Before we talk about financial planning for medical residents, let’s start with the most important part first: your primary goal while in residency or fellowship should be to become an exceptional doctor. The kicker is that you also have to devote some time and energy to your finances and not completely neglect them. We understand that finances may not be the first thing on your mind after working 80+ hours a week, but having healthy financial habits is just as important as keeping your patients healthy.

Here are a few important financial items you should worry about while in residency: student loans, budget, emergency fund, homeownership, insurance, and investing.

Don’t have an emergency fund or know anything about investing? Are you worried about your student loans? It’s okay— we will help you every step of the way.

KEY TAKEAWAYS:

- Organize your student loan debt, then consolidate it (if possible), create a payment schedule, and get the debt forgiven.

- Make and stick to a budget — we make it easier than you think. We’ve got a few tips on how to save for a rainy day, deciding on insurance, and how to keep your accounts organized.

- Start investing. Take advantage of the retirement savings plans your employer offers and open a (Backdoor) Roth IRA.

Prefer video over the blog? We got you covered! Watch our YouTube video as we dissect this blog post for you.

The Harsh Reality of Medical Resident Student Loans

If you don’t have student loans, lucky you! Go ahead and skip to the next item. However, the unfortunate reality is that most medical residents and fellows are burdened with student debt — and lots of it.

Our professional advice is to get your student loans organized as an intern/PGY-1, if possible. This is arguably one of the most important financial tasks a newly minted physician can do. You can check out our doctor’s guide to paying off student loans for more information. In the meantime, let’s review why paying your student loans as soon as possible (or forgiveness!), and on time, is so important.

Financial Planning 101: Know Your Debt

Before you can start to pay off your student debt, you have to be well acquainted with it. Start by writing down and organizing all of your student loans including providers, interest rates, and the balances of each.

Understanding the debt you have will help you create a strategy to pay it off faster and ensure that you don’t lose sight of any loans.

While prioritizing your student debt isn’t as enticing as buying a new car or immediately adopting a new lifestyle, it is important for your future financial wellbeing to make paying off your loans the first priority.

Consolidate When You Can

Consolidating your private loans (keyword is private!) is a great way to reduce interest and end up paying down your debt quicker. While a lucrative strategy for private loans, federal student loans shouldn’t be consolidated with private loans as you lose some of your repayment options. It usually (keyword is usually!) does make sense, however, to consolidate federal loans with other federal loans.

Create a Payment Schedule

Once you know the type of debt you have (and how much you have of it), you will need to make a plan to repay that debt. The three most common income-driven repayment plans:

- Revised Pay As You Earn (REPAYE)

- Pay As You Earn (PAYE)

- Income-Based Repayment (IBR)

All of these payment plans look at your income and calculate your monthly payments based on that. So while you aren’t earning as much money, your student loan payments would be smaller. They increase proportionally to your rising income.

Get That Debt Forgiven

The desired goal for many medical professionals should be to have their student debt forgiven, and thanks to the Public Service Loan Forgiveness (PSLF) program, that can be an achievable goal. The best shot you have at qualifying for PSLF is by starting your debt payments right out of medical school. While this may seem like an impossible task, the income-driven repayment plan and a few other strategies can keep your payments low (maybe $0 for your intern year!).

The PSLF program will require 120 qualified payments (10 years) on your federal direct consolidated loans to have them forgiven. These 10 years are critical because your residency/fellowship can be anywhere from three to seven years (or more). Let’s assume it takes you six years: You now only have four years left to qualify for PSLF. This can force that first attending role a bit, but the more PSLF years you knock out in training, the better.

Key things to remember for PSLF:

- Consolidate your federal loans and make sure they are direct loans.

- Make sure you are using an income-based repayment plan.

- Don’t consolidate any federal loans with private loans or you will lose your option for PSLF.

- Once your salary increases with your first medical contract, so will your student debt payments since you are using an income-based repayment plan.

With any private loans, it is a good idea to look to consolidate those loans and shop around for low and fixed rates. Here are some companies that can help you with private loan consolidation: Credible, SoFi, and Earnest (Use the WCI link to get some “free” money 💰).

FYI, but try to avoid: Instead of paying student loans immediately, the other option is called forbearance. With forbearance, no payments are required during residency — but there’s a catch. You may not be paying your loans back during residency, but during your residency, your loans will continue to accrue interest. In short, your loans will get more expensive the longer you wait to pay them off. You also are not getting credit for qualified PSLF payments during the most vital years. With the addition of income-based repayment plans, our advice is to avoid forbearance if possible — it’ll cost you in the long run.

The Importance of a Budget (and the Ease of Making One)

We know the thought of making and sticking to a budget can be both daunting and intimidating, but the process is more simple than you might think.

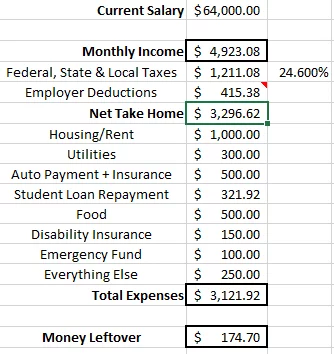

The good news is that budgeting is typically a bit easier as a resident because you probably have your first regular paychecks coming in. On average, most residents/fellows can expect to earn a yearly salary anywhere between $55,000-$70,000.

While there may be times you feel more financially strained, the reality is you are making as much, if not more, than the average United States household, so it is possible to be financially stable — you just have to follow your budget.

A budget really only consists of two things:

- An Excel or Google Sheet

- Realistic goals and expectations

You can also use wonderful tools like Tiller or YNAB.

It’s that simple.

We’ve created a budget template specifically for medical residents. Download it here and customize it to fit into your lifestyle. Different expenses that should be included in your budget are housing/rent, medical, insurance, food, subscriptions, entertainment, car payments, and student loans. Within your budget, decide on a number that you feel comfortable with putting away in savings.

Even if you make an epic budget that you are really proud of, with every lifestyle change, you’re bound to slip up. You may pay a credit card bill late or spend too much on takeout. It’s also important to note that life happens. That is okay. It is part of this wild and beautiful journey.

You may get a flat tire or have to file an insurance claim — and that’s okay. There will be multiple factors that will slightly alter or even ruin your budget, but that doesn’t mean you have to throw the budget out.

Having realistic goals and expectations when planning your budget is not only helpful to your wallet but for your mental state as well. Start by compiling your expenses to see how much you really spend every month, and cut out the areas that are not necessary or are too extravagant.

Expenses that can easily be minimized or removed completely from your budget include:

- Takeout or eating out

- Subscriptions (Spotify, Netflix, Hulu, BarkBox, Fabletics)

- Grocery delivery services

Tip of a lifetime: Even as an attending, try to live off of your resident budget for at least a few years. Build up your savings, pay off any debt and student loans, save for a down payment on a home, and max out your 401k/403 and Backdoor Roth IRA.

It can be tempting to stray away from the budgetary lifestyle once you get a pay raise, but by continually saving and being cost-conscious, you will be better off in the long run.

Put Some Away for a Rainy Day

Saving some money each paycheck to go towards an emergency fund may not seem glamorous, but it is vitally important. Do you have the immediate funds to replace your car if need be? What if you had to be out of work for a month or two because of a medical emergency, would you be able to make it?

We won’t scare you with any more disastrous scenarios, but just know it’s crucial to stow away some money for an emergency. In a perfect world, you would save three to six months of your total income in your emergency fund. That would mean that if you are earning $60,000 per year, your emergency fund should fall between $15,000 and $30,000.

Now as a medical resident paying off student loans, that may not be possible for you at the moment. At the very least, your goal should be to save three to six months of your total expenses. Those expenses would include food, housing/rent, utilities, and/or a car payment — essentially everything you have to pay for every month.

The money that you put away each month for your emergency fund should go into a separate savings account, not your checking account, to discourage temporal spending or dipping into the fund for non-emergency use.

Keep Personal and Emergency Accounts Separate

It’s vital to keep these accounts separate so that you’re not tempted to use that money for anything else. Life happens — you’ll need to pay for something that you never could have anticipated. But when that happens, it’ll put your mind at ease knowing that you don’t have to put your expenses on a credit card just to get by.

Avoid Homeownership at All Costs

We could probably stop there, but we will go into some more details for you. Unless you have already signed a medical contract to work in the same city as your training, you should not be or consider being a homeowner.

Let’s start with the basics. As a resident/fellow, your schedule is incredibly hectic, and if you work 20 hours a day, you will never see your home.

You’re a resident, so you also probably don’t have enough money for a 20% down payment. Which is perfectly fine. Do not listen to your mortgage broker or real estate agent if they tell you they can get you into a home for only 3% down. Yes, physician mortgage loans will allow you to do 0% down with no private mortgage insurance (PMI)— don’t be tempted to take the bait (yet)!

There are many other costs in the home-owning process. These additional expenses include closing costs, escrow (property taxes and homeowner’s insurance), and annual home maintenance costs such as roof or yard maintenance.

At this point in your career, it’s safest for you to continue renting. There are outliers to this comment, but for most, I would really try to stick to renting.

Decide on Insurance for Medical Residents

There are three types of insurance that you should concern yourself with: malpractice, disability insurance, and term life insurance. Malpractice should be a no-brainer (hopefully)… However, you also want to make sure you have reliable disability coverage in place and a term life insurance policy if your situation requires it.

When inquiring about disability insurance, ask if there is a discount or a GSI policy (Guaranteed Standard Issue) for your hospital and if they offer a unisex rate. Unisex rates typically yield lower premiums for women. Also, be sure to do research on every rider to your policy before you commit.

We highly recommend not purchasing permanent life insurance as a medical resident. Term insurance is typically very inexpensive — you can expect it to be less than $100 per month for a good size policy. As your income increases and/or life changes, you can add additional term life insurance as needed.

Consider the following when looking for a term insurance policy:

- Work with a company with a 90+ or higher Comdex score.

- Ensure the term policy is convertible to the company’s permanent product.

- Possibly add a waiver of premium (more important for a single income household and/or when your emergency fund is low).

Don’t Ignore Investing as a Medical Resident

Investing comes last on our list for financial planning for residents because if you take care of all the above items, investing should come pretty easily.

There’s no time like the present to grab hold of the investment opportunities before you, and right now, your retirement accounts are a great route. Retirement accounts are an excellent way to take advantage of compounding interest. Look for a 403(b)/401(k) and a Roth IRA.

If your employer offers any sort of match within your plan, take advantage of it. For example, if your hospital offers a 100% match on the first 4% of contributions to your 403(b), elect to have at least 4% of your salary go into your 403(b).

Pro-Tip: If you are going for PSLF, using the pre-tax 403b will help lower your income-driven repayment since it is lowering your AGI (adjusted gross income).

Once you have done that, if you have more room to save, it would be wise to open your own Roth IRA. You will be able to contribute up to $7,000 per year (2025 Limit) to that account. Contributing to a Roth IRA early in your career will help you build up post-tax savings while you can still contribute to the fund in a conventional way. Once you reach the income threshold ($165,000 if filing single or $246,000 if married and filing jointly – 2025 Limits), you won’t be able to directly contribute to a Roth IRA (don’t worry, we still have the Backdoor Roth IRA). Prioritize this savings vehicle, because it will boost your retirement savings while offering tax-efficient benefits later on.

If you have done all of the above and still have room to save, head back to the employer plan. You can never start saving too early for your golden years.

As a medical resident, you have a lot to worry about. Whether it’s student loans, investing, or planning out a realistic budget, the process can seem very overwhelming. It’s all a learning process. Know that you are not alone.

We believe that financial planning is more than just managing your investments or creating budgets in an Excel spreadsheet. Financial planning is a comprehensive process that takes into account your goals, dreams, challenges, and ambitions, and saving for retirement is the cornerstone of that process. At the end of the day, your time and energy are much more valuable at learning to be an outstanding doctor than a financial guru.

Looking for a more thorough, all-in-one spot for your financial life? Check out our free eBook: A Doctor’s Prescription to Comprehensive Financial Wellness [Yes, it will ask for your email 😉]