least 50% of the offered amount or the rider will be removed from your policy permanently. The same is true if you do not apply every three years.

Like the FIO Rider, some companies issue new policies while others amend the base policy to reflect the new monthly benefit and premium rates.

Catastrophic Disability Benefit (CAT) Rider

If you become catastrophically disabled under the terms of the policy and lose the ability to perform two or more Activities of Daily Living (ADLs) without assistance, or become cognitively impaired, or become presumptively disabled, you would receive a monthly benefit in addition to the base monthly benefit purchased.

The theory is that you use your disability insurance benefits to cover your expenses and the benefits received under the CAT Rider to hire someone to help care for you at home or pay for medical expenses not covered under your health insurance.

Are Two Policies Better Than One?

Typically, any one insurance company will issue individual disability insurance policies with a maximum monthly benefit of $20,000. However, by purchasing policies from two different companies, with increased options on both, you can potentially reach a total of $25,000-$30,000 per month of individual disability insurance (or potentially up to $35,000 per month with employer-provided/sponsored group Long-Term Disability coverage, depending upon which companies are combined), subject to your income and other disability insurance in force.

Therefore, I often recommend that high-income specialists, including but not limited to Plastic Surgeons, Neurosurgeons, and Orthopedic Surgeons, purchase two different policies from two different companies. This affords the ability to reach the larger amounts referenced above without the need for additional medical exams, blood tests, urine tests. or having to answer any medical questions in the future.

As a result, they are adequately protected today and have the ability to increase the monthly benefit on their policies, regardless of their health, as their incomes rise. This strategy guarantees that any medical condition(s) that develop after the original policies are purchased would not need to be disclosed to the insurance company and would not be subject to medical underwriting (only financial underwriting is required when increase options are exercised).

All Agents are Not Created Equal

There is no shortage of insurance agents and/or financial advisors that work with or want to work with physicians. Unlike medicine, which has a standardized path that physicians must take to gain the education, training, and experience requirements necessary to obtain board certification, the insurance and financial services industry does not.

Since the insurance industry is heavily regulated, you will not be paying anything more by purchasing your policy from an “experienced” insurance agent than you would be by purchasing your policy from a newly licensed or “inexperienced” insurance agent or broker.

Parting Thoughts

In conclusion, remember that the contractual language and premium rates must be approved by the insurance department of each state before a policy can be approved for sale by a particular insurance company. If policies are structured the same way and all agents are showing policies with the same discounts, the premium rate will be the same and the only way that one agent can provide a lower price to the consumer is by having access to or knowledge of a discount plan that another agent does not.

Looking for a more thorough all-in-one spot for your financial life? Check out our free eBook, A Doctor’s Prescription to Comprehensive Financial Wellness.

Written by Larry Keller; guest post for WealthKeel LLC