Everyone knows they need to save for retirement to have any hope of reaching financial independence, but what retirement accounts should physicians be utilizing in 2026? What might not be as clear is what type of retirement account to use and how it can fit your overall financial plan. As a physician, you likely have several different options for how you can save for retirement.

Last updated: December 30, 2025

Key Takeaways:

- How much should be in my nest egg?

- What do these account titles mean?

- Which accounts should I save to?

🚨 First, here is a free flowchart we put together for you: What Accounts Should I Consider If I Want To Save More [PDF]

Prefer video over the blog? We got you covered! Watch our YouTube video as we dissect this blog post for you:

This post will help you determine which accounts you should use to invest for retirement. However, before you begin filling these accounts up, it is essential to know how much you need to save to reach your goals. It goes without saying that you also need to understand what your goals are before you can determine how much you need to save for them. Once you’ve given thought to when you would like to retire and what you would like that retirement to look like, you can use our “Calculate Your Nest Egg” Excel spreadsheet at the bottom of our post on “How Much Do I Need to Retire as a Physician?” to get a rough idea of how much you need to save to reach your goal.

HINT: Your nest egg (estimate) = 30x your needed living expenses

i.e. $100,000/year = $3,000,000.

Before we begin discussing which accounts to use, there are a few essential considerations to make note of. In many cases, it will make sense to start investing in the most tax-advantaged accounts and work your way down to less tax-advantaged accounts as you fill these up. However, everyone’s situation is different, and there is certainly room for flexibility when deciding which accounts to fill up first.

If your goal is to reach financial independence and retire early (well before 59 ½), then it may make sense to focus on contributing to a taxable account for greater flexibility. While there are rules in place to help get qualified funds before 59 ½ (i.e., Rule 72T), the taxable account will allow you to be agile. Therefore, building up a taxable investment account would provide a bridge you can use in the early years of your retirement until those retirement accounts become fully available.

Other important considerations to take into account before investing include how much debt you have and how much you will be able to save based on your cash flow. If you have a large amount of debt (especially high-interest credit card debt), it may make sense to focus on paying this down before worrying about maxing out your retirement accounts. This goes hand-in-hand with your cash flow, since paying off debt will free up more money to be used to save for retirement. However, it is vital to create a budget so that you have the power to control where your money is going and make sure enough is being saved to reach your goals.

Retirement Savings Accounts for Physicians:

As mentioned before, there is room for flexibility when deciding the order of which accounts to fill up first. Ideally, you will be able to max out all these accounts and still be able to make investments in a taxable account. If this is the case, then the order in which you fill up the accounts becomes a moot point, assuming all tax-advantaged retirement accounts are maxed out before contributing to a taxable account. Rather than providing an exact list to follow when saving into retirement accounts, here is an overview of all your options, starting with tax-deferred accounts.

401k & 403b Plans

401k plans and 403b plans are very similar retirement saving accounts offered by an employer. This can also include a Solo-401k in which you are the employer. The main difference from the employee’s viewpoint is that 401k’s are offered by for-profit companies and 403b’s are offered by non-profit organizations or government employers.

These accounts are often considered a great starting point when beginning to save for retirement. The reason for this is that many employers often offer a match on your contributions to the plan, and maybe a profit share also. It’s important to know that employers have different equations for how they calculate the match. Some may simply contribute a match on your contributions dollar-for-dollar up to a certain percentage.

For example, some employers offer a 100% match on all employee contributions up to 3% of compensation. However, some may have an equation that only provides a partial match on employee contributions, for example, a 50% match on all employee contributions up to 6% of compensation. Therefore, in both examples, the most the employer will match is 3% of compensation. However, in the first example, the employee would only need to contribute 3% of compensation to receive the full match. In the second example, the employee would need to contribute 6% of compensation to receive the full 3% match. It is often recommended that you contribute at least the amount you need to in order to receive the full match, even if you have other pressing priorities like larger amounts of student loans or debts.

Many plans provide the option to invest in a pre-tax or Roth account. Conventional wisdom says you should take advantage of the pre-tax option as a tax planning strategy to reduce your tax bill (knowing a high-income physician is our specialty). The idea here is that you will be lowering your income while you are in a higher tax bracket during your peak earning years, and then you will have less taxable income when you take a distribution in retirement. At this point, you will ideally be in a lower tax bracket and pay less tax on the income.

The current maximum employee contribution to these plans is $24,500 ($32,500 for Age 50+ & $35,750 Age 60-63) for 2026. There is another catch-up provision if you have a 403b and have been employed for more than 15 years. However, you can also receive employer contributions (and/or make after-tax contributions, if eligible) to bring the total contribution up to $72,000.

Pro-Tip: We did not include SEP-IRAs or SIMPLE IRAs for a reason — they ruin your opportunity for Backdoor Roth IRAs. In a perfect world, you use a Solo-K and not a SEP or SIMPLE.

Health Savings Accounts (HSA)

An HSA can be an incredible tool when saving for retirement since it is the only triple-tax-advantaged account available. Contributions made to the account are pre-tax (meaning they reduce taxable income like 401k contributions), the funds inside of the account grow tax-deferred, and distributions used for qualified medical expenses may be taken from the account tax-free.

Some have even referred to the HSA as a “Stealth IRA” due to these incredible tax advantages. It is possible to use the HSA as a retirement savings account by making the max contribution each year and if possible, avoiding using the funds to pay for medical expenses during your working years. To do this, you would need sufficient cash on hand (i.e., an emergency fund) to be able to cover the out-of-pocket expenses and deductibles during these years.

In order to be eligible to contribute to an HSA, you must be enrolled in a high-deductible health plan (HDHP). It’s important to note that an HSA is not for everyone, and you should never sacrifice good health insurance just to get the tax benefits of an HSA. This is especially true if you expect to have high medical bills throughout the year. The additional out-of-pocket expenses from an HDHP would likely outweigh the benefits of the HSA.

The current maximum 2026 contributions are $4,400 for a self-only plan and $8,750 for a family HDHP. Add $1,000 to both limits if you are over age 55.

457b Plans

In addition to a 401k plan or 403b plan, many physicians also have access to a 457b plan. 457b plans are very similar to the 401k and 403b plans already discussed. They are employer-sponsored plans, and contributions are taken from your paycheck on a pre-tax basis. These plans are another great tool to save for retirement while simultaneously lowering your taxable income during your peak earning years. If your employer offers both a 401k/403b and a 457b plan, you are able to make contributions to both plans. In 2026, the maximum contribution you can make to a 457b plan is $24,500 ($32,500 for Age 50+ & $35,750 Age 60-63). Therefore, if you were to max out both of your employer-sponsored retirement plans, your total annual contribution would be $49,000 ($65,000 for Age 50+ & $71,500 Age 60-63).

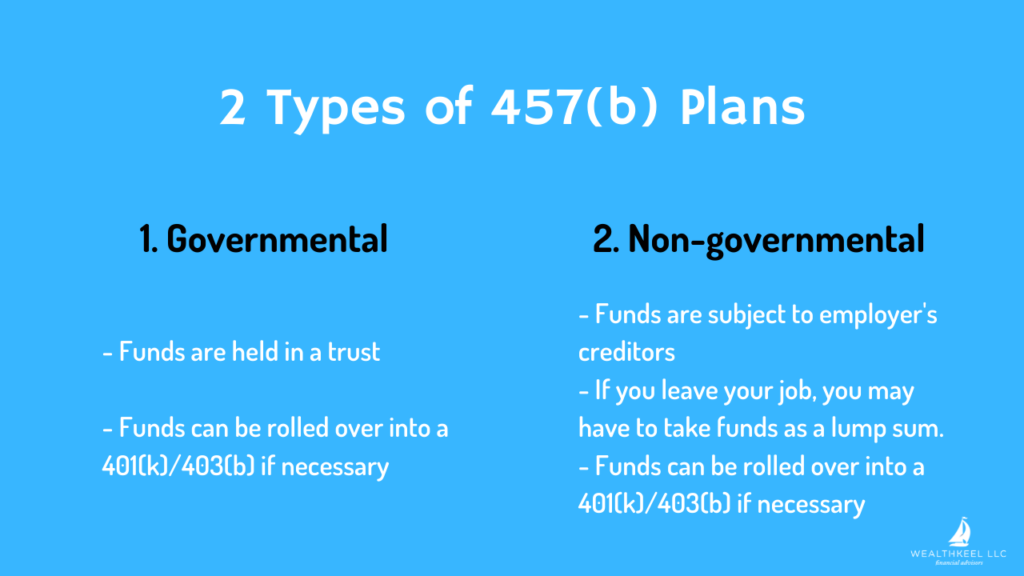

It is important to note that there are two different types of 457b plans: governmental 457b plans and non-governmental 457b plans.

The main difference is that a governmental plan is backed by the government, while a non-governmental plan is backed by your employer. Since non-governmental 457b plans are backed by your employer, they are also subject to claims from your employer’s creditors. This means the money in the account is not truly “your” money until you leave your employer or retire and are paid the money. This puts you at risk of losing the money if your employer were to be sued or unable to pay their debts. Below are a few other key differences to be aware of.

In a governmental plan:

- Funds can be rolled over to other accounts like an IRA or 401k/403b.

- The money in the plan is held in a trust.

- This is a bonus account, and you are cleared to use it.

In a non-governmental plan:

- Funds can only “usually” be transferred to other non-governmental 457b plans (cannot be rolled over to an IRA). This is not always the case, and you should understand your exact options at separation from service. Some force you to take all the funds in a short window, which can lead to a large tax issue.

- The money in the plan is subject to your employer’s creditors and is not protected by a trust.

- Read the fine print! While the fact is you can lose all this money if the hospital goes under, you are more likely to have issues based on the withdrawal options.

Another key feature of this account is that you do not need to be 59 ½ to start withdrawing contributions. This feature makes it a great tool if you plan to retire early.

Backdoor Roth IRAs

A Roth IRA is different from the other tax-advantaged accounts in this post as it does not offer tax deductions on contributions to the account and must be funded with after-tax money. Simply put, you will not reduce your taxable income by making contributions to this account. However, a Roth IRA still offers significant tax advantages.

The after-tax money contributed to a Roth IRA grows tax-deferred (similar to the other retirement accounts discussed). However, when you withdraw your money from the account in retirement (assuming it is a qualified withdrawal), you will receive your funds tax-free. This means that any qualified withdrawals you make from your Roth IRA in retirement will not increase your taxable income for that year. Having money in both traditional retirement plans (like 401ks and 457 plans) and Roth accounts allows you to diversify your retirement income. This will provide greater flexibility to meet retirement income needs without having to face a large tax bill each year.

An issue for many physicians is that your income will be too high to contribute to a Roth IRA directly. This is where the backdoor Roth IRA comes in. To complete a backdoor Roth IRA, you simply make an after-tax contribution to a traditional IRA and then submit a Roth conversion to move those funds into your Roth IRA. The maximum annual contribution is $7,500 ($8,600 for 50+) regardless of whether you are doing a backdoor Roth IRA contribution or a direct contribution.

Pro-Tip: Keep an eye out for after-tax contributions (401k/403b), especially if they allow in-plan Roth conversions of those contributions.

Taxable Accounts

Typically, this will be the last place you invest your money when saving for retirement. Once you have fully funded all of your retirement accounts to get their full tax benefits, you can look at a taxable account for additional savings.

Although a taxable account does not offer any tax advantages itself, there are certain strategies that can be used to help minimize the tax impact of this account. When dealing with a taxable account, it is always a good idea to work with a tax professional and/or financial advisor to make sure the transactions you place will not have an adverse effect on your taxes and overall financial plan. While this is not investment or tax advice, a few strategies to consider using in a taxable account include taking advantage of long-term capital gains tax rates and the use of municipal bonds in your portfolio.

If you hold a security for over one year (Pro-Tip: One year and one day!), any gains on the sale of the security will be taxed at the reduced long-term capital gains tax rate. If you sold that same security within one year of its purchase, the gain would then be taxed at your ordinary tax rate. Municipal bonds may also be a good option for the fixed-income portion of your portfolio. The interest received on these bonds are not subject to federal income tax and may even be exempt from state and local income tax as well.

Taxable accounts also offer the advantage of flexibility. There are no early withdrawal penalties for a taxable account, so these accounts are outstanding accounts to invest in when saving for early retirement. They also can make great backup emergency funds when life happens — just make sure you use an appropriate risk allocation.

While everyone’s situation is different, it is best to start by defining your goals and determining how much you will need to save to reach those goals. Depending on the timeline of those goals, it is generally best to start by filling up your tax-advantaged accounts, and once those accounts are maxed out, to begin investing in a taxable account. Hopefully, this post helps you as you begin to analyze the tools available to you while saving for financial independence! Most importantly, build good habits, automate your savings, and control your emotions!

Looking for a more thorough, all-in-one spot for your financial life? Check out our free eBook: A Doctor’s Prescription to Comprehensive Financial Wellness [Yes, it will ask for your email 😉]

Disclosures