While most people are familiar with retirement saving tools like a 401(k) or 403(b), fewer people are familiar with the 457(b) plan.

With several different choices available, each more confusing than the other, taking control of your retirement can seem like a near-impossible task. It can be an exhausting process — but we’re here to make that process easier for you to navigate.

Retirement savings are primarily made up of individual contributions, making it extremely important that you know all of the savings options available to you.

While you may be familiar with other classic retirement saving tools like a 401(k), Roth IRA, or 403(b) plan, many doctors have access to another vehicle that, when used wisely, can really boost retirement savings while also improving cash flow in retirement. This remarkable option is known as a 457(b) plan.

Now, what exactly is a 457(b) plan, how does it work, and when does it make sense for you?

Let’s find out.

KEY TAKEAWAYS:

- 457(b) plans are similar to 401(k)/403(b) retirement plans; they’re offered by your employer and allow pre-tax contributions.

- There are governmental and non-governmental 457(b) plans. The former is held in a trust and can be rolled over, the latter is owned by your employer and cannot be rolled over (some employers will allow them to roll into another non-government 457(b) plan).

- 457(b) plans have great tax benefits and are another retirement saving tool to help you reach your financial goals.

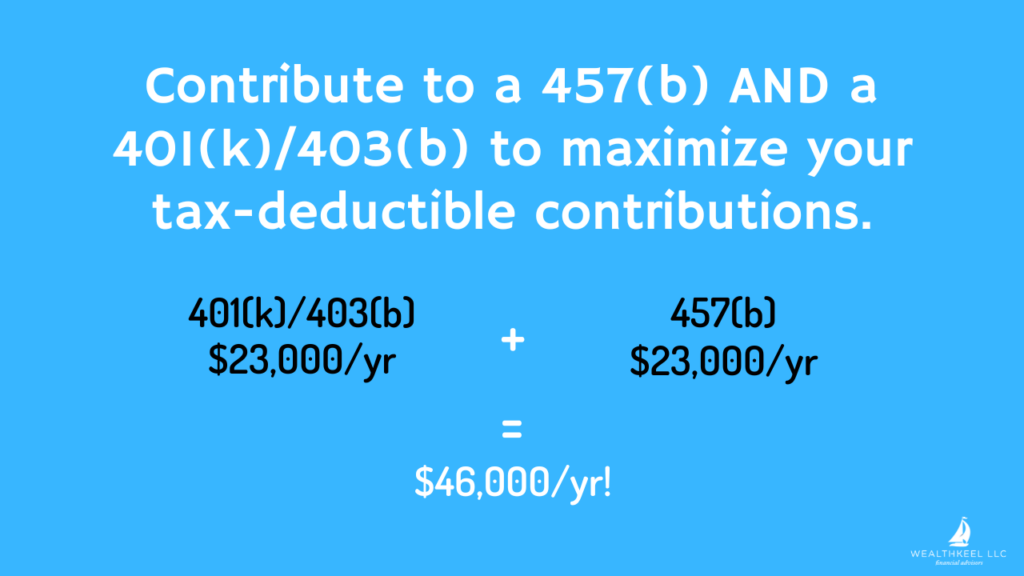

- You can max out a 401(k)/403(b) AND a 457(b) simultaneously.

Prefer video over the blog? We got you covered! Watch our YouTube video as we dissect this blog post for you:

*The videos have some overlap, but the top one is our newest video*

WHAT IS A 457B?

A 457(b) plan is an employer-sponsored, IRS-sanctioned, tax-deferred savings account that allows you to make pre-tax contributions towards your retirement. You may have also heard of a 457(b) plan referred to as a deferred compensation plan.

A 457(b) retirement plan is similar to a 401(k) or 403(b) plan, in that a 457(b) plan is offered through your employer, and your contributions are taken from your paycheck on a pre-tax basis, which ultimately lowers your taxable income.

How do 457b plans work?

457(b) plans are generally available for state and local government employees, as well as certain tax-exempt nonprofits. These plans are very similar to other types of employer-offered retirement accounts. Employees can make contributions up to the annual limit, invest these funds, and grow their retirement nest egg.

Like many other retirement savings accounts, contributions to a 457(b) account are made pre-tax, which can lower your overall taxable income for the year. However, this does mean that you’ll need to pay tax on distributions you receive in retirement.

One great feature of 457(b) plans is that you don’t have to wait until you are 59 ½ to start withdrawing contributions. Instead, you can begin withdrawing funds whenever you stop working at your employer. This unique element makes it a great account for retirees to draw from at the very start of their golden years (or even earlier).

Pro-Tip: The “flexibility” can also lead to a potentially major tax issue with non-governmental 457bs. Make sure you read the fine print and understand the withdrawal rules after separation from employment. Some plans may force you to withdraw the entire amount in a very, very short window, leading to a difficult tax situation.

For other accounts like a 401(k), you can’t withdraw any funds before 59 ½ without incurring 10% early withdrawal fees, as well as income tax on the distributions.

457(b) contribution limits

For both 401(k)/403(b) and 457(b) plans, you can only contribute up to $23,000 per year in 2024. However, you can max out a 401(k)/403(b) AND your 457(b) in a given year. With a governmental 457(b), you essentially have an additional “403(b)” now.

However, a 457(b) plan has some wiggle room in regards to the contribution limit. Within a 457(b) plan, there are special catch-up contributions (if permitted by the specific plan) designed to help you save more if you’re nearing retirement. They allow you to save enough for your golden years, even if you may have started saving a little later than optimal.

Catch-up contributions have the ability to allow a participant to contribute to the lesser one of the following:

- $46,000 (twice the annual limit of $23,000)

- The basic annual limit plus the amount of the basic limit not used in prior years (age restrictions apply)

TYPES OF 457(B) PLANS

Pro-Tip: This is probably the most important thing to understand when investing in a 457b plan.

There are two types of 457(b) plans to be aware of:

- Governmental 457(b) plans

- Non-governmental 457(b) plans

Governmental and non-governmental plans are both deferred contribution plans, but they have many different rules, regulations, and responsibilities that come along with them. Let’s take a better look at the differences between these two types of 457(b) plans.

Governmental 457(b) plans

There are a few key differences you need to be aware of when it comes to governmental and non-governmental 457(b) plans. Simply put, governmental plans are backed by the government, and non-governmental plans are backed by your employer. Governmental 457(b) plans are generally viewed as less risky since they don’t rely on an individual business or company.

In a governmental 457(b) plan:

- Funds can be rolled over into other accounts such as an IRA or 401(k) which can allow you more investment opportunities.

- The money is held in a trust.

- This account is generally viewed as less risky since it’s not subject to the success or failure of an individual company.

- We often call it a “bonus 403b.”

Non-governmental 457(b) plans

Non-governmental plans tend to carry more risk in general as the plan’s solvency hinges on the employer. For non-governmental 457(b) plans, the money contributed doesn’t come directly out of your paycheck. Instead, it’s technically money that you haven’t yet received. Your employer owns the account and takes a percentage (that you indicate) that you would have received in a regular paycheck and instead contributes it to this fund.

This technically means that 457(b) plans belong to your employer and not to you, which saves you in the event of creditors or bankruptcy (aka good for your asset protection). However, this protection is a double-edged sword. Unlike a 401(k), which has stricter protections, 457(b) plans are subject to your employer’s creditors, which could leave your plan in jeopardy should the company go under. While this is not a likely situation if you are with an established company/hospital, it’s still something to consider before you open up this type of retirement account.

In a non-governmental 457(b) plan:

- Funds can only be transferred to or withdrawn from other non-governmental plans (i.e. if you leave your job, you could have to take a lump sum which could turn into a major tax headache).

- Funds cannot be rolled over into other retirement savings accounts such as an IRA or 401(k).

- Money is subject to your employer’s creditors; it is not held in a trust.

HOW TO COORDINATE YOUR 457(B) WITH OTHER SAVINGS VEHICLES

When you have other savings accounts, it can be difficult to make them work together and not against each other. The first step to coordinating your savings accounts is to understand which type of 457(b) plan you have, governmental or non-governmental, and weigh the pros and cons of each savings account.

These types of other accounts include, but are not limited to:

- Traditional IRA/Roth IRA

- 401(k)/403b

- Health Savings Account (HSA)

Pro-Tip: You can max out a 401(k)/403(b) AND your 457(b) in a given year. This is an amazing feature to take advantage of if you have the opportunity. With a governmental 403(b), you essentially have an additional “403(b)” now.

It’s important to keep in mind that non-governmental plans cannot be rolled over into other savings accounts such as an IRA or 401(k), unlike governmental plans. This will affect how your other savings vehicles will be able to work with each other.

Is a 457b better than a 401k?

The short answer is that 457(b) and 401(k) plans are very similar: both are offered by your employer, both are funded by pre-tax contributions, and both have the same annual contribution limit. That said, there are a few important differences that you should be aware of.

Most importantly, 457(b) plans aren’t available to everyone. Instead, they’re generally only available to state and local government employees, as well as the employees of certain nonprofit organizations. Sometimes (not all the time), 457(b) have fewer investment options than 401(k) plans, making them potentially less appealing depending on the options offered. They also tend not to come with matching employer contributions (Hopefully, it is because the match is already going into your 401(k)).

The main benefit is that the 457b sits on its own island, which allows you to max out your 401(k) and still max out your 457(b).

There are also a few other unique benefits that come with a 457(b) plan. One great feature of this type of retirement account is that the annual contribution limit is doubled for 3 years prior to the plan-specified retirement age. This means that you can contribute $46,000 per year instead of the typical $23,000 in the three years before you retire.

Another benefit of a 457(b) plan is that you don’t necessarily have to wait until retirement in order to begin withdrawing funds. Instead, you can begin withdrawing funds whenever you stop working at your employer. This makes it a great choice if you’re looking to retire early or just want more flexible access to your retirement savings.

What is the difference between a 403b and a 457b?

457(b) accounts and 403(b) accounts are also very similar. While 457(b) plans are typically offered to local and state government employees, as well as some nonprofit employees, 403(b) plans are usually offered to employees of private nonprofits and some government employees, including most academic hospitals.

Another key difference between these two plans is the number of employer contributions allowed. 457(b) plans only allow a maximum of $23,000 in contributions per year, from both the employer and the employee. On the other hand, 403(b) plans allow up to $69,000 in total contributions, including up to $23,000 from the employee and up to $46,000 from the employer.

The plans also differ when it comes to catch-up contributions. For 457(b) plans, the annual contribution limit is doubled in the three years leading up to retirement, allowing older investors to save more in order to pad out their nest egg. For 403(b) plans, you can make extra contributions of up to $3,000 per year, not to exceed a total of $15,000, if you’ve worked for your employer for more than 15 years.

Many employers offer either a 457(b) or a 403(b) plan to their employees. However, some employers offer both retirement account options. If you have to decide between the two, consider how the differences in contribution limits and withdrawal rules might affect you. If you’re able to contribute to both types, it’s a good idea to take advantage of both 457(b) and 403(b) accounts.

SHOULD I INVEST IN A 457(B) PLAN?

The real question is, why wouldn’t you? If your employer offers a 457(b) plan, they’re a great option for saving for retirement. While they might not have quite as many options as a standard 401(k), they still offer tax benefits and encourage employees to grow their nest egg.

Pros of 457(b) plans

Some of the benefits of 457(b) plans include:

- A reduction of your adjusted gross income, which can help in lowering your tax bill and your student loan payments, if you are on an Income Driven Repayment Plan

- The ability to grow your investments tax-free

- Funds are only taxed at the point of distribution or withdrawal of funds in retirement

- Investors can withdraw funds before retirement when they stop working for their employer

Cons of 457(b) plans:

- Fewer investing options than 401(k)s (Not as common today)

- Only available to certain employees employed by state or local governments or qualifying nonprofits

- Employer contributions count toward the annual limit

- Non-governmental 457(b) plans are riskier

Are 457b plans worth it?

It’s generally a good idea to invest in a governmental 457(b) plan, because there they have less risk than a non-governmental plan. If you have a non-governmental plan, you should take a look at your investment options, distribution requirements, and the financial stability of your employer when making your decision whether to invest or not. Evaluate your other accounts and ensure you and your financial advisor have a plan for how those work together.

A 457(b) plan also offers you another retirement savings tool, and prioritizing saving is vital to help you reach your other financial goals. A 457(b) plan is an excellent option to better prepare yourself for retirement, especially if you have access to a governmental plan.

That said, choosing a retirement account isn’t a zero-sum game. In many cases, you may also be able to invest in additional retirement accounts, including 401(k)s, 403(b)s, and Roth and Traditional IRAs. 457(b) plans can complement other areas of retirement savings by offering more flexibility and more immediate access to funds.

Pro Tip: You should always be aware of the two major drawbacks for Non-Governmental 457(b) plans. You could lose ALL your funds if your employer goes bankrupt. Understand their withdrawal rules at a separation of service; some will allow great flexibility on those withdrawals (remember, fully taxable!), while others can force you to pull everything out in a short window.

PRIORITIZING SAVING FOR RETIREMENT

401(k), IRA, 403(b), or 457(b)— no matter which you choose, saving for retirement should always be a top priority. Saving as much as you can for retirement can help you to take advantage of compounding interest and grow your savings throughout your working career.

If you do choose a 457(b) retirement plan, it’s important to remember the differences between governmental and non-governmental plans. In a governmental plan, money is held in a trust and funds can be rolled into other savings accounts. In a non-governmental plan, the money is controlled by your employer and funds can only move within other non-governmental plans. Non-governmental plans are inherently riskier since your plan could be trouble if your employer goes under.

In many cases, you don’t have to pick just one type of retirement account. In fact, taking advantage of multiple different types of accounts can be a great way to balance out your investments and the amount of taxable income you’ll have during retirement.

Looking for a more thorough, all-in-one spot for your financial life? Check out our free eBook: A Doctor’s Prescription to Comprehensive Financial Wellness [Yes, it will ask for your email 😉]