One of the most common questions we get is “how do I build a budget as a medical resident?” This came up when we first moved to Philly in 2015, and we had our new neighbors over for dinner. It just so happened that they were medical graduate students at Drexel University. After that realization, I deemed the three of them the first official focus study group of WealthKeel. Not only did I learn more about the medical master’s route prior to medical school, but I was also able to shed light on their biggest financial concerns in their medical school years and their subsequent residency. This was a special moment in WealthKeel history, as it was when we started to specialize in Gen X & Gen Y physicians.

It should come as no surprise that student loans and repayment were these medical graduate students’ #1 concern — and it seems like that trend will only continue. We’ve talked in-depth about student loans, but we wanted to dig a little deeper and find out what else was on their mind financially.

Their second main financial concern was budgeting. We must say, hearing that made us proud. At this point, we put ourselves in their shoes: if we had to build a medical resident budget, what would it look like?

Truthfully, you could probably use the same budget that you had (hopefully) been using in medical school. The main difference is that you finally have some income while in residency! For this post, we will assume you “just” have your resident salary and won’t account for any moonlighting or side gigs. However, you can easily add that extra income (great job!) into our free budget spreadsheet provided at the end.

Budgeting is a core pillar of a great financial plan, and it’s actually a lot easier than you may think! When you have a budget, you’re in control of everything— debt, spending, you name it. It’s not a word to be intimidated by. On the contrary, it’s a very empowering process.

KEY TAKEAWAYS:

- Budgeting puts you in control of your financial life — and that’s empowering.

- To start your budget, we’ll take a good look at your salary and categorize your expenses so that you’re prioritizing important expenses.

- Taking advantage of tax-planning strategies and employer deductions will organize your finances and ensure your money is working for you.

- Categorizing your expenses like housing, transportation, student loans, utilities, food, and everything else ensures you are spending your money in a way that aligns with your values and goals.

- FREE budget spreadsheet! Yes, free! Keep reading and it will be waiting for you at the end of the post.

Prefer video over the blog? We’ve got you covered! Watch our YouTube video as we dissect this blog post for you:

Building a Medical Resident’s Budget: Start With Salary

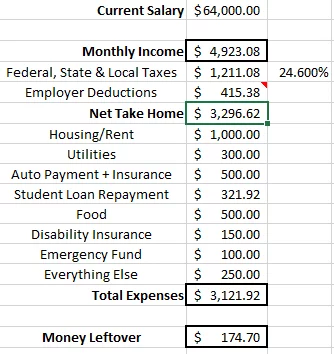

Let’s start with the basics: your salary. Throughout this post, we will use the national average salary, $64,000, when talking about numbers in examples like taxes or deductions.

If you’re from the Philadelphia area, it is a little bit higher here (not uncommon in larger cities due to the higher cost of living). For example, Thomas Jefferson starts at $71,923 for PGY-1 (2024-2025). By PGY-3, you are approaching $78,000.

The money coming in is the good part of being a resident. Now comes the bad part… money coming out.

The Costs of Uncle Sam (Taxes)

As much as we love him, Uncle Sam can be pretty costly. You will have to subtract all taxes that are applicable to balance out your budget. These taxes include: federal, social security, medicare, state, local, and other taxes — which can all add up pretty quickly. ADP offers a nice calculator to help with the specifics of your situation.

For example, if you’re earning $64,000, you’re looking at roughly $1,211 per month in taxes.

Now, the beginning of your career is a great time to explore tax planning strategies to help alleviate tax pressures on your budget.

One of the easiest ways to reduce your taxable income is to maximize contributions towards your pre-tax retirement accounts, such as a 403b.

The maximum contribution is $23,500 for 2025. The funds in these accounts will grow tax-free until you withdraw them in retirement.

Pro-Tip: If you are going for Public Service Loan Forgiveness (PSLF), the lower you can get your adjusted gross income (AGI) by saving to pre-tax items such as 403b, HSAs, FSAs, etc., the lower your income driven repayment will be.

Another simple way to reduce your taxable income is to stay up to date on tax laws. Tax laws change constantly and can greatly affect the distribution of your money.

Employer Deductions for Medical Residents

Employer deductions from your paycheck will include your 403b, health insurance, and other group benefits from the hospital. In this example, we will assume that you’re contributing 6% of your paycheck to your 403b and you also have health/dental/vision insurance. Combining all of these employer deductions will cost you about $415 per month.

When considering other group benefits packages, think about what you really need. You may be presented with many additional benefits, at a cost, such as cancer insurance, AD&D insurance, or identity theft protection, which you may not need or want at this point in your life.

Pro-Tip: If a high-deductible health plan makes sense for you and your family, utilizing a Health Savings Account (HSA) is a great tax tool and possible bonus investment account.

After employer deductions and taxes, your monthly take-home pay should be right around $3,297 per month. Of course, this will vary state-by-state and city-by-city. For example, Philadelphia’s local tax is higher than the Pennsylvania state tax. For Philly residents, this means that take-home pay is usually a little bit lower, unfortunately.

Again, we are using averages and estimates here, so take-home pay will vary, but this is a great starting point. Our budget template will help give you more accurate numbers that fit your lifestyle, so take some time to make it your own and enter your own figures!

Housing and Rent Costs

In today’s world, it’s very uncommon to see residents living on their own (rent is ridiculously high) or owning their own home. In reality, at this point in your career, you should be renting and not owning property (yes, this can vary on a case-by-case basis, but in general, we would say not owning a home during training is ideal).

Why should you rent and not own? First, renting is far less expensive, especially depending on where you live. If you reside in a big city such as NYC or San Francisco, of course, rent is going to be expensive, but owning is a whole other ballgame.

One nice thing about renting is that, usually, you’re not responsible if an appliance breaks or the heat stops working. You call your landlord and the problem gets solved quickly (hopefully!). With ownership, you handle all costs and expenses. This could include broken appliances, lawn maintenance, roof care, and so on.

Also, you’re a resident, so you probably don’t have the funds for a 20% down payment, and that is totally acceptable. You may come across a broker or real estate agent telling you that you can buy a home for 0% down. Don’t do it, or at least try to avoid it! Yes, yes, we know about The Physician Mortgage Loan, but we are giving general, non-specific guidance here.

The second reason to not own property is the unknowns of the future — who knows where you will end up after residency? You may get a job offer across the country, or even across the world. If that does happen, it will be much easier to leave the keys and move, as opposed to selling your home.

You should allot about $1,000 per month for housing expenses.

Budget for Transportation Expenses

The car situation is where you can really get ahead on your budget. For example, if you live in a city (i.e. Philadelphia), you should easily be able to make it around without a car, and that should hold true for almost any major city due to the public transportation systems. There are costs to consider when taking public transportation, but typically those costs are extremely minimal.

Pro-Tip: Many employers in major cities will allow you to pay for a transit card with pre-tax dollars. If you have that benefit and take public transit, take advantage of it!

Not only does public transportation relieve you of a car payment, but also the car insurance, gas, maintenance, and parking fees. Parking fees can be especially astronomical if you live in a big city.

If you do have a car, make sure it’s reliable and, hopefully, paid off. If you do need a car, now is not the time to buy a Ferrari or Range Rover.

The reality is: you’re a resident, and that eight-year-old Honda with a dent or two (or 20) on the hood will do just fine! There are plenty of dream cars waiting for you down the road — take your time.

If you have a car, you’re looking at $500 per month, which includes car insurance and gas.

Student Loan Payments for Medical Residents

We can’t let an opportunity to talk about student loans pass us by. Student loans can take up a large part of your spending, and it’s imperative to work them into your budget as soon as possible. While in residency, you should be using an income-based repayment plan, and if we stick with the $64,000 salary, your student loan repayment should fall in right around $322 per month (assuming it is just you for the calculation).

Pro-Tip: While we note you “should” be using an IDR plan, the fact of the matter is that if you don’t plan to go for some type of forgiveness (i.e. PSLF), an IDR plan could hurt you in the form of extra accumulated interest which could capitalize, leading to negative amortization. Do your research and/or hire a student loan expert to help review your specific situation.

If you have private student loans, consider refinancing them as they typically have high-interest rates.

Federal loans are a little different. Federal loans typically offer lower interest rates and more flexible repayment plans. The three most common payment plans are:

- Income-Based Repayment (IBR)

- Pay As You Earn (PAYE)

- Revised Pay As You Earn (REPAYE)

A few other vital pieces of information on forbearance and the Public Service Loan Forgiveness (PSLF) program.

With forbearance, no payments are required during your residency. The catch is, however, that interest continues to accrue so you’ll end up paying more in the long run. We highly recommend that you avoid this option, and look to utilize income-driven repayment plans instead of forbearance.

Pro-Tip: With forbearance, we highly recommend that you avoid this option and look to utilize income-driven repayment plans instead of forbearance. Correct, that is not a typo, we just really thought we needed to say it twice.

The PSLF program will require 120 payments (10 years) on your direct federal consolidated loans to have them forgiven. Payments must* be based on an income-based repayment plan to qualify (*however, that is not the case right now, and you should know how Temporary Public Service Loan Forgiveness works).

We completely understand that your loan balance is overwhelming at this point; however, get a plan in place, and then stick to the plan!

Utilities

Utilities are one area that tends to swing all over the place, but assuming you are sharing these expenses in some way, you should anticipate utility expenses to be about $300 per month. That number is including your cell phone bill along with gas, water, heat, electricity, and cable/internet.

Kick your cable bill to the curb! You’re a medical resident — you barely have enough time to open the cable bill and send a payment, let alone actually watch some TV. If you really think you’ll have time for TV, get a Netflix or Hulu subscription for about $10 per month (for those lucky moments you have to binge “The Office”). You could also borrow your friend’s username & password for free or split the bill with them (you pick your moral road 😉 judgement-free zone here). Do not pay for every subscription available. You don’t need Netflix, Hulu, Disney+, HBO Go, ESPN Plus, and Sling TV! Take the advice above, spilt one or two with a friend.

Food

Food is a pretty important thing, so you will need to include that in your budget as well.

Plan to budget about $500 per month on food, which equates to $125 per week and $18 per day. It can help make the process seem more manageable by breaking up these bigger goals into smaller ones.

Here are some other easy ways to save money on food:

- Buy meat on sale when it’s almost expired, and freeze it to keep it fresh.

- Stock up on beans and lentils — they are cheaper than meat and packed with protein.

- Always shop the sales!

- Plan out your grocery list in advance to avoid buying excess/unnecessary food.

- Take full advantage of every free meal (seriously, take 2 sandwiches if you can). Limit how often you eat out, including coffee, smoothies, and other drinks.

- Shop the store brands.

Medical Resident Disability Insurance

Your biggest asset is you and the ability to wake up and go to work every day.

Disability coverage is an absolute must-have for any physician — no questions asked! Disability insurance protects your income should anything happen to you.

Your residency hospital should provide some form of group disability coverage for you. However, you will want to consider buying an individual disability policy to supplement any gaps and also provide a guaranteed insurability rider. The guaranteed insurability rider will allow you to increase your coverage without proving insurability in the future. This is vital for when you leave residency and sign your first medical contract and your income skyrockets.

When inquiring about disability insurance, ask if there is a discount for your hospital or if they offer a GSI (Guaranteed Standard Issue) policy, or if they offer a unisex rate (women typically receive lower premiums on unisex rates). You may also be faced with adding additional riders to your policy. Before paying for anything, do research on every rider to make sure it fits your needs.

The monthly premium will vary based on your age, sex, state, specialty, and income (most carriers don’t look at income while in training and will have pre-set limits in place, like $5,000/m in benefits). For the budget, we will use $150 per month. That number is likely on the high side, but it’s better to overestimate rather than underestimate when it comes to budgeting.

Emergency Fund

That’s right — you are still saving for an emergency even on a resident’s budget. An emergency fund will help you when you need it most and when you least expect it.

We suggest depositing $100 per month into your savings account, not your checking account. It’s important that you keep these accounts separate. If you put your emergency fund into your checking account, you’ll be more tempted to dive into it because it’ll be an easier process to withdraw the cash. At some, or multiple, times in your life, you will be grateful that you have these savings.

An emergency fund is all about preparing for the unexpected. There may be a time in your life where you are forced to live paycheck to paycheck and in that situation, it can be very tempting to put your expenses on a credit card. With credit cards having such high-interest rates, it can be nearly impossible to live that way.

Everything Else

When it comes to your budget, you also have to make room for the little expenses that pop up. Whether it’s a trip to CVS, a stop at the local bakery, or a night out with your friends — a budget shouldn’t stop you from living your life. To make an accurate budget, include $250 per month to go towards these types of expenses.

There you have it, with a $64,000 salary and taking in the necessary expenses into account, you’re left with a grand total of $175.00 at the end of the month. Enough to buy a coffee every now and again! This will vary for everyone; however, it gives you a great starting point.

Budgeting doesn’t have to feel like rocket science. Craft your own budget with our Medical Resident Budget Template and you’ll see how easy it can be!

A few tips for your budget worksheet: when you update your salary number, the taxes, employer deductions, and the student loan payment will update automatically with our pre-built formulas. All three can be adjusted in the formula; you can update/adjust your tax rates, your student loan figure which is based on PAYE/REPAYE (10% and just you for your family size), and employer deductions can be updated based on the 6% savings to your 403b.

Looking for a more thorough, all-in-one spot for your financial life? Check out our free eBook: A Doctor’s Prescription to Comprehensive Financial Wellness [Yes, it will ask for your email 😉]