Understanding your cash flow and creating a budget is the first step in creating a successful financial plan. Every other aspect of your personal finances stems from how you balance your income and expenses. Unfortunately, not everyone has a clear handle on their own family’s cash flow.

Many people have an incorrect assumption that they are budgeting and tracking cash flow successfully. They think that because they outlined a budget last year (or last month, or last week), and because they loosely keep an eye on their spending, they’re knocking it out of the park. The truth is that budgets aren’t a set-it-and-forget-it thing. You need to constantly track and evaluate your income and expenses to ensure that you’re on track.

Prefer video over the blog? We’ve got you covered! Watch our YouTube video as we dissect this blog post for you:

Key Takeaways:

- How do I create a budget?

- What are some of the best ways to manage debt?

- What is “good” debt, and what is “bad” debt?

- Tips for building your savings and achieving financial wellness.

Creating a Budget

Budgets may not be easy to put together, but they are well worth it in the long run. Keep in mind that, as you build your budget, you may take 3-4 months to successfully adjust your spending. Then, you’ll need to continuously revisit your budget annually to ensure it’s meeting your needs.

When you start to build your budget, it can be easier to start with the type of spending you’re currently doing. As Jerry Maguire says: Show me the money!

If you see how you’re currently spending your income, you can evaluate what’s working, what’s not, and what you want to adjust in a future budget. Here’s how to get started:

- Track all of your spending for a few months. Yes – I mean all of it! You can do this in a few different ways. You can use a traditional pen-and-paper method to track each expense. However, this can be tedious and difficult to maintain. I recommend using either an Excel spreadsheet for a slightly elevated method or leverage a budgeting app like Tiller (Budget provider for the Chubb family) or YNAB to auto-track your spending by connecting the app to your bank account.

- Compare your spending to your take-home income. At a minimum, your monthly spending needs to be lower than your monthly take-home income. Ideally, you’ll leave a margin for other financial goals like building up your savings and paying down your debt.

- Review and revise. Your budget is a living, breathing thing, and will need to be adjusted periodically. A budget isn’t meant to be a restriction. When you review and revise your budget, you’re able to build a spending plan that matches your values and helps you to achieve a fulfilling lifestyle. For example, if you’ve budgeted a certain percentage of your income to be spent on eating out, but are disappointed that you’re unable to travel as much as you’d like to, you may want to revisit your budget. Eating out less and putting those funds toward an account earmarked for travel can help you achieve a lifestyle goal.

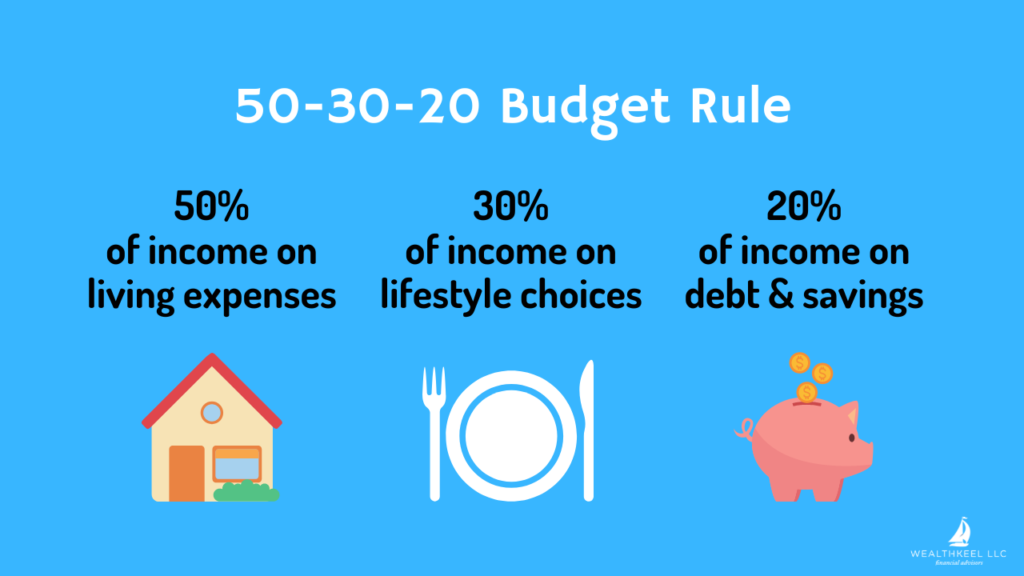

If you’re worried about budgeting, keeping it simple may be key. For example, the 50/30/20 budget works well for many families and individuals who want to do a better job of tracking their spending. The budget would look like this:

- 50% – total living expenses (mortgage or rent, utilities, groceries, eating out, etc.)

- 30% – non-essential living expenses (travel, subscription services, etc.)

- 20% – savings and/or debt repayment

Of course, use this as a starting point. If you’re focusing more on debt repayment in this season of your life, feel free to allocate more toward knocking out your debt. If you have no debt and your emergency savings is topped off, think about saving a bigger portion of your take-home income toward short-term goals like a house down payment.

Managing Your Debt

If you want to pay down your debt quickly, you need to track your cash flow and prioritize repayment as part of your lifestyle. In fact, debt repayment should always be on your financial “to do” list until you’re debt free.

With the exception of your mortgage and student loans, your goal should be to have no additional credit or personal debts. Of course, nobody is perfect, and when you start your budgeting journey you may have some personal debt to pay off.

In general, there are two types of debt: good and bad. “Good” debt consists of debt that has a return on your investment – like a student loan, or a mortgage. “Bad” debt is debt that will only end up costing you more in the future because of interest and doesn’t appreciate in value. This could be a credit card, personal loan, or auto loan.

Paying Off “Bad” Debt

Auto Loans

Many people mistakenly think that an auto loan is “good” debt because buying a car feels like a big investment. In a perfect world, you’d be able to purchase your car outright with cash and not take on an auto loan at all. Unfortunately, we don’t live in a perfect world, and depending on where you live a car may be non-negotiable.

When you purchase a car, your goal should be to pay it off in three years or less. If paying off your car will take longer than three years, you’re likely shopping outside of your price range. This is an excellent rule of thumb to keep in mind when you start your car search. The vast majority of car loans end up being paid off in 68 months or more.

Remember – your car is a depreciating asset. In other words, it loses value as the years go on. You don’t want to still owe money on a car, and only be able to sell it for less than the total cost to pay off your auto loan.

Credit Cards

Credit cards are a form of revolving debt, which makes them dangerous. You can always continue to ring up more debt on your card, even while you’re paying it off. It’s incredibly important to focus on using your credit card only for expenses within your budget and to pay it off monthly.

Using the Debt Snowball Method (Psychological Snowball)

The debt “snowball” was a term first coined by Dave Ramsey. Using this strategy as part of your budget can help you to knock out debt more efficiently than just throwing extra money at different debt obligations without a strategy. Here’s how it works step-by-step:

- You evaluate your current debt obligations and put them in order from smallest total amount to largest.

- Set all of your debt payments to the minimum monthly payment amount except for your smallest obligation.

- Take any extra money you’re using for debt repayment and put it all towards your smallest debt.

- Once that debt is paid off, you “snowball” the total amount you were paying towards it into knocking out the next-biggest debt.

If you haven’t heard of this concept before, it may sound counterintuitive – why pay the smallest debt off first? Wouldn’t it make more sense to knock back the larger debt amount?

When you’re able to focus on knocking out one small debt – like a credit card, or a small personal loan – you’re able to see your progress more quickly. Then, knocking out the next debt on the list won’t feel as daunting. Your smaller bills are paid off quickly, and it feels like you’re “winning the game.” The more you can “gamify” your debt repayment, the more likely you are to stick with it in the long run.

Using the Debt Avalanche Method (APR Snowball)

Not sure if you love the debt snowball method? There’s another repayment strategy, called the Debt Avalanche, that may better fit your needs. Here’s how it works:

- You evaluate your current debt obligations and put them in order from smallest interest rate to largest.

- Set all of your debt payments to the minimum monthly payment amount except for your obligation with the highest interest rate.

- Take any extra money you’re using for debt repayment and put it all towards your highest interest rate debt.

- Once that debt is paid off, you “avalanche” the total amount you were paying towards it into knocking out the next-biggest interest rate loan you have.

The benefit of the debt avalanche is that it knocks out high-interest rate debts first, saving you more money in the long run. Unfortunately, it may take you longer to pay off the first few loans or credit cards with a high-interest rate if the balance is also high. This means you’ll have to stay focused and dedicated since there won’t be the same “win” as you’d feel with the debt snowball strategy.

Paying Off “Good” Debt

Your #1 priority should be to knock out your “bad” debt, but once that’s complete, the ultimate goal should be to live debt-free. Paying off your “good” debt, like student loans or a mortgage, may take longer. However, it should still be a priority, especially as you continue to look toward other financial goals like retirement or education savings for your kids.

Once your bad debt has been paid in full, you can focus extra cash flow toward knocking out your student loans or mortgage early. Keep in mind that if you’re a physician, depending on the type of student loans you have, loan forgiveness may be an option.

Building Your Savings

Studies have shown that 70% of Americans live paycheck to paycheck – yikes!

Your goal should be to have enough savings to fall back on in the event of an emergency at the very least. Most advisors and financial experts recommend keeping between 3-6 months of emergency savings in an accessible, cash-based savings account. If you’re in a high-risk job, you might consider increasing that to 12 months.

Beyond that, your goals may include:

- Retirement savings

- Education savings

- House down payments

- Lifestyle purchases (new cars, boats, travel with the family)

- Legacy building

Your savings goals are completely unique to you, and beyond initial emergency savings, you can set whichever goals make sense for your financial future. If you’re uncertain what you should save for next, consider reverse engineering your goals.

For example, if you want to retire at 55, your retirement savings needs may be bigger than someone who wants to retire at 70. Think about what short and long term lifestyle goals you have, and reverse engineer them to determine how much you’ll need to save both now and in the future.

Achieving Financial Wellness

We use the term “Financial Wellness” to encompass your comprehensive financial health. This includes your cash flow, net worth, emergency funds, debt management, and future life planning. In order to live a fulfilling life, it’s critical to make sure that every aspect of your finances is healthy – or on track to shape up. A few of the first and most important steps you can take toward financial wellness are:

- Organizing a budget to get a handle on your cash flow.

- Growing your savings so that you’re no longer living paycheck to paycheck.

- Setting future savings goals to avoid debt.

- Putting together a debt payoff plan (and sticking with it!).

Working toward financial wellness can be overwhelming when you first start, but it pays off! If you stick with it, you’ll soon be able to live a life that’s largely free of financial worry.

Looking for a more thorough, all-in-one spot for your financial life? Check out our free eBook: A Doctor’s Prescription to Comprehensive Financial Wellness [Yes, it will ask for your email 😉]