Back in 2018, I was asked to speak at the American Society of Colon and Rectal Surgeons (ASCRS) conference, and the topic was simple: How Much Do I Need to Retire as a Physician? Well, simple question, complex answer. So how do I answer such a crucial question in a room full of surgeons? I had to work it backwards, and in this post, not only will I share how I did it, but I will also share my Excel spreadsheet with you so you can make it your own.

KEY TAKEAWAYS:

- Have you ever asked, “I wonder if I am on track?” Well, keep reading, my friend — you will find out soon. As an appetizer, if you are a 40-year-old physician making $250,000/year, you need to have seven figures saved today.

- You will know how much you need to save, not only as a percentage of your income but also down to the dollar. And we even provide you with your own Excel spreadsheet so that you can plug in your own numbers.

- The star of this post is a simple way to estimate your “nest egg” utilizing your estimated expenses in retirement and the 30x and 25x multiplier rules.

- Am I using the “right” accounts to save these large numbers? 401ks, 403bs, Roths, HSAs, taxable accounts, and the rest of the alphabet soup are covered.

Prefer video over the blog? We’ve got you covered! Watch our YouTube video as we dissect this blog post for you:

Before we get into the math part of our lesson, let’s start with some focal points.

When To Start Saving for Retirement as a Physician?

Short answer: yesterday. But seriously, the sooner, the better. People come up with all kinds of excuses to delay saving for retirement. Some of these include “Retirement? Why would I worry about retirement when I’ve barely even started my career?” or “I don’t have enough money to invest right now, but I will once I make more,” or “Yeah, that’s cute, talk to my extra mortgage about that (aka student loans!).” Maybe they simply just don’t know how or what to invest in.

Whatever the reason, it is essential to acknowledge what is holding you back and to recognize the importance of starting as soon as possible. The sooner you begin investing, the less you will need to save down the road.

To put this into context, consider the following example:

Let’s say your goal is to retire at age 65, and you believe you will need to save $4,000,000 to retire comfortably. We’ll assume you can achieve a 6% annual rate of return.

If you started saving at age 30, you would need to save about $2,800/m to reach your goal of $4,000,000 at age 65.

However, if you decided to delay saving for retirement until age 40, you would need to save about $5,775/m to reach that same goal of $4,000,000 at age 65.

By starting ten years earlier, you are able to cut your required monthly savings amount in half.

Now, I know what you are thinking: “$4,000,000?! That seems like a lot. Do I really need that much?” Maybe, maybe not, but keep reading, and you will see that is not an outlandish number. As a physician, you likely maintain a pleasant lifestyle, and most prefer to keep that in their retirement years.

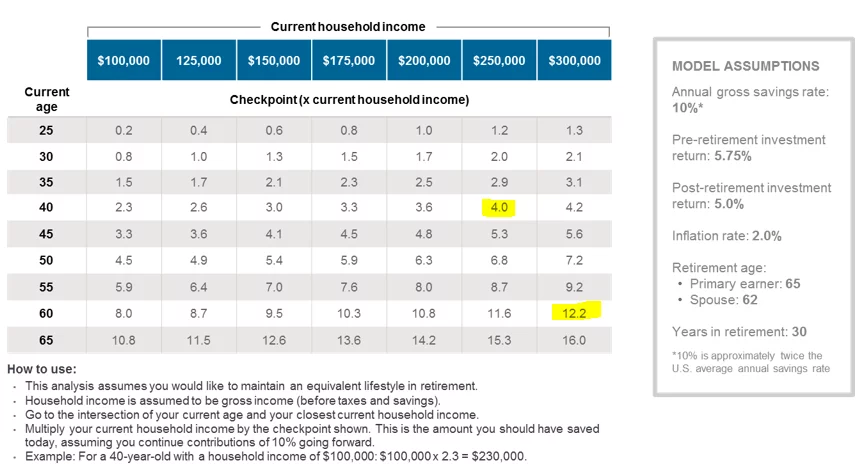

Shout-out to JP Morgan Asset Management for these two helpful charts, let’s review.

The one thing I don’t love about this chart is that it does not account for the late start that physicians get due to their training. However, there is still valuable data to extract.

- The chart says a 40-year-old physician making $250,000/yr should have $1,000,000 saved (4.0).

- The chart says a 60-year-old physician making $300,000/yr should have $3,600,000 saved (12.2).

As you can see, the $4,000,000 example is not outlandish when you put it into context. How are you looking based on this chart?

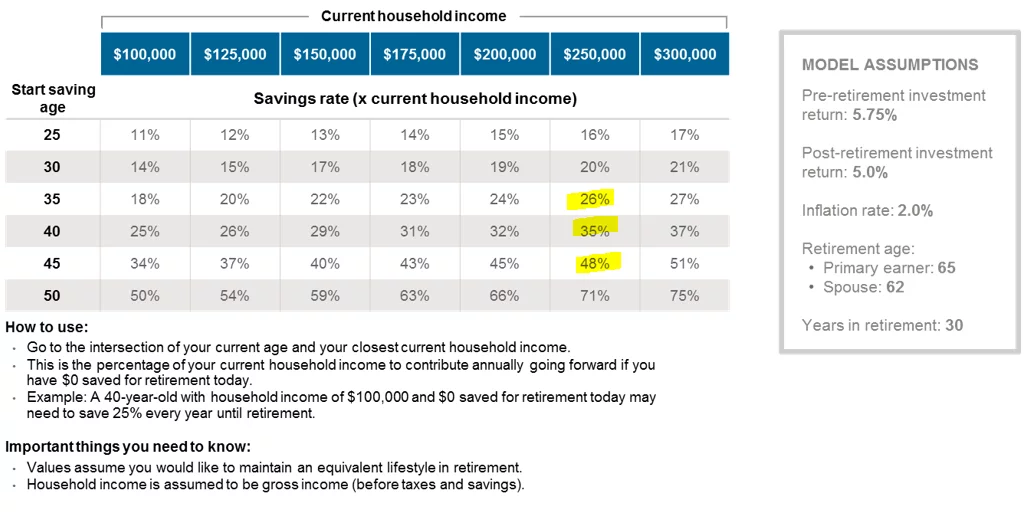

This chart does a better job illustrating the delayed start for physicians. You sometimes hear, “You should be saving 10% or 15% of your income.” As you can see from the chart above, that may be low or very low depending on when you get started. The main point of this chart is to show that the later you start, the more you need to save. According to the chart:

- A 35-year-old physician making $250,000/yr. needs to be saving 26% of their income each year.

- That is $65,000/yr.

- A 40-year-old physician making $250,000/yr. needs to be saving 35% of their income each year.

- That is $87,500/yr.

- A 45-year-old physician making $250,000/yr. needs to be saving 48% of their income each year.

- That is $120,000/yr.

- Don’t forget: the main assumption would be you had $0 in savings at age 45 (in this example) and are just getting started. I hope that is highly unlikely 😉

How Much Should I Be Saving?

A good goal when starting is to save 15-20% of your income. I know, I know — “What the heck, you just told me that number is too low!” Correct, that number is too low if you wait. Don’t wait! Get started while in training. 10-15% can go a long way, and it also starts to create good habits before your attending pay.

“But Chad, I can’t save while I am a resident…” Well wait, hear me out:

Suppose you are a resident earning a salary of $60,000, and your employer offers a 403b with a 4% match (yes, I know, not all that common while in training, but some programs do offer it). You save 4% of your salary, and your employer match is 4% (also known as 100% match up to 4%). This means 4% of your paycheck is deducted and contributed directly to your 403b each pay period.

You then max out your Roth IRA, which is 12.5% of your gross income ($7,500 Roth contribution with a gross income of $60,000), which puts you at 16.5%.

Boom, you should be very proud of the 4% and maxed-out Roth IRA (don’t forget to add the extra step for the Backdoor Roth IRA — I would start that process your last year of training to be safe). Notice that I don’t count your 403b match towards your saving percentage; not going to let you off that easy!

Pro-Tip: If your employer offers a Roth 403b (or Roth 401k), it may make sense to utilize this during your years of residency/fellow while your income is lower and you are in a lower tax bracket. However, if you are going for Public Service Loan Forgiveness, you may want to still use the pre-tax 403b/401k. This would lower your adjusted gross income (AGI), which in turn would lower your student loan payments. HSAs & FSAs can also lower your AGI.

Okay, back to the fun. To keep it simple and organized, let’s use the popular 50-30-20 budget rule. This budgeting method breaks your spending down as follows:

- 50% of your income on living expenses (rent/mortgage, groceries, bills, etc.).

- 30% of your income on lifestyle choices like eating out and other discretionary spending.

- 20% of your income toward debt payments and savings.

While the 50-30-20 budget rule is a great starting point to help you start saving, eventually, you will want to take the time to make an actual budget. While creating a budget is often a dreaded activity in personal finance, it is a crucial step to take on your path to financial freedom.

Great budgeting tools: Tiller & YNAB

Don’t think of a budget as a chore you must do but rather a tool that is used to tell your money where to go. Think of yourself as the boss and the dollars you have/earn as your employees. Each dollar should have its own purpose or job, even if it is simply just to be spent on something fun like a vacation or new shoes. Not every dollar needs to go to savings, but it is important to make sure each dollar has a purpose and that those purposes are aligned with your goals.

You should automate as much of this as possible so that bills, debts, and your planned savings are automatically pulled from your checking or savings account each month without any work or thinking required on your end. It is much easier to reach your savings goals when the money is pulled from your account automatically versus having to actively move it each month. By automating, you will only be able to spend what is left each month after the money has already been put towards savings. If you wait to see how much you spend during the month and then save what is left at the end, you may find that you have very little left to save.

You can follow this guide to help automate your finances. Once you are in control of where your money is going and have your essential expenses and savings automated, this opens the door for guilt-free spending on the money that is left after you know your goals have been taken care of.

How Much Do I Need to Retire as a Physician?

This is where it gets fun! Let me flip the question to you:

You are now retired (or financially independent), and it’s your first month of spending. Your financial advisor calls you and says, “How much money do you need to hit your bank account this month?” What is your answer?

Is it $8,333 ($100,000/year)?

Is it $10,000 ($120,000/year)?

Is it $15,000 ($180,000/year)?

Is it $20,000 ($240,000/year)?

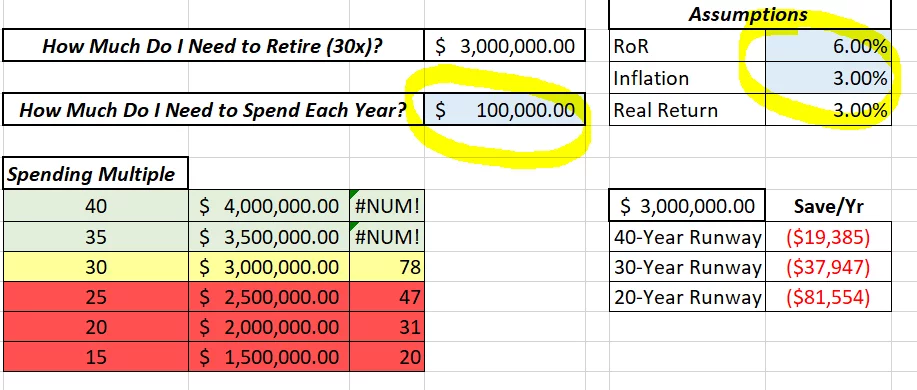

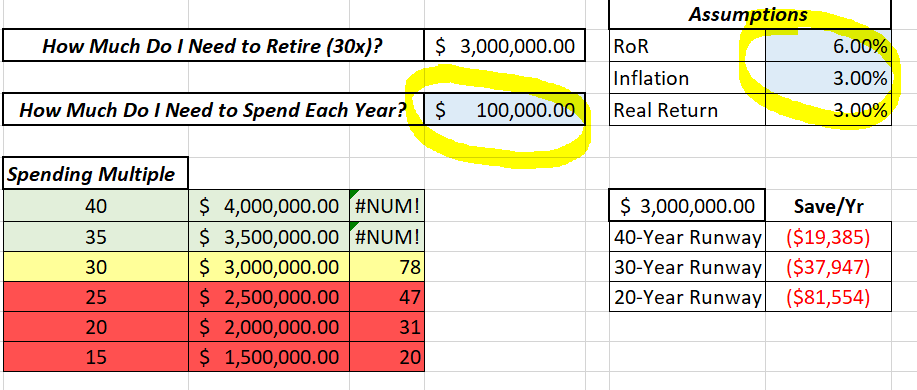

From here, I created an Excel spreadsheet (available below) to use a multiple of your expenses to estimate the needed nest egg to retire. The spreadsheet is straightforward, it doesn’t have any fancy bells & whistles, but it should provide a reasonable estimate of how much you should have saved by using a multiple of your expenses.

Back to you. Let’s assume you said “$100,000,” and I said a 30x multiple is a good number. You would then need $3,000,000 in your nest egg to retire. Now, we have to include some assumptions to get that number, so let’s look at the case study below to review those details (also in my slides).

Important assumptions: We are keeping this simple with the primary goal of giving you a target. For precision, you need a full plan. Full plans take my team 30+ hours to craft, and this is a blog post. I used a $3 million case study during my presentation (the slides from my presentation are available below). Here are the assumptions used:

- No other forms of income (no pensions and no social security); I assume you are only living off your portfolios. In reality, this should be your worst-case scenario.

- I assume a 6% growth rate and 3% inflation rate, which gives us a 3% real rate of return. In the Excel spreadsheet, you can adjust those assumptions.

- I include the annual savings amount to get you to your required nest egg, and I am using a 30x spending multiple for your baseline figure.

- I included a 40-year, 30-year, and 20-year timeframe for your required annual savings.

- We did not factor in taxes. Why? Well, it would really overcomplicate this post. Are you using pre-tax dollars, Roth dollars, or money from your taxable account? It is probably a combination of those buckets, which affects tax rates. Taxes are complicated and ever-changing. What I tell you today will probably be utterly inaccurate in a few years (or even by the end of the year!).

In the case study, if you needed $100,000 per year to live from in retirement, you will need to have a nest egg of $3,000,000. That is a 30x multiple of your desired spending (30 x $100,000), and based on the assumptions we used, that should last 78 years. The biggest issue here is that it doesn’t factor in the sequence of returns during the decumulation phase, but it should still be a fair estimate. If you were to retire at 60 years old, 78 years should provide plenty of buffer room. Unless you think you can live past age 138; if so, save more or spend less!

Where you see blue, you can update those boxes to customize it for goals (income) and assumptions (rate of return & inflation)! Once updated, the rest of the sheet will revise for you.

Excel Spreadsheet: Calculate Your Nest Egg

Best Accounts for Physicians To Use When Saving for Retirement

Now you know your nest egg number, but where the heck do you save all those funds each year? Fantastic question, let’s go there now. We broke it down into accumulate 1.0 and accumulate 2.0.

With accumulate 1.0, we want you to max out your employer plan (401k, 403b, etc) and also a Roth IRA each year. And as a physician, your income is more than likely too high to save right to the Roth IRA, so you need to add the extra step for the backdoor Roth IRA.

With accumulate 2.0, we advise that simply maxing out your employer plan and a backdoor Roth IRA each year are not going to do the trick. You have to save more than that each year. So we listed a few other options that should be researched.

- Do you have the option to utilize an after-tax 401k?

- If your plan has this option, it gives you the possibility to save up to $70,000 (2025) into your qualified plan. FYI, that $70,000 includes all your contributions and your employer contributions.

- The biggest benefit is tax-deferred growth!

- It may be possible for a large rollover to a Roth IRA at the separation of service. Here is the post we wrote for The White Coat Investor on this topic: The “Secret” Ultimate Roth Contribution.

- A recent development has been more hospitals and medical organizations are adding an auto-conversion feature that will automatically convert after-tax savings to your Roth. Awesome feature!

- Does your employer offer more than one retirement plan?

- For those of you in the non-profit and education systems of medicine, it is not uncommon to have a 403b and a 457b that you can utilize. In addition, you may also be making mandatory contributions to a 401a. Don’t assume one plan — ask HR!

- If you are at a for-profit hospital or medical organization, they may also offer a 457b, but that 457b does have some due diligence requirements, so read the details!

- Are you saving to a taxable account?

- If you are married, your taxable account should be a joint account. Joint accounts can be good for both asset protection and estate planning. If your state allows tenants by the entirety, that will give you good asset protection.

- Your goal is to build this as tax-efficient as possible.

- Are you using a Health Savings Account (HSA)? If so, have you heard of the “Stealth IRA?”

- After 65 Stealth IRA: You get penalty-free distributions after age 65 on anything! Now, you still have to pay income taxes, but that is the same for any assets you pull from your IRA. Qualified health care expenses still avoid taxation.

- Lastly, if you are age 50+, don’t forget to take advantage of your catch-up contributions!

- 401k, 403b, 457b plans: +$7,500/year (2025)

- IRA/ROTH IRA: +$1,000/year (2025)

- HSA: +$1,000/year (AGE 55!) (2025)

- Profit Sharing Plan: +$7,500/year (2025)

- Unique Rule for some 403bs: “15-year rule.” If you’ve been working for your current employer for 15 years or more and your average annual contribution was less than $5,000 per year, then you can contribute up to $3,000 extra per year, with a $15,000-lifetime maximum. You don’t need to be 50 years old to qualify for this type of catch-up contribution, but if you are 50 or older, you can make both types of catch-up contributions in the same year. This is not very common anymore, and I hope you were saving more than $5,000/year, but this is still good to know!

- Unique Rule for 457(b) plans: Certain state and local governments and other tax-exempt entities offer these retirement plans. 457(b) plans may have a special catch-up provision that allows participants within three years of the plan’s normal retirement age to contribute up to twice the annual limit, or $470,000 (2025).

For many physicians in the accumulation phase, they are fantastic savers, but they often sail without a map. My main goal is to give you at least a map today. Life will throw many course corrections your way; that is expected and part of this beautiful journey.

Free Resources:

Excel Spreadsheet: Calculate Your Nest Egg ⬆

Financial Planning Symposium Presentation (2018): The American Society of Colon and Rectal Surgeons

NerdWallet’s Retirement Calculator

SmartAsset’s Retirement Calculator

Looking for a more thorough, all-in-one spot for your financial life? Check out our free eBook: A Doctor’s Prescription to Comprehensive Financial Wellness [Yes, it will ask for your email 😉]