We built the ultimate first year baby budget by tracking all our major expenses in Ryker’s first year with us (Life update; he is almost 5 now!).

As any first-time parent will tell you, YES, there are undoubtedly tough times. However, one small smile, giggle, or milestone makes you forget the tough (sleepless) nights. Ryker was not the world’s best sleeper until about eight months, so my wife and I had an ongoing joke that anything said between midnight and 4 am was not allowed to be brought up ever again. Boy, if these walls could talk.

One of my favorite things about working with our Gen X & Gen Y physicians is that we are going through or have gone through similar life events recently. Before we bought our first home, I recall being at a disadvantage when advising on the topic. Yes, of course, I knew the textbook answers, but we all know real life is the ultimate learning experience. The same holds true for having a child. I knew the budget details, the costs, the 529 plans, adding guardians, etc., but I didn’t have the real-life experience. Well, today, I share the ultimate first-year baby budget! That’s right, I am going to share every major cost that we encountered in the first year of our son’s life.

The inspiration for this post is from all our amazing clients who are preparing to have their first child or have recently had one. I am often asked, “What does it cost?” and I always had a good answer, but I didn’t have “our” answer listed out. Today, that changes.

At the very end of this post, I have included an Excel spreadsheet. In this spreadsheet, I have each topic listed with our dollar amount. The sheet is form fillable, so please take a copy and make it your own.

Key Takeaways

- Total first-year cost in our case: $28,361.61, based on real receipts and tracking.

- Birth and prenatal costs after insurance: $5,208.91 for delivery, $30 prenatal copay, $1,208.74 in misc prenatal items.

- Core monthly budget targets: child care $1,000 (Philly can be $2,000), diapers and wipes $87, food $200 if using formula, babysitter $120, clothes $55, misc $75.

- Pre-baby setup, typical one-time items: stroller $500, car seat $300, bassinet $225, nursery $794.96 list price, misc gear about $1,000.

- Insurance tip: expect to hit your deductible and out-of-pocket max, review your Summary of Benefits and Coverage, and consider one family plan

- Inflation: Yes, it is real. Most of these costs are from 2017, so while all the details are fantastic, add a little inflation to the costs.

Prefer video over the blog? We’ve got you covered! Watch our YouTube video as we dissect this blog post for you.

*In the video, I also added some life updates as our 2nd child arrived since the initial writing of this baby budget*

As a reminder, this was our experience, and it is not to say our choices are the same choices you will make, but we do believe we followed a rather traditional path.

PRE-BABY: Hospital & Doctor Costs

I consider myself well-versed in health insurance. Technically, I am a licensed health insurance agent, but I don’t sell it. However, I learned a lot during this experience.

The first item up is Mommy wellness visits (also known as prenatal visits). We had these visits from the first time we heard our little stinky butt’s heartbeat until we met him for the first time. The good news is that once you pay your first co-pay, it should cover all of them. You should confirm this with your insurance provider; however, that is the case for most.

Prenatal Co-Pay= $30

There were some other events that we had to pay out of pocket for, including ultrasounds (not covered for some reason…) and one other test that we opted for to make sure Ryker was safe. We also had a minor fright when Ryker didn’t kick for a short period of time, even after a sugary drink, so we ran to the emergency room (You know, first-time parent stuff). While it stinks to pay, I would do it every time just for the peace of mind. Okay, so add up all those items and here is the total. We had an average health insurance plan, so this may be on the high side (or low side with minimal coverage).

Miscellaneous Prenatal Items= $1,208.74 ($281 of that was for our extra emergency room trip when Ryker wasn’t kicking, aka taking a very long nap!)

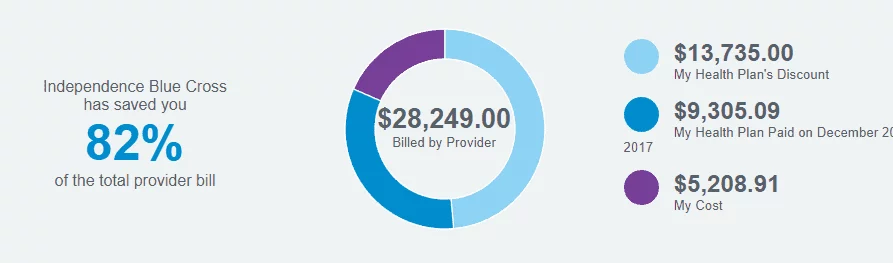

Fast forward 9-months, and it is Ryker’s day! The first mistake we made was that we got to the hospital at a bad time. If you ever saw The Office episode where Pam is trying to hold off until midnight, that is a good idea. We got to the hospital around 7 pm after Mari’s water broke. That led to three nights in Penn Hospital. And while Penn is one of the best hospitals in the world, it is also one of the most expensive. The total bill from Penn Hospital was $28,249. I know what you’re thinking, no way it cost that much, well the proof is below! This was not a C-section and we were only in the labor room for a total of six hours and a few nurses even noted that it was the easiest and quickest delivery.

Not only did we hit our deductible in 2017, but we also hit our out-of-pocket maximum for the year. The final bill that we were left to pay was $5,208.91.

Pro Tip: If you are planning to have a baby in a given year, make sure you understand your deductible and out-of-pocket maximum. There is a good chance you will hit them. When shopping for health insurance, ask for a copy of the Summary of Benefits and Coverage. I attached one for you, scroll down to page 7, and read “Peg is having a baby.” That should be a pretty good estimate of your costs. I believe every insurance plan now provides this estimate in the benefits summary.

Ryker’s Birth: $5,208.91

Next section, preparing for the baby to come home!

PRE-BABY: Nursery

We bought our current house because the family that lived here before us did a great job on their nursery; it was so good that we didn’t change a thing. The paint colors, lights, shelves, etc. were all perfect. The only thing we had to do was furnish, so right off the bat, we saved a few bucks there.

Ryker’s nursery features a crib, a rocking chair, a dresser with a changing table, and an additional dresser. The rocking chair and dresser were gifts.

Pro Tip: Make sure you are really good at your baby registry. Don’t be afraid to tell people what you need or ask for cash or gift cards to Amazon/buybuyBABY.

Nursery Cost: $794.96 (crib and dresser with changing table)

Crazy story: We bought those items from Babies”R”Us when they were on the brink of bankruptcy. When the items arrived we took them upstairs and noticed they were damaged. The marks were noticeable but didn’t compromise the items. However, if you put a very pregnant and hormonal soon-to-be Mommy on the phone you will be amazed at the bargaining power. By the end of the phone call, Babies”R”Us didn’t want the liability of picking the items up and shipping them back. The items were heavy, and we have a crazy staircase to our 3rd floor. So crazy, that when we moved into our house the mover fell down our stairs with Mari’s office desk and the desk went through the wall in two places. Babies”R”Us refunded us $720.78! That’s right, Mari negotiated a 90% discount! The following day, they filed for bankruptcy (I am just kidding, but it was soon after). We lucked out here and paid a total of $74.18 to furnish our nursery.

PRE-BABY: Miscellaneous Items

Babies require a lot of items, I will list out many of our big items, but I am sure to miss a few odds and ends.

Stroller: $500

We went with the UPPAbaby Cruz (We have an awesome friend that we trust with all her baby research and suggestions. Hi Bianca!). The grandmas split the cost of this and bought it for us. We also waited for the next year’s model to come out which saved us about $50 at buybuyBABY.

Our only regret was that we should have looked at the UPPAbaby Vista since we plan to have another child. The Cruz is perfect for one baby, but if you plan to have another baby in the near future take a look at the Vista which can expand to fit two kids (technically three kids with the skateboard feature).

Car Seat: $300

You need this to get the baby home! I believe a lot of hospitals will check the car seat before you leave, but they didn’t at Penn for some reason. Maybe they assumed we were walking home… However, we did take our car seat to a free safety check at Penn Hospital a few weeks before Ryker was born to make sure Dad installed it correctly. While it was about 75% correct, they did fix a few things, so this is a good idea to double check! This was a free safety check. If you want to find one in your area, use this Car Seat Inspection search tool and enter your zip code. Also, AAA offers free checks once per month.

Ours: UPPAbaby Mesa; I loved that car seat and thought it was great!

Mamaroo: $250 (including the infant insert)

It’s like a spaceship for infants. It was a cool item and Ryker liked it for a few of his early months and then he wasn’t a fan. If I had to do it again, I don’t think this was worth the cost. However, some parents say it was the best money ever spent. We kept ours, so hopefully, the second baby will be a bigger fan (Update: He wasn’t a fan either 🤦♂️).

Ours: 4moms mamaRoo.

Bassinet: $225 (Originally $250 but we got 10% off)

When you bring home an infant, you can’t just place them in the crib and let them sleep peacefully (That would be nice though!). So they sleep in this little baby bed beside Mom and Dad’s bed called a bassinet.

Ours: HALO Bassinest Premiere

Again, there are a lot of little things! I have a receipt from Babies”R”Us for $372 which was for his mattress, swaddles, pacifiers, bottles, medicine, etc. I have another one for similar items for another $279. Both of those trips were pre-Ryker so that was prepping for him. I am sure I can find another $450 between Amazon and Target without any problems. While I don’t think we overspent, I don’t think we underspent either.

We also had a fair amount of cash and gift cards that did help to offset a lot of the small costs. Again, be smart with your baby registry!

Use this budget from babycenter and scroll down to their “One-Time Costs” section which does a wonderful job listing EVERYthing you may buy.

Miscellaneous: $1,000

POST-BABY: Health Care

Once your baby is born, he or she will now have their own wellness visits just as Mommy did. The good news is that the same rule applies, one co-pay covers all the wellness visits in year one and there are a lot; 1 week, 1 month, 2 months, 4 months, 6 months, 9 months, and 12 months.

Ryker’s Wellness Visits: $30

As first-year parents, you will probably have 2-3 visits to the doctor for coughs and rashes. We had two visits in Ryker’s first year.

Extra Doctor Trips: $70 – $60 (2x co-pays of $30 each) + $10 for a medication or two

If this is your first child, your health insurance cost is going to go up. Your actual insurance plan will increase to a family plan. I can’t put a dollar value on this because every plan is different.

Pro Tip: If you and your spouse are on separate plans, now may be a good time to get the entire family on one plan. I am still amazed by how many are on separate plans, and I think the biggest factor is that it is a lot to comprehend when making a change with health insurance plans. The main reason to be on one plan as a family is one family deductible/out-of-pocket maximum.

Family Health Care Plan: Increasing

POST-BABY: Child Care and Babysitter

Child care is no joke today! You should be prepared to add a 2nd mortgage on your budget but without the actual 2nd home.

Let’s start with the average in Pennsylvania since that is where we call home (Use this awesome calculator to plug in your state).

The average annual cost for infant care in PA is $10,640 or $887 per month. Keep in mind that PA has two major cities (Philly & Pittsburgh) followed by A LOT of farmland, so that average is pulled down. In Philly, I usually quote $2,000/month for infant care. With most child care, as your child gets older the costs will come down, they aren’t as fragile as they get older and usually the child/caregiver ratio increases.

Fun fact, infant care in PA costs only $1,967 less than in-state tuition for a 4-year public college and is almost the same average cost as rent.

For budgeting purposes, we will round up and use $1,000, however, if you live in one of the major metropolitan areas, you should be prepared to pay much more (Example: Philly at $2,000/month).

Our story, we don’t pay for childcare. Mari and I made the decision early on that we wanted Mari to stay home with Ryker and that we would then hire someone to replace Mari which we did. So while we don’t pay for childcare directly, we did have to make changes to our budget to allow (financially) for Mari to stay at home.

Day Care Cost: $1,000

The first 6-months or so you probably won’t get a babysitter, especially if it is your first child. Why? Well, you don’t trust anyone with your baby, even grandparents were on watch from the Nest Cam! For us, we were just worried about keeping him alive, let alone going out. We took him a lot of places, even as an infant in the middle of a cold winter in 2017. We would bundle him up and take him to brunch with us. As Mari would say, “They come into our lives, and we want them to be comfortable with our lives.” The funny story is that Ryker attended a few brunches with bottomless mimosas and the environment was relatively loud (not headphone loud but loud). And the kid would just sleep, it was amazing. Today, we can take him anywhere and he is very comfortable. We took him to Boston in December and he fell asleep during his first NHL hockey game (Go Bruins!). The Bruins scored, and he kept sleeping (picture below).

I think date nights are vital (call me old-fashioned!) but having a trusted babysitter or two can go a long way! In Philly we have two amazing babysitters that we often use, in addition, we have two grandmas who will gladly hop on a train to Philly to spend a few days with their grandson. Grandparents are free (sometimes we cover the Amtrak ticket) but we usually pay our babysitters $15/hour. The average in Philly for our needs seems to be $13-$14 per hour (based on this resource from Care.com). The calculator from Care.com is pretty awesome, you can enter your zip code and other specifics to get your average hourly rate.

I am assuming two date nights per month with a 4-hour time block at the $15/hour.

Babysitter Cost: $120

POST-BABY: Food

This section comes down to two things: breastfeeding vs. formula. This is not saying one is right or wrong, you do you momma!

The main factor is that one is free, and one is about $150/m based on the average.

For us, we were very fortunate that Mari was able to breastfeed Ryker for the first year of his life. So we have never bought formula. As new parents going into it, we didn’t know what to expect. What if he didn’t like breastfeeding, what if Mari’s supply only lasted 6 months, which is why we didn’t have a set food budget. The other fun fact was that Ryker got his first tooth at 5 months and then they came in one after the next. By 9 months, the kid could shred meat like a lion! Mari is a great cook and makes dinner every night (Yes, I can cook too, but she is much better), so she would take a chunk of our dinner (pre-salt or any crazy spices) and blend the foods in a blender (also known as puree). Once Ryker became more comfortable with solids, we continued to introduce more. By 9-10 months he was eating what we ate but just cut up smaller.

I feel that we were very fortunate in the food section. Our son drank breast milk and then transitioned to our dinner in pureed format and then small pieces. For us, I never adjusted our food budget for him. As he gets older and eats like a crazed growing teen, we will probably have to double our Costco budget for bulk buys. Of course, we have little snacks and treats that we buy him when we go to the grocery store, but we are talking about $25- $50/month and that didn’t happen until 9 months or so. Milk, squeeze yogurts and fruits, animal shaped everything, etc…

Pro Tip: Don’t buy a breast pump until you contact your insurance provider! Many insurance providers will pay for your breast pump. Our breast pump was free from insurance.

I will base this budget on the formula plus a few extra dollars at the store. Adjust based on your goals.

Food Costs: $200 ($150 Formula + $50 Miscellaneous)

Look at those chompers!

POST-BABY: Diapers

They poop and pee A LOT! If you want to use cotton diapers and wash them and reuse, god bless you and you are much stronger than us. I have seen what my son does to diapers, and while I don’t love my washer and dryer, I would never put them through that suffering.

The average baby goes through six to ten diapers a day, which, according to the National Diaper Bank Network, can set you back $70 to $80 per month.

Make life easy, sign up for a diaper subscription at Amazon or Target. We used Amazon for just about the entire first year and recently changed to Target since he is not as sensitive anymore.

I guess Amazon used some type of algorithm to price diapers because the price changed each month (even when the size was the same), however, it was always between $40-$50 per month. That was for a box of 150 diapers, which seemed like more than enough each month, so I guess Ryker averaged closer to five diapers per day. There were certainly a few emergency refills needed but not that often, maybe 2-3 that I can recall. With that said, let’s average our costs vs. the national average of $80 and call it $65/month.

With diaper changes, comes baby wipes. You will also go through a lot of baby wipes, they somehow become the main cleaning item you have in your home. We are avid Costco fans, so I usually grab a box of Kirkland Baby Wipes every other time we go.

Diapers & Wipes Cost: $87 ($65 Diapers + $22 Wipes)

POST-BABY: Clothes

It helps to have a cool family here because hand-me-downs are vital. Mari’s cousin delivered boxes (almost an SUV full) of clothes, not once but twice (Julia you are the best!).

Dad tip: Remember what I said earlier, they poop A LOT and somehow it seems to always get on clothes. And then you have to use “delicate” laundry detergent that can’t even remove a water stain let alone fluorescent colored poop. Do yourself a favor and don’t buy anything nice. Sure, buy the special occasion outfit, but for the day-to-day onesie, buy intelligently.

The USDA says you will spend $640/year on clothing for a child ages 0-2. That seems high for our situation, but without the hand-me-downs, I can see that as a fair number, especially if it is your first child. Let’s go with it.

Clothes Cost: $55 (~$640 annually)

POST-BABY: Miscellaneous Items

Whether it is a miscellaneous item bought on Amazon or at Target, or you just signed them up for music classes, you will have month-to-month miscellaneous expenses that don’t fall neatly into a category. It could be toiletries, toys, books, media, 529 plan contributions, diaper bag refills for your Diaper Genie or a million other things, but they will occur.

I was torn between using $50 or $100 for this section, so let’s go with $75 per month. That may be on the high side for some and low side for others but again, it seems fair looking back on our spending.

Miscellaneous Items: $75

POST-BABY: Car Seat #2

I know, I know, we already bought a car seat, what the hell Chad?!?! Well depending on how fast that munchkin grows you may need to upgrade the car seat to the “big kid” car seat.

Either keep the current car seat for your next baby, but always keep an eye on recalls and expiration dates for any old car seats. Or if no more kids are in the future, sell it. Those mommy groups and Facebook groups are the best to sell baby items.

Ours: Britax Boulevard Clicktight

Cost: $300

Drum roll please….The Grand Total: $28,361.61

There you have it, the ultimate first year baby budget! It may not be perfect, but I truly walked through our home to make sure all major costs were accounted for, and went through credit card statements and past order histories from Amazon. I am sure I missed some items or some items that were gifted that didn’t show up on a transaction (Examples: Baby Clothes, Pack ‘n Play, Safety Gates, etc).

If you want to look for some of the items I may have missed, this budget from babycenter was very detailed.

Never in a million years did I think my first 3,500+ word blog post would be on the cost of raising my son, what can I say, I am a proud father! To Ryker, if you ever read Daddy’s blog post in the future, while you were expensive, you are the best thing that has ever happened to me and I can’t wait for all our future adventures together. I love you.

“The ultimate first year baby budget” excel spreadsheet! The sheet is form fillable so make it our own.

Frequently Asked Questions About First-Year Baby Budgets

How much did the first year actually cost?

Our total was $28,361.61. That includes prenatal care, birth costs after insurance, nursery and gear, and ongoing monthly items like child care, diapers, food, clothes, and misc expenses.

What birth and prenatal costs should parents expect with insurance?

We paid $5,208.91 for delivery after hitting our deductible and out-of-pocket maximum. Prenatal wellness visits had a $30 copay that covered them for the year. We also had $1,208.74 in prenatal misc costs, including ultrasounds and an emergency room visit.

What should I budget each month for recurring first-year expenses?

A simple starting plan: child care $1,000, diapers and wipes $87, food $200 if using formula, babysitter $120 for two date nights, clothes $55, and misc $75. Adjust based on feeding choice, city costs, and your support system.

How much is infant child care in Pennsylvania and big cities?

The PA average is $10,640 per year, about $887 per month. In Philadelphia, plan for about $2,000 per month for infant care. Costs drop as the child gets older and ratios improve.

What gear is essential before baby arrives, and what did you spend?

Big items we bought: stroller $500, infant car seat $300, bassinet $225, nursery furniture $794.96 list price, and about $1,000 in misc gear like mattress, swaddles, bottles, and medicine. We also later bought a convertible car seat at $300.

Looking for a more thorough all-in-one spot for your financial life? Check out our free eBook: A Doctor’s Prescription to Comprehensive Financial Wellness [Yes, it will ask for your email 😉]