Physician Mortgage Loans 2026: Guide for Doctors

Last updated:

The physician mortgage loan (sometimes called the doctor mortgage loan) exists because medical professionals face unique challenges. For example, high student loan debt and lower income during residency or fellowship often limit savings. As a result, these factors push your debt-to-income (DTI) ratio higher. Moreover, strained credit can make conventional mortgages harder or more expensive.

However, there is an alternative. A physician mortgage offers flexible underwriting for doctors, dentists, veterinarians, and other qualifying professionals. For instance, many allow down payments as low as 0%. In addition, they treat Income-Driven Repayment (IDR) student loan payments more favorably in DTI calculations. Furthermore, they permit higher loan amounts than conforming limits. Take this example: A resident earns $65,000, has $250,000 in debt, and pays $300/month on IDR. Consequently, they may qualify based on projected attending income. Thus, many physicians buy sooner rather than wait to save a large down payment.

In this 2026 guide, you’ll learn how physician mortgage loans work. Additionally, you’ll see key benefits and drawbacks. Moreover, you’ll get practical financing options. Ultimately, you can decide if a doctor mortgage fits your long-term plan. Ready to compare scenarios?

Key Takeaways

- A physician mortgage allows eligible doctors to buy a home with little to no down payment.

- Student loans are often excluded or more flexibly treated in debt calculations.

- These loans typically avoid private mortgage insurance (PMI), even with low down payments.

- They’re best suited for high-income professionals early in their careers who value cash flow flexibility.

🧭 Free Home-Buying Flowchart for Physicians

Not sure whether buying makes sense right now? Use our step-by-step decision flowchart to evaluate timing, affordability, and tradeoffs.

👉 What Issues Should I Consider When Buying a Home

Prefer video over the blog? We’ve got you covered

Watch our YouTube video as we break down this guide step by step.

Jump To:

- What Is a Physician Mortgage Loan?

- Benefits of a Physician Mortgage

- Drawbacks of a Physician Mortgage

- Who Qualifies?

- Monthly Costs

- Is It Right For You?

- Frequently Asked Questions

What Is a Physician Mortgage Loan?

A physician mortgage loan is a home financing option built specifically for medical professionals, including physicians, dentists, and veterinarians.

Residents and fellows earn far less during training. However, they earn much more as attendings. Therefore, many lenders accept offer letters or contracts as future income proof. Moreover, they use projected earnings for repayment ability. Consequently, this lowers DTI compared to counting the full student loan balance.

Here’s how it typically works: Lenders request degree proof. In addition, they need an employment offer or contract. Furthermore, recent pay stubs (if available) and student loan docs (like IDR statements) are common. For example, consider a resident with a $65,000 stipend, $250,000 debt, and $300/month IDR payment. Thus, they qualify on expected attending pay. For a detailed docs/IDR checklist, see our underwriting guide and lender comparisons.

Benefits of a Physician Mortgage

Doctor mortgages provide targeted advantages. In particular, they help medical professionals buy earlier. Below are the main benefits with practical context.

Down Payment

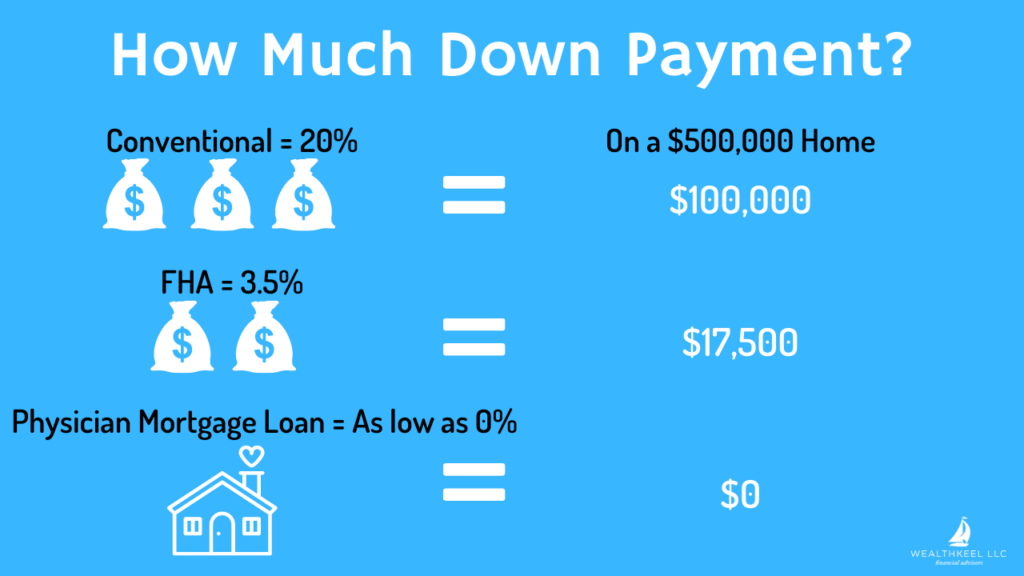

Many programs reduce or eliminate down payments. For instance, specialty lenders often waive PMI. PMI is an extra monthly cost on conventional loans under 20% down.

Why it helps: $0–5% down cuts upfront cash needs. This is especially useful for docs with student debt. Additionally, a larger down payment lowers monthly payments and builds equity faster.

Example: Skip PMI on a $500,000 loan. As a result, save hundreds monthly vs. conventional with PMI. Moreover, compare FHA (3.5% down but insurance required).

Debt-to-Income (DTI) Ratio

Conventional loans count full student debt as a fixed obligation. In contrast, physician loans use your actual IDR payment (or training pay) for DTI.

Why it helps: Low IDR payments drop DTI. Therefore, you qualify for more. This is ideal for residents/fellows becoming attendings.

Example: $250,000 loans with $300 IDR payment. Consequently, use $300 in DTI (not assumed $2,000). Thus, free up capacity for a larger mortgage.

Loan Limits

Conforming limits change annually (FHFA). In many markets, physician loans can stretch beyond conforming limits and into jumbo territory.

Why it helps: More flexibility in expensive markets. Moreover, no big down forced. However, larger loans raise payments and interest. Ultimately, borrow within budget.

| Feature | Conventional | Physician Mortgage (2026) |

|---|---|---|

| Down Payment | 3–20% (PMI <20%) | 0–10%, often no PMI |

| DTI Calc | Full student balance | IDR payment only |

| Max Loan | $832K–$1.25M | $1M–$2M+ common |

| Rates | Standard | 0.25–0.75% higher, mostly ARMs |

Here’s the catch: Benefits are strong. However, rates may rise. Therefore, shop carefully. In addition, avoid common errors—see our Top 6 Money Errors Doctors Make.

🚀 Grab Your Free Physician Financial Playbook🩺

Everything you need to master debt, taxes, investing, and retirement—tailored for doctors.

📥 Download “A Doctor’s Prescription to Comprehensive Financial Wellness”

[Yes, it will ask for your email 😉]

Drawbacks of a Physician Mortgage

Physician loans open doors for early-career doctors. However, tradeoffs exist. Therefore, understand them before committing. They affect cost, stability, and property options.

Interest Rates

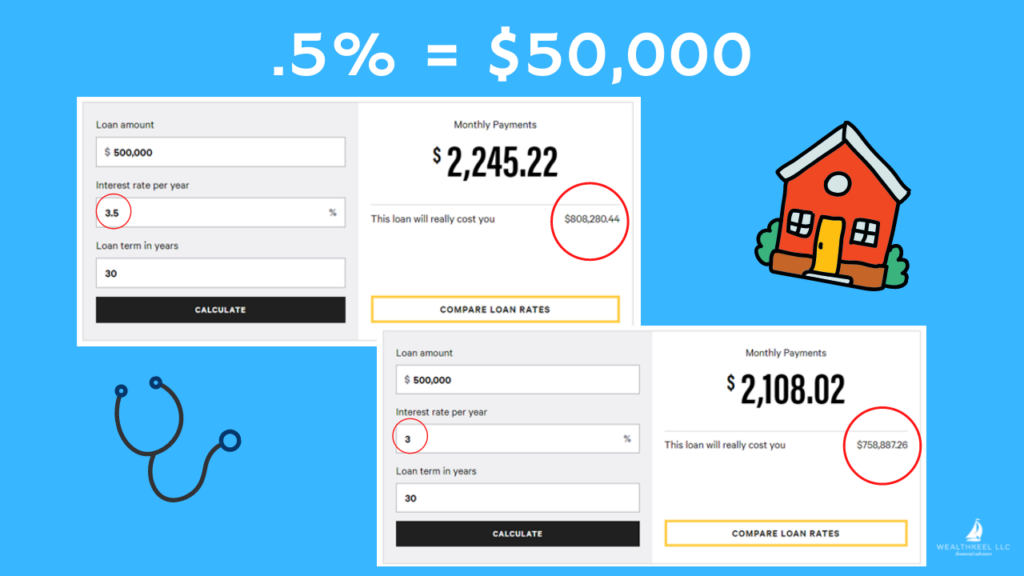

Variable rates: Some start low. But they can rise over time. As a result, payments increase. Moreover, total interest grows. This is easy to overlook until refinance.

Higher rates: Often 0.25–0.75% above conventional/jumbo in 2026. Even small gaps matter. For example, 0.50% difference on $500K 30-year adds tens of thousands extra. Therefore, use a calculator and compare APR.

Limits on Property Types

Some lenders restrict types. For instance, common limits include condos. In addition, investment properties and rentals are often excluded. Vacation homes typically don’t qualify.

Why? Lender risk policies. These properties can be harder to sell. Therefore, always confirm eligibility before offers.

How to Mitigate Risks

- Ask for fixed rates or caps. Prioritize if you plan long-term stay.

- Plan refinance. For example, 12–24 months when income/equity is stronger.

- Shop lenders. Compare pricing, PMI waiver, and property rules. Use comparison page.

- Run numbers. Use calculator for payments/interest. Include taxes, insurance, HOA.

Bottom line: Upfront barriers drop. However, rate risk and constraints remain. Ultimately, if stability matters, consider fixed conventional or clear refinance path. In particular, ask pros for modeling.

Who Qualifies for a Physician Mortgage Loan?

Programs target medical pros. However, rules vary by lender. Typical roles include:

- Medical resident: Offer or appointment letter often works. Thus, qualify pre-attending pay.

- Fellow/attending: Current income docs. Moreover, some tiers note 7–10 years post-training for pricing.

- Dentist/veterinarian: Many extend to these.

Additionally, you need:

- Education proof (degree/diploma).

- Contract/offer letter (start date/salary).

- Strong credit (700+ preferred; lower possible with factors).

- Student loan docs (IDR statements).

- DTI ~45% or less post-IDR.

Checklist: Degree/license, contract, pay stubs, bank statements, loan statements, ID. If short, pay debt, fix credit, save down, or use broker.

What are the Monthly Costs of a Physician Mortgage?

Total payment includes several parts. Understanding them helps compare and budget.

- Principal

- Interest

- Escrow (Taxes & Insurance)

- HOA (Maybe)

Principal: Reduces balance. Early payments mostly interest. Therefore, extra principal cuts lifetime interest.

Interest: Percentage of balance. Depends on rate/product. Small changes = big impact. Thus, use a calculator for scenarios.

Taxes/insurance: Escrowed. Vary by location. Moreover, can rise. Budget for growth.

HOA: Adds expense in condos/communities. Separate from mortgage. In addition, include utilities/maintenance/assessments.

Sample: $700K 30-year fixed shows splits. Use a calculator for current rates. Include escrow/HOA.

Is a Physician Mortgage Loan Right For You?

These loans ease barriers. However, buying isn’t always best. Therefore, compare tradeoffs, timeline, and alternatives. Sometimes renting wins.

When Buying Makes Sense

- Stay 3+ years: Recover buying costs vs. rent.

- Stable offer/contract: Improves underwriting. Thus, lowers refinance risk.

- Lock housing now: Tight markets or family needs.

- Low IDR keeps DTI ok: Higher loan without big down.

When Renting Wins

- Short timeline: Relocate soon. Therefore, keep flexibility.

- Cash focus: Debt payoff, emergency fund, retirement.

- Rate risk aversion: Prefer predictable. In addition, improve credit/savings first.

Quick checklist:

- Stay 3+ years + stable offer → consider buying.

- Relocate soon or unstable cash → rent. Build credit/savings.

Common Questions About Physician Mortgages

A physician mortgage loan is a home loan designed for medical professionals that often allows low or no down payment, does not require private mortgage insurance, and uses flexible underwriting for student loan debt. These loans are commonly offered to physicians, dentists, residents, and fellows.

Eligibility typically includes physicians (MD or DO), dentists, and sometimes other high-income medical professionals. Many lenders also allow residents and fellows to qualify, even with limited employment history, though requirements vary by lender.

Most physician mortgage loans do not require private mortgage insurance, even with little or no down payment. This can reduce monthly payments compared to conventional loans, though interest rates may be slightly higher.

Many lenders use flexible approaches when evaluating student loan debt, such as considering income-based repayment amounts instead of full loan balances. This can make it easier for physicians with high student loan balances to qualify.

Physician mortgage loans can be helpful for buyers who want to purchase a home earlier in their careers, but they are not always the best choice. Factors like interest rates, long-term plans, and overall financial goals should be considered before choosing this type of loan.

📞 Schedule Your Free Icebreaker Call🩺

Ready for a financial plan as straightforward as the care you give your patients? Let’s talk.