Are you a physician struggling with your finances? Yes, we see a lot of money errors from doctors (It happens! It can be fixed. I promise.). In this post, we will cover the top 6 money errors that doctors make (We have 100s of case studies to prove it 😉). Although physicians often make a higher-than-average income (sometimes much higher!), they can still fall into bad financial habits that hurt them in the long run. Let’s review the top six money errors that (can) physicians make – and how you can avoid these pitfalls!

KEY TAKEAWAYS:

- Get in control of your money by managing your debt, saying no to loaning money, and setting (and sticking to!) a budget so you’re not overspending. I know, I know — budgeting is boring, but it’s essential to your financial well-being!

- Since you have a higher income, it’s time to start ramping up your savings! Aim to contribute 15%+ of your salary to a retirement account each year. Bonus: set them up so they lower your taxable income.

- Divorce — whether from your spouse or your business partner, or your current practice — is expensive! Invest in your personal and professional relationships.

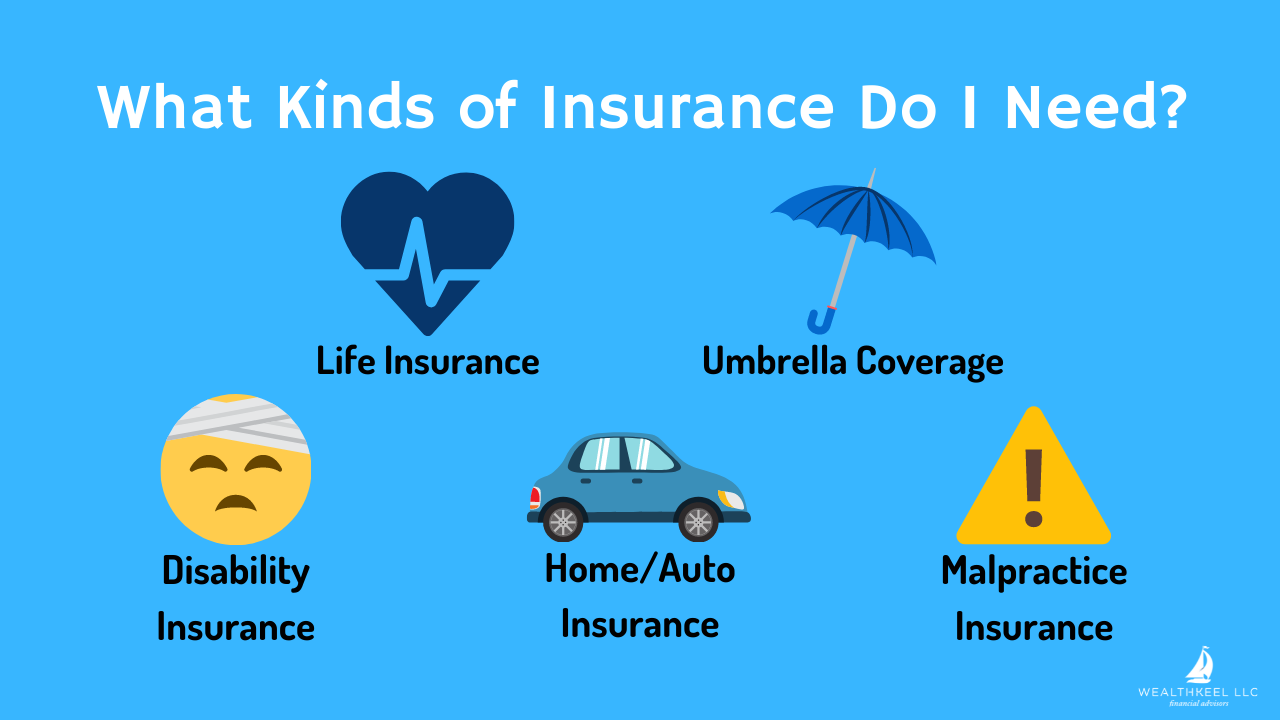

- Get insurance to protect your wealth and your loved ones, likely including life insurance, disability insurance, home, and auto insurance, umbrella coverage, and malpractice insurance. You can’t afford not to have it!

Mismanaging Money

The #1 reason physicians struggle to meet their financial goals is because of poor money management. This happens in a number of different ways, including:

Failing to pay down debt. Most medical professionals are saddled with a hefty amount of school debt. Sometimes, physicians even have consumer debt (like auto loans or credit card debt) from their time as a resident. Having debt isn’t the end of the world, especially if your salary is high enough to knock it out quickly. Unfortunately, many physicians bury their heads in the sand when it comes to their debt.

The biggest mistake you can make is to remain blind to your debt. Your best bet is to put together a debt repayment strategy that pays back your balance quickly and to have a cash flow plan that keeps you out of debt.

Loaning money. Taking care of your family and friends financially may be a priority for you, especially if you’re the only family member who makes an above-average salary. Unfortunately, loaning money to loved ones is often a recipe for disaster.

This is especially true if you’re still early in your career and trying to get your financial house in order. If you feel the need to give money to family, set a predetermined budget for family giving each year – and don’t exceed it. Give the money without the expectation of getting it back to preserve your relationship.

Overspending. When you get your first job as a medical professional, you might feel completely free when it comes to your finances. You’re making more money than you ever have, and you may find yourself spending like you have a neverending pool of income rolling in. Unfortunately, that’s not a sustainable financial strategy. It’s important to set (and stick to) a budget!

Skipping Saving

This mistake is often coupled with poor money management and overspending. When you don’t have a clear handle on your budget, you don’t prioritize saving. This can pose a huge risk to your short- and long-term financial goals.

You should be ramping up several aspects of your saving over the course of your career as a physician:

- Emergency savings

- Retirement savings

- Long-term savings goals (like buying a vacation home, or funding your child’s education)

- Short-term savings goals (like an international vacation, or a home renovation)

It’s usually recommended that families have 3-6 months of expenses in emergency savings that’s all cash and highly accessible.

It’s also recommended that professionals start contributing 10%+ of their paycheck toward retirement. However, physicians are in a unique position.

As a physician, you’re starting your career after extended schooling. This means you have less time to boost your retirement savings. Additionally, your high income and potentially high-risk career path (think malpractice lawsuits, etc.) mean you may need a heftier emergency savings to fall back on.

Aim to contribute 15%+ or more to your retirement savings each year. If you can, max out contributions to your retirement account to set yourself up for long-term success. It’s also wise to work toward 6-12 months of your current living expenses and to have a small “slush fund” on hand for short-term savings goals so that you aren’t tempted to turn toward your credit card the next time you have a big expense.

Failing to Plan for Taxes

Are you maximizing your retirement savings to lower your taxable income now and/or save more money on taxes in retirement? Start by working to max out your workplace 401(k)/403(b)/457(b) you may have. Beyond that, explore a Backdoor Roth IRA. Setting up a Backdoor Roth IRA is relatively simple.

It’s also wise to speak with a tax professional about your annual tax filings and to ensure that you’re withholding enough of your paycheck to cover what you owe each year. This is especially important if you’ve moved for a new job, if your family situation has changed due to marriage or having kids, or if your salary has fluctuated.

Divorce

Divorce – both personal and professional – can get expensive. Personal divorces can cost up to $15,000 per person, and that’s only the actual legal event. You may still owe alimony or expenses associated with moving out, finding a new place, and starting over. Oh yeah, and possibly losing half your assets! Couples where one spouse is a physician, have approximately a 24% divorce rate. To protect yourself against the negative side effects of divorce, you can:

- Put a pre-nup in place before you get married.

- Focus on improving your marriage. Dedicate time to your spouse, discuss shared goals, and get counseling if necessary.

Unfortunately, physicians aren’t only vulnerable to personal divorce. Too often, physicians “break up” with a business partner or their current practice. This kind of “professional divorce” can be equally pricey! The costs of closing a practice, legal fees, moving expenses, and the cost of starting up a new business adds up. To avoid potential future expenses of a “professional break up”, you can:

- Speak to an attorney when putting together contracts for a partnership

- Take your time before choosing a business partner, and have honest discussions about the direction of the business

- Think about what you want in the long term – will this partnership stand the test of time?

- Consider your location before jumping into business with someone – do you want to stay here for the long haul?

Investing in your personal and professional relationships can help you to save money both now and in the future.

Inadequate Insurance Coverage

Insurance is the #1 way you can protect your wealth and your loved ones. As a physician with a high income, your insurance needs are a little bit different. You’ll need:

Life insurance. Your goal with life insurance is to find coverage that will effectively replace your income both now and in the future in the event that you pass away. The amount of life insurance you need will depend on your current income, expenses, and long-term family goals. For example, you may want your life insurance to cover:

- Both your income and your spouse’s income through the time your kids graduate high school so they don’t have to work, or can hire child care assistance

- Future education or wedding expenses for your kids

- K-12 Tuition costs (if applicable)

- Paying off the balance of your mortgage and any other debt you may have

It’s recommended that most physicians start anywhere between $1-3 million in term life insurance (this number can vary widely based on your specific situation). Remember: you likely don’t need permanent life insurance (especially early on).

Disability insurance. Life insurance covers your income if you pass away – but what happens if you’re injured and can’t work? That’s where disability insurance comes in! You should carry up to $15,000-$20,000/month (sometimes more, and again, varies based on your specific situation) in disability insurance. Keep in mind that different types of disability insurance offer coverage based on different injuries or types of disabilities. Make sure you read the fine print before signing on the dotted line to ensure the coverage meets your needs. You are looking for true-own occ with specialty language.

Home/auto insurance. You’ll want enough coverage on your home and cars (or other vehicles) to cover the value of your assets.

Umbrella coverage. For individuals who make over several hundred thousand dollars a year and have a large amount of wealth accumulated, umbrella coverage is almost a necessity. It’s an ideal way to protect your assets and your net worth above and beyond what your other liability coverage offers.

Malpractice insurance. Unfortunately, physicians work in a high-risk field. You may, at one point in your career, face a malpractice lawsuit. Keeping between $1-3 million (varies with specialties) in malpractice insurance in effect can protect you, your career, and your assets.

Investing Without Research

Do you know what fees you’re paying on your investments? Many physicians are paying 1-3%+ in investment management charges and fees. These fees can come from working with advisors who charge high Assets Under Management (you can learn more about our flat fee model here) or from mutual fund management fees.

Regardless of how you’re invested, it’s critical to do your research! Find out what fees you’re paying and ask for clarity from your advisor so you can more deeply understand what you’re paying (and why).

It’s easy for physicians to fall into any of these financial traps. Luckily, with some forward-thinking, you’ll be able to sidestep these pitfalls and you’ll be on your way to comprehensive financial wellness.

Looking for a more thorough, all-in-one spot for your financial life? Check out our free eBook: A Doctor’s Prescription to Comprehensive Financial Wellness [Yes, it will ask for your email 😉]