While financial planning for doctors is a long process that relies heavily on personal circumstances and preferences, we break it down into a simple five step process to get you on the right path. This is simply a starting point, and your work will by no means be done after completing these steps. However, if you are just starting in your career or maybe are in the middle of your career and have found your finances aren’t where you want them to be, you can use these tips to help set (or correct) your course in financial planning.

Obviously, the entire scope of a financial plan cannot be described in a single blog post. However, we touch on five of the major fundamentals to help set you on the right path.

KEY TAKEAWAYS:

- One of the most vital parts of your financial foundation is your emergency fund! We will cover how much you should have and how that changes over time.

- Ever wonder what the difference between good debt and bad debt is? We’ll break this down and provide strategies on how you can effectively eliminate your debt.

- Employer benefits are one of our favorite topics, and it can sometimes be overwhelming when you get that 100-page document. We will take some time to review the main details you should be looking for.

- Yes, we know, budgets are boring. However, they are vital to your success. We have a free template and some other valuable tools below to help and make it fun (okay, maybe not fun, but not as bad.)

- Pop quiz! What is the most powerful tool in all of finance? Time! Time = compounding interest. Don’t worry about being perfect, just get started with your savings. We include some tips on where to start.

Prefer video over the blog? We’ve got you covered! Watch our YouTube video as we dissect this blog post for you:

Step 1: Building an Emergency Fund as a Physician

The first step in your path to financial independence is to build an adequate cash reserve to cover an unexpected expense, aka an emergency fund. While this is often an overlooked first step, building your emergency fund is a crucial foundation in your financial plan. Whether it be unexpected medical bills, an unexpected job loss, or maybe a leaky roof, all of these can wreak havoc on your financial plan if you are not adequately prepared for them.

Without an emergency fund in place, you may be forced to cover these expenses by pulling from your investment accounts if you do not have enough cash on hand. Doing so can result in taxes, lost potential gains had the funds remained invested, and potentially even penalties if forced to pull from a retirement account like an IRA. These negative impacts can be even further amplified if you are forced to sell your investments while the market is in a downturn. Or even worse, using a high-interest rate credit card (noooo!).

While throwing your money into a savings account isn’t as “sexy” or “exciting” as investing in the latest meme stock from Reddit with your friends, it is a necessary step in your financial plan.

You can think of it as a “rite of passage” before you earn the right to invest and take risks (calculated risks) with your money.

This is also a good point to mention that you need this money to be immediately accessible and 100% safe. This makes savings accounts and money market accounts excellent options. This should also be a separate account, and you should not commingle your emergency fund with your checking account.

Pro-Tip: Online savings accounts at banks like Ally, Marcus, Capital One, and American Express offer strong rates and make a good home for your emergency fund.

How Much Do I Need in my Emergency Fund?

By now, you’re probably wondering, “how much do I need to have saved in my emergency fund?” This is a great question, and the answer is “well, it depends.” The rule of thumb you usually hear is to have 3-6 months of your non-discretionary expenses in your emergency fund. However, we like to take it a step further and suggest saving 3-6 months of gross income. We are a bit more aggressive on this figure because we work with physicians that may have a lot of transitions and large life events in the near future. There are psychological benefits to seeing your cash on hand that are stronger than a rate of return. We also like to direct a portion to a lower-risk taxable investment account, but we will save that for another day.

The amount you actually save in your emergency fund will depend on a few factors such as family structure, job security, consistency of income, and risk tolerance. To keep things simple, here is a breakdown of how much you should try to have saved (ignoring personal preference and risk tolerance):

- 3 Months of Gross Income: Single with strong and reliable income or married with a dual reliable income.

- 4-5 Months of Gross Income: Married with one income, or single with kids.

- 6+ Months of Gross Income: Married with kids or single with variable income (i.e. practice owner or performance-based (RVUs))

At the end of the day, how much you keep in your emergency fund will be whatever amount is needed to make you feel safe and sleep easy at night. If the idea of not having enough money saved in the case of an emergency causes you to have stress, that is probably a good sign you should increase your emergency fund savings.

Remember, it’s okay to take baby steps. Start by looking at your most recent paystub and locate your gross pay at the top (before taxes and deductions). Make it your goal to save 1x your monthly gross income as fast as possible and build from there.

Step 2: Eliminating Debt as a Physician

Once you have built up your emergency fund, the next step will be to work on eliminating your debt. Now when we say to eliminate debt, we don’t mean you should rush to pay off every single debt as soon as you can. There is such a thing as “good debt” that you do not need to be in a rush to pay off. However, if there is good debt, there is also bad debt.

As a general rule on good debt vs. bad debt, if the debt increases your net worth, it is good debt. However, if you take debt to purchase something you simply don’t have cash for, it is bad debt.

Good Debt Examples:

- A mortgage

- Student loans

- A small business loan

Bad Debt Examples:

- Credit cards

- Payday loans

- Car loans

If you hold good debt, it is still important to make the required minimum payments. However, paying off bad debt as quickly as possible should be your priority.

Credit cards should always have a $0 balance at the end of each month. If these balances are out of control and you can’t pay them off each month, you are most likely living outside of your means (sorry, the truth hurts sometimes).

It’s important to note that of the bad debts, car loans typically have the lowest interest rates. If you purchase a reasonable car and take a loan at a low interest rate, this could actually be good debt as a car is likely a necessity for you. However, it is a slippery slope as you can also take on too much debt to buy a car you can’t truly afford and thus become bad debt.

Pro-Tip: Cars should be paid off in 3 years. If you can’t pay it off within three years, you bought a car you can’t afford. Sorry, but someone needs to be honest with you. The car salesman that just locked you in for 72 months of payments doesn’t care about your financial wellness, he cared about his commission.

How to Attack the Debt?

Now, if you have found yourself with a large amount of bad debts, there are several techniques available to you to eliminate this debt. Two of these include the snowball and avalanche methods. Under the avalanche method, you start by paying as much as possible towards the loan with the highest interest rate (you continue to pay the minimum payment on the remaining loans as well). Once paid off, you apply that payment to the loan with the next highest rate and work your way down until all bad debts have been paid off.

The snowball method is similar, but instead of focusing on the interest rate, you focus on the balance of the individual debts. You start by paying as much as possible to the loan with the lowest balance to pay it off quickly. Once paid off, you move on to the loan with the next lowest balance until eventually you reach and pay off the largest balance.

Pro-Tip: The avalanche method will save you money in the long run, but the snowball method can give you the psychological boost of paying off the lower balances quickly to keep you motivated while tackling the debt.

You should also keep an eye on the interest rates of your debts. If interest rates have fallen, refinancing your mortgage or student loans to take advantage of the lower rates could save you thousands of dollars over the life of the loan.

Step 3: Maximize Your Employer Benefits

As the job market for new physicians becomes more and more competitive, employers are forced to offer benefits to help attract and retain employees. One of the most common benefits is for an employer to sponsor a retirement savings plan for its employees. In many cases, this comes in the form of a 401k or 403b.

If your employer offers one of these plans and has an employer match on contributions, you should be investing whatever amount is necessary to get the full match, it is FREE money!

Example: Your employer matches 50% of employee contributions up to 6%. You should be contributing at least 6% of your income to receive the full 3% match from your employer.

Not only will you get free money from the match, but contributing to these accounts can also represent significant tax savings. The funds in the account grow tax-deferred until you make withdrawals in retirement, but contributions also go in pre-tax, reducing your total taxable income. As a physician, you likely are in one of the top tax brackets, thus you should use this to your advantage and make contributions to reduce your taxable income.

Pro-Tip: Pre-tax retirement contributions can also lower your adjusted gross income (AGI) which would then lower your income driven repayment plan for any of your going for Public Service Loan Forgiveness (PSLF).

Example: Let’s assume you are married and earned $250,000 this year. Contributing the maximum $23,500 (2025) to your employer’s 401k plan would represent $5,640 in tax savings for the year — more free money. Yes, it is a simple example using a 24% tax rate, but it helps to see the numbers.

In addition to the retirement accounts (keep an eye out for a 457b), you will likely have several other benefits available to you. These may include things like group life insurance, group disability insurance, health insurance, etc. You will have to elect many of these benefits during open enrollment.

Pro-Tip: If a high deductible health plan makes sense for you and your health insurance needs, you should consider contributing to a Health Savings Plan (HSA). HSAs can be used as a stealth IRA and can supplement your retirement savings.

Step 4: Budgets Are Boring, But Vital to Your Success

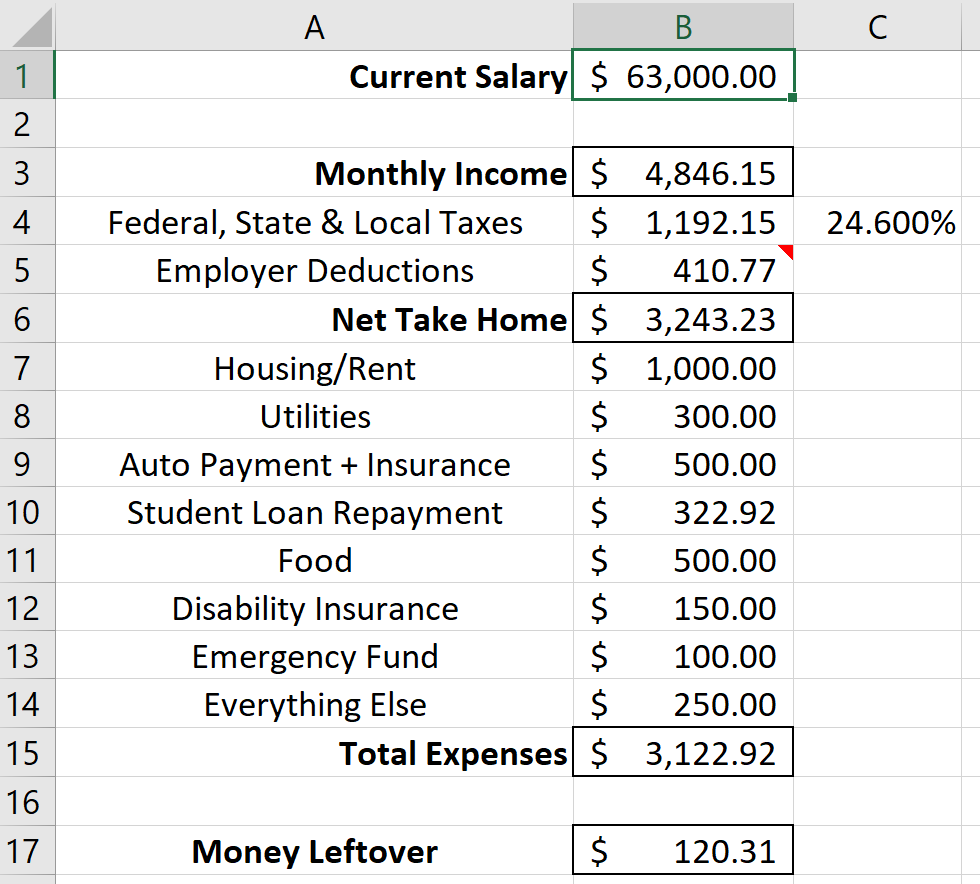

While no one is suggesting that creating a budget is a fun activity, it is a necessary step in the path to financial independence. A budget is a tool that allows you to remain in control of where your money goes. Without one, you will quickly find that spending can get out of control. This presents several problems. First, by not keeping a close watch on how much you’re spending, you’re probably going to find there is not very much money left at the end of the month to save. Second, if spending gets truly out of control, you may be living beyond your means and will be forced to take on credit card debt.

Budgets can avoid both of these problems. In your budget, you should “pay yourself first,” meaning as soon as you get your paycheck, have a portion of it automatically deposited to your retirement or savings account. Doing so will allow you to spend the remaining cash guilt-free, as you know your savings goal has already been reached.

While creating a budget can take a fair amount of time as you will need to track your expenses over the course of a few months. A good starting point is to use the 50-30-20 budget rule. This budgeting method breaks your spending down as follows:

- 50% of your income on living expenses (rent/mortgage, groceries, bills, etc.).

- 30% of your income on lifestyle choices like eating out and other discretionary spending.

- 20% of your income toward debt payments and savings.

The sooner you build your budget, the better. Realistically you should try to do this while you are a resident.

Need help? Use our free budget worksheet to get started.

Pro-Tip: Tiller & YNAB offer great budgeting tools to make this process as easy as possible for you.

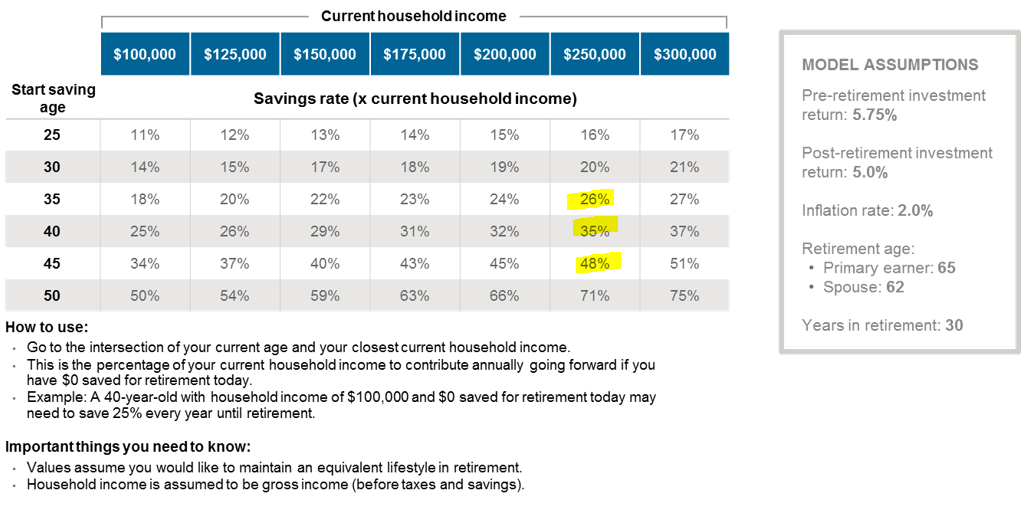

Step 5: Save 15-20% of Your Income

We’ve already discussed contributing to your employer’s retirement plan to at least receive the full employer match. However, you shouldn’t stop at the match and call it a day. Your goal should be to save 15-20%. This sounds much more difficult than it actually is. Follow this plan of attack to get you there:

- Take the full employer match first

- Then max-out your Roth IRA

- Then back to your 401k/403b

Example: Let’s say you are a resident earning $55,000 and your employer offers a 3% match on their 403b. Matches are not all that common while in training, but some programs do offer it. You start by saving 3% to your 403b, and then max out your Roth IRA ($7,000 in 2025). Right now, your total savings rate is at 14.8%. You could then return to your 403b to increase your contribution to 5-10% of your salary.

Once you are an attending, you will likely need to make additional contributions to a 457b Plan (if available) or a taxable investment account to reach the full 20% at your higher income. However, we will stick to the basics of using your employer’s retirement plan and a Roth IRA.

Depending on when you get started, your savings percentage may be much higher!

Source: JP Morgan

Your goal should be to figure out how much you believe you need to retire and save accordingly. This may require a rate greater than 20%, or closer to 15% or 10% if you live a modest lifestyle.

And there you have it, the five basic steps to help build a solid financial foundation. Heck, if you were able to follow just those five items, you would be looking pretty good financially!

Remember that wealth building is a marathon, not a sprint. The tortoise wins the race every time you read The Tortoise and the Hare.

Looking for a more thorough all-in-one spot for your financial life? Check out of free eBook, A Doctor’s Prescription to Comprehensive Financial Wellness.

Disclosures